4.3: Pricing with Market Power

ECON 306 · Microeconomic Analysis · Fall 2019

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microf19

microF19.classes.ryansafner.com

Profit-Seeking Firms

Any firm with market power seeks to maximize profits

Wants to (1st) create a surplus

Profit-Seeking Firms

Any firm with market power seeks to maximize profits

Wants to (1st) create a surplus and then extract some of it as profit

- i.e. convert consumer surplus into profit

Consumers are still better off than without the firm because it creates value (consumer surplus)

- Just not as best-off as under perfect competition

Most Firms Create More Value than They Can Capture!

William Nordhaus

(1941-)

Economics Nobel 2018

"We conclude that [about 2.2%] of the social returns from technological advances over the 1948-2001 period was captured by producers, indicating that most of the benefits of technological change are passed on to consumers rather than captured by producers," (p.1)

Nordhaus, William, 2004, "Schumpeterian Profits in the American Economy: Theory and Measurement," NBER Working Paper 10433

Price Discrimination

The most obvious way to capture more surplus is to raise prices

- But Law of Demand ⟹ this would turn many customers away!

Instead, if firm could charge different customers with different WTP different prices, firm could convert more consumer surplus into profit

"Price discrimination" or "Variable pricing"1

1 The term price discrimination has unnecessary negative moral baggage. We'll assess later today whether this type of pricing is "good" or ethical. "Variable pricing" is a more neutral term.

The Economics of Pricing Strategy I

- Two conditions are required for a firm to engage in variable pricing:

1: Firm must have market power

- A competitive firm must charge the market price

The Economics of Pricing Strategy II

- Two conditions are required for a firm to engage in variable pricing:

1: Firm must have market power

- A competitive firm must charge the market price

2: Firms must be able to prevent resale or arbitrage

- Suppose you sell the same good at two different prices:

- Smart customers only buy at your lower-price and resell it at your higher-price

The Economics of Pricing Strategy II

Firm must acquire information about the variations in its customers' demands

Can the firm identify consumers' demands before they buy the product?

The Economics of Pricing Strategy II

Firm must acquire information about the variations in its customers' demands

Can the firm identify consumers' demands before they buy the product?

If Yes:

- With perfect information ⟹ 1st-degree price discrimination: firm can engage in perfect price discrimination: charge a different price to each customer

The Economics of Pricing Strategy II

Firm must acquire information about the variations in its customers' demands

Can the firm identify consumers' demands before they buy the product?

If Yes:

- With perfect information ⟹ 1st-degree price discrimination: firm can engage in perfect price discrimination: charge a different price to each customer

- With imperfect information ⟹ 3rd-degree price discrimination: can separate customers into groups and charge different prices across groups

The Economics of Pricing Strategy III

Firm must acquire information about the variations in its customers' demands

Can the firm identify consumers' demands before they buy the product?

If No:

- 2nd-degree price discrimination: More indirect forms of pricing: tying, bundling, quantity-discounts

- Having consumers self-select into their own group

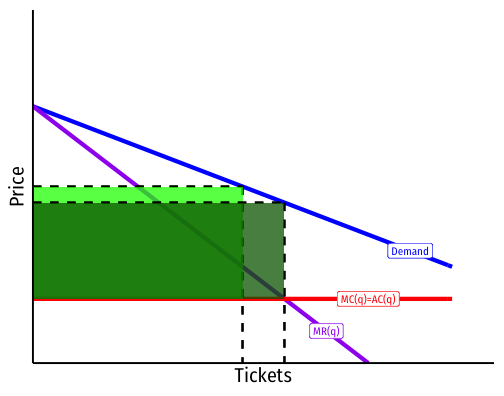

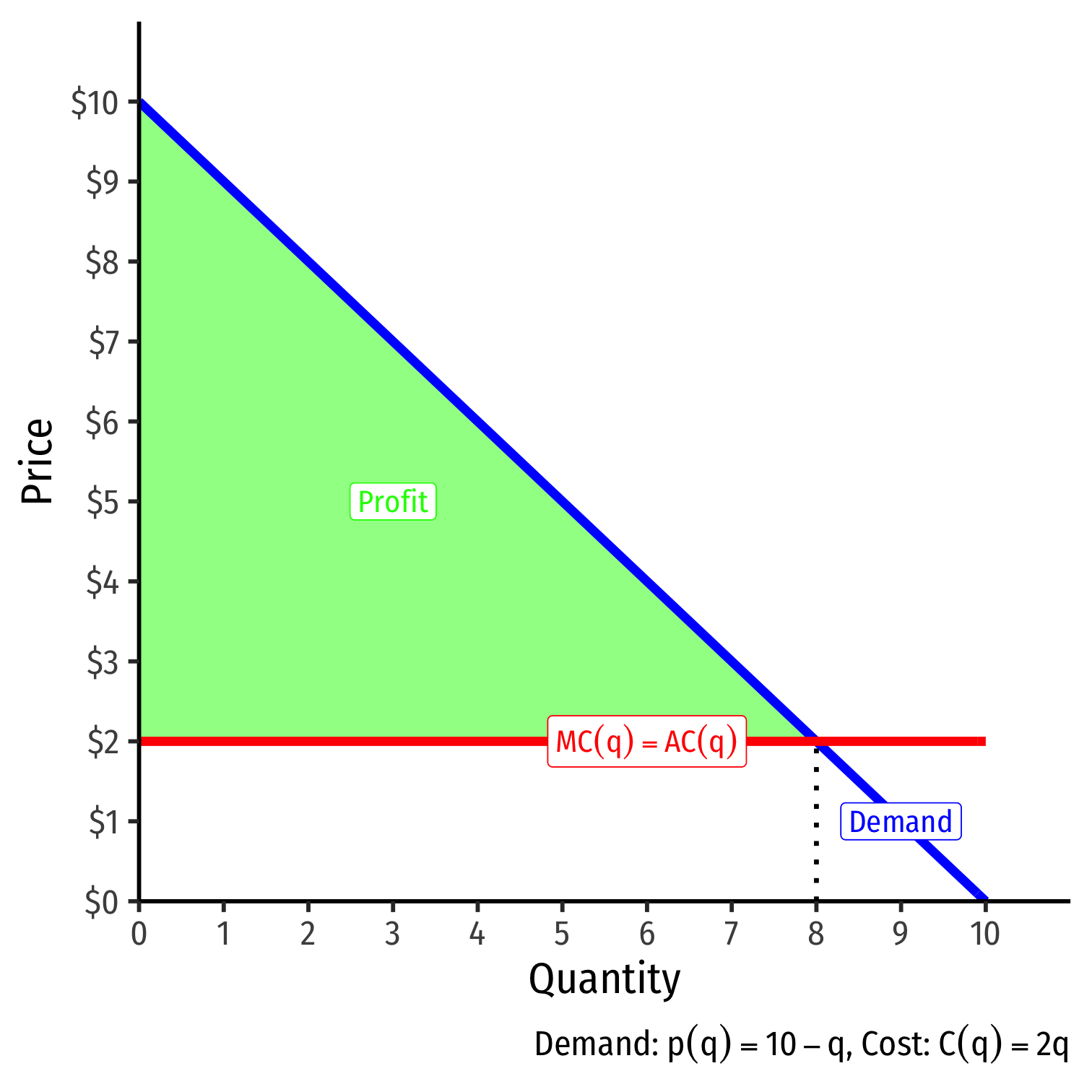

1st-Degree Price Discrimination

1st-Degree Price Discrimination I

If firm has perfect information about every customer's demand before purchase:

Perfect or 1st-degree price discrimination: firm charges each customer their maximum willingness to pay

- "walks" down the market demand curve customer by customer

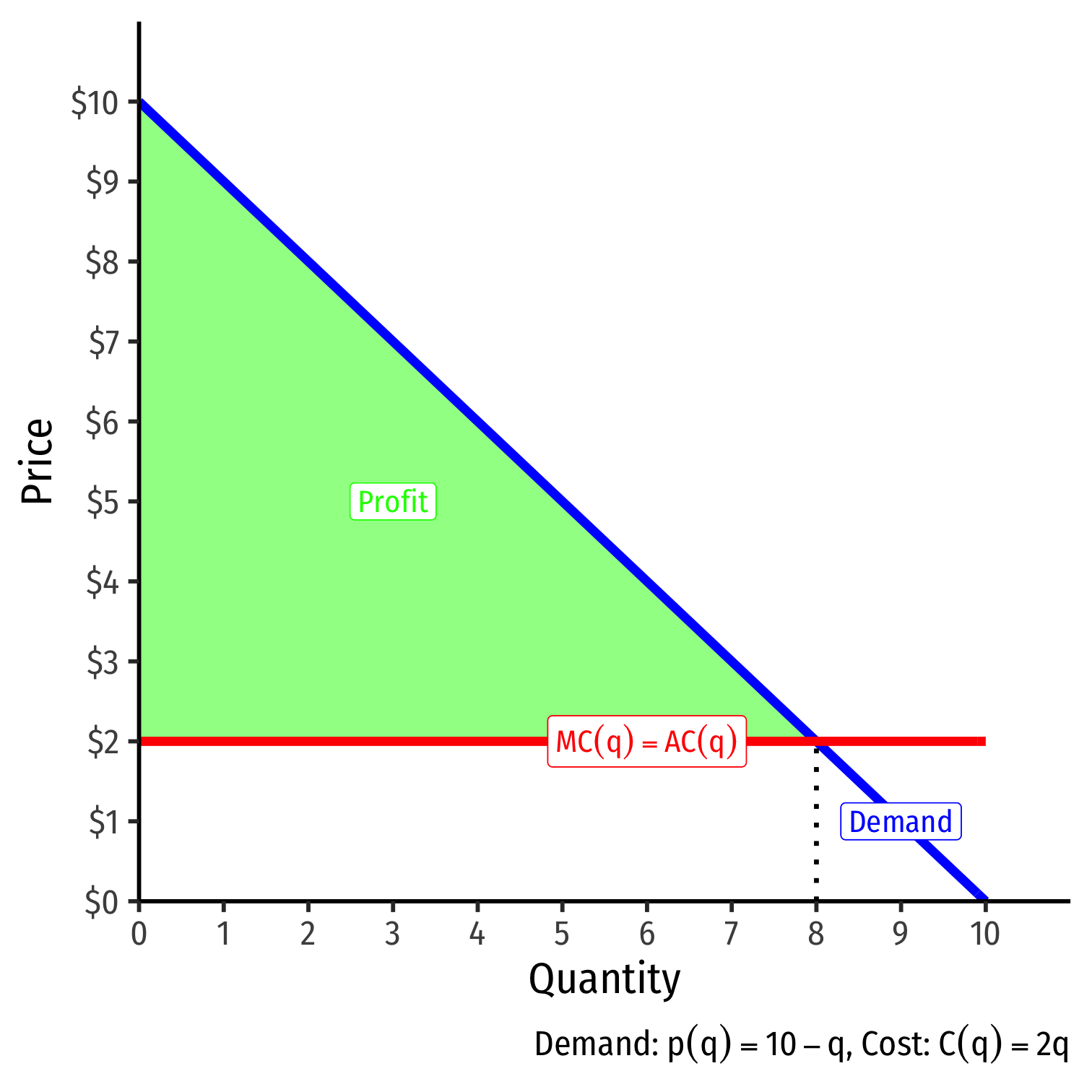

1st-Degree Price Discrimination II

Firm converts all consumer surplus into profit!

Produces the competitive amount (8)

1st-Degree Price Discrimination: Example

3rd-Degree Price Discrimination

3rd-Degree Price Discrimination I

Firms almost never have perfect information about their customers

But they can often separate customers by observable characteristics into different groups that have similar demands before purchasing

Firms segment the market or engage in 3rd-degree price discrimination by charging different prices to different groups of customers

By far the most common type of price-discrimination

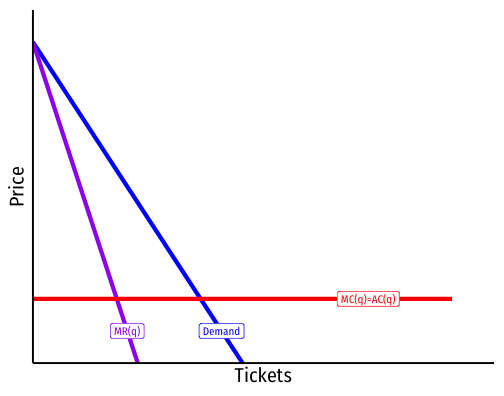

3rd-Degree Price Discrimination II

Business Travelers (Less Elastic)

Vacationers (More Elastic)

- Consider airlines: different groups of travelers have different demands & price elasticities

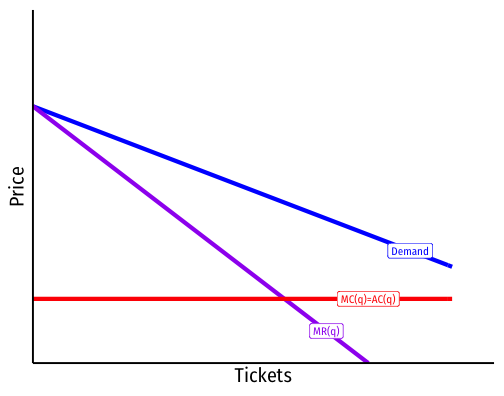

3rd-Degree Price Discrimination II

Business Travelers (Less Elastic)

Vacationers (More Elastic)

- The firm could charge a single price to all travelers and earn some profit

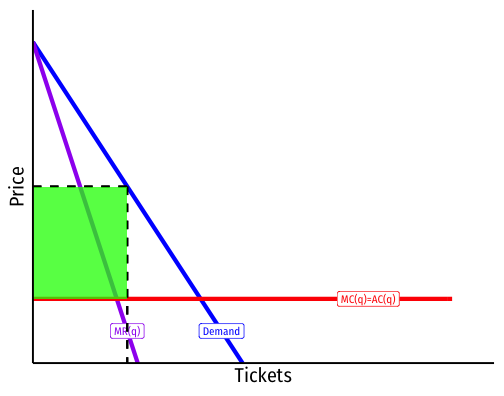

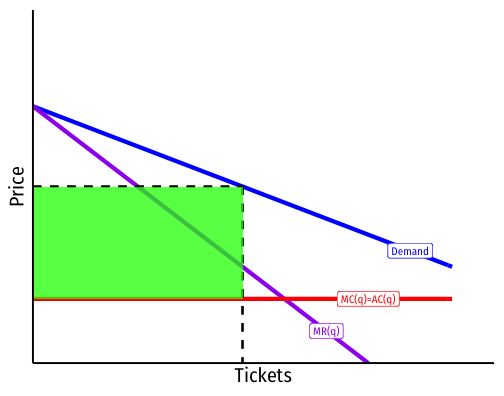

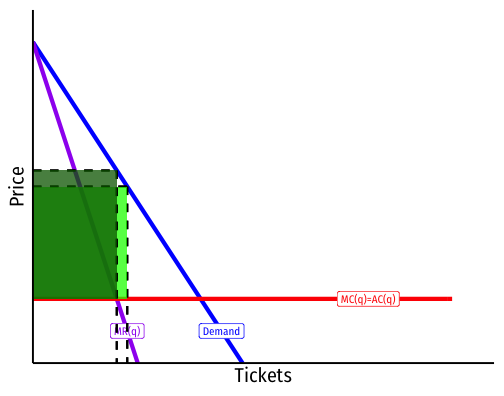

3rd-Degree Price Discrimination II

Business Travelers (Less Elastic)

Vacationers (More Elastic)

- If firm could charge different prices: raise price on inelastic travelers, lower price on elastic travelers, earns more profit!

3rd-Degree Price Discrimination: Examples I

3rd-Degree Price Discrimination: Examples I

3rd-Degree Price Discrimination: Examples II

3rd-Degree Price Discrimination: Examples III

3rd-Degree Price Discrimination: Examples IV

3rd-Degree Price Discrimination: Examples IV

3rd-Degree Price Discrimination: Numerical Example

Example: Suppose you run a bar in downtown Frederick, and estimate the demands for beer from undergraduates (U) and graduates (G) to be:

qU=18−4pUqG=12−pG

Assume the only cost of producing drinks is a constant marginal (and average) cost of $2.

If your bar could not price discriminate, and could only set one price, find the profit-maximizing quantity and price. How much profit does the bar earn?

If your bar can price discriminate, find the quantity and price for each group. How much profit does the bar earn?

Pricing

How much should each segment be charged?

Firm treats each segment as a different market (set MR(q)=MC(q) and then raise price to max WTP)

Lerner index implies optimal markup for each segment, again: L=p−MC(q)p=−1ϵ

Ways to Segment Markets

By customer characteristics

- Age

- Gender

Past purchase behavior

- repeat customers (more price sensitive)

By location

- local demand characteristics

Over time

2nd-Degree Price Discrimination

2nd-Degree Price Discrimination I

If firm has cannot identify which customers have which type of demand before purchase

Indirect or 2nd-degree price discrimination: firm offers difference price-quantity bundles and allows customers self-select their offer

Most often: quantity-discounts to price discriminate

- Larger quantities offered at lower prices

Is Price Discrimination Good or Bad?

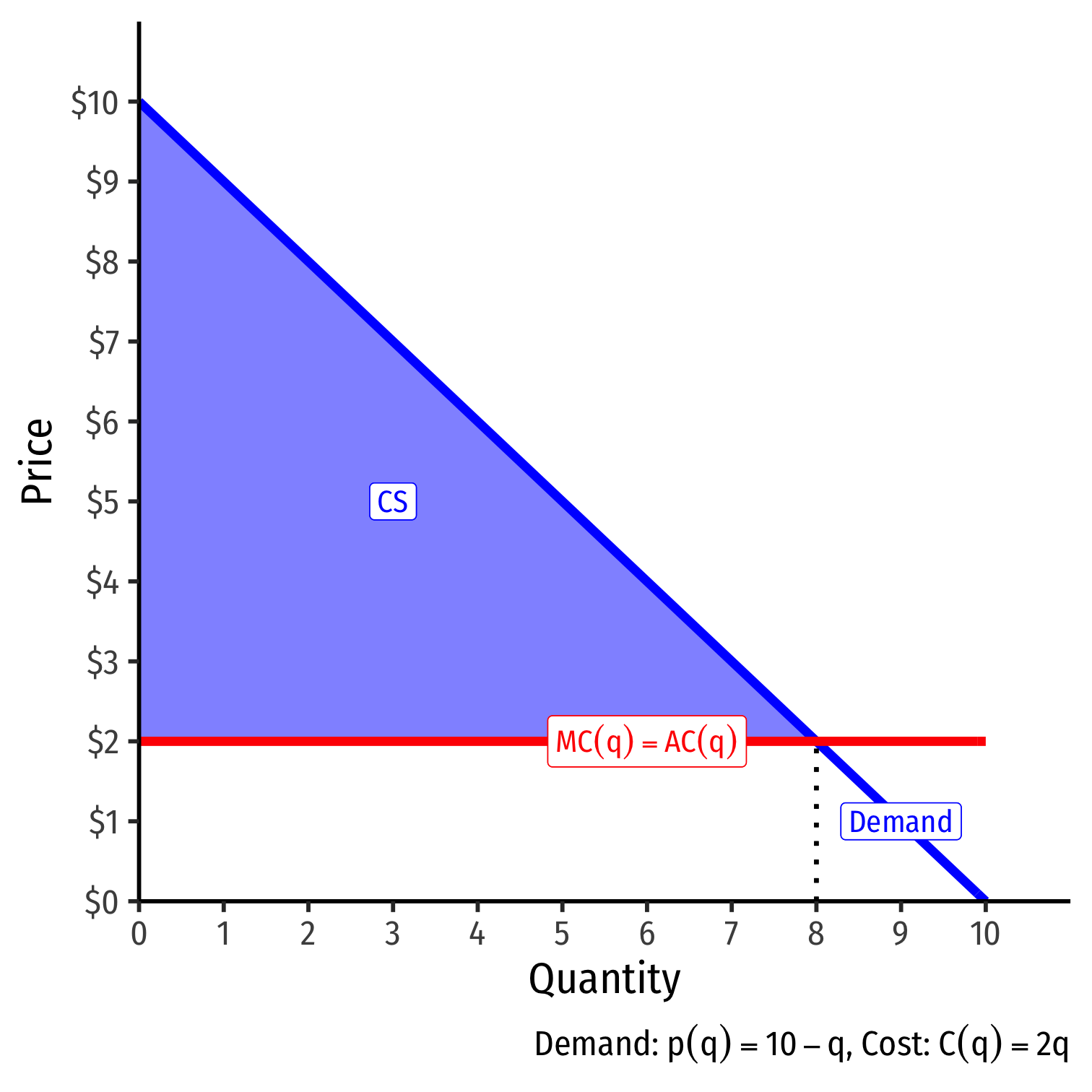

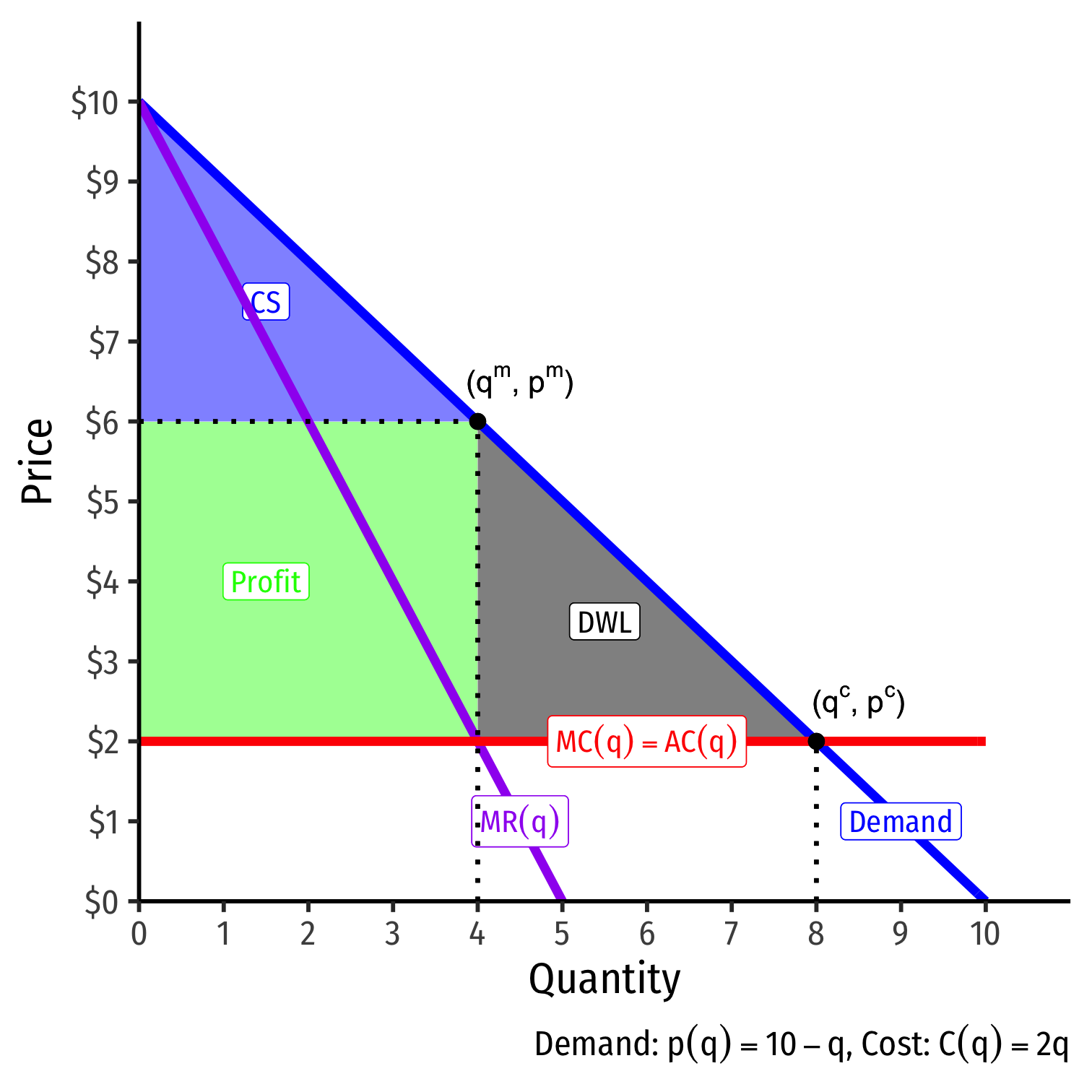

Is Price Discrimination Good or Bad? I

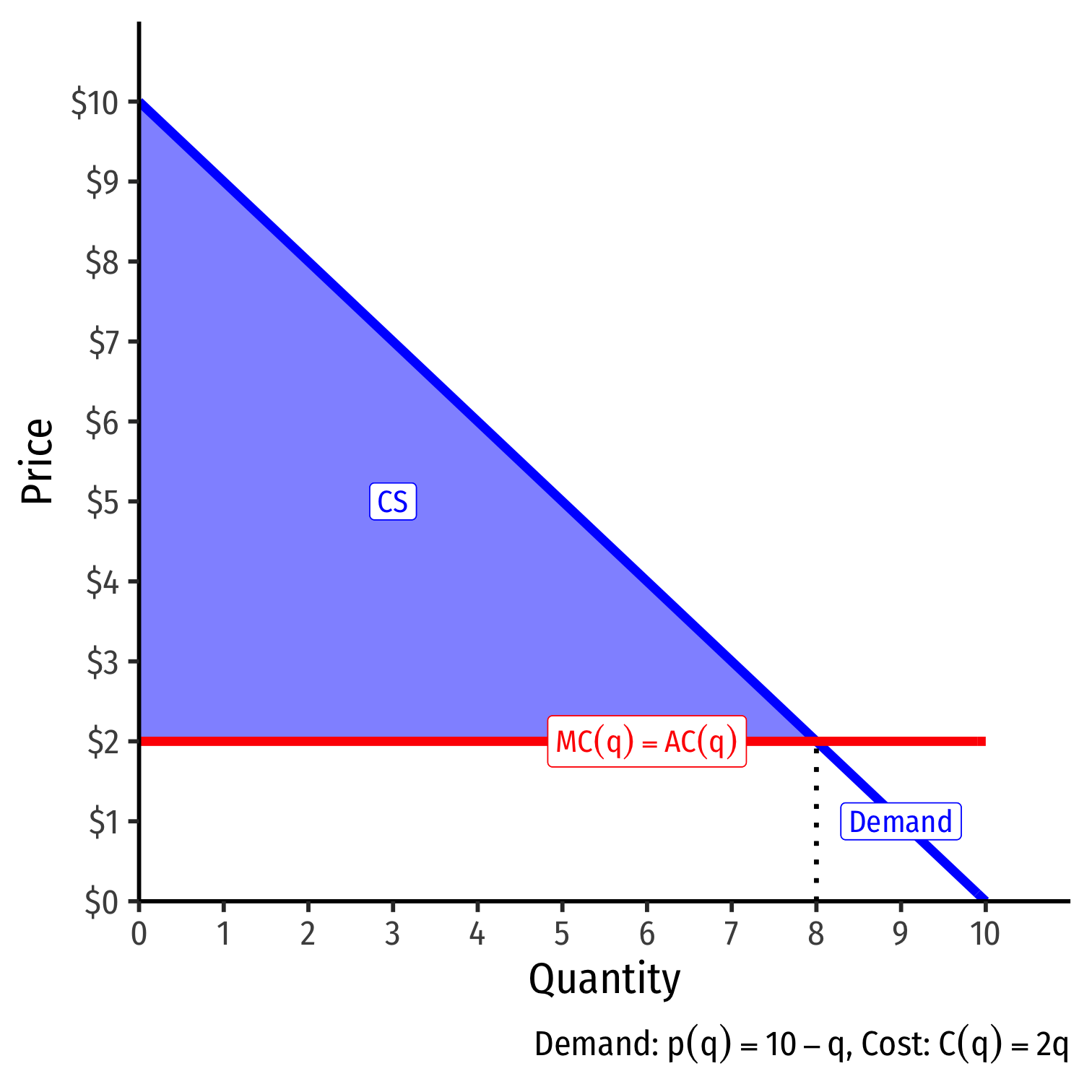

- Ideal competitive market, q∗ where p=MC

Is Price Discrimination Good or Bad? I

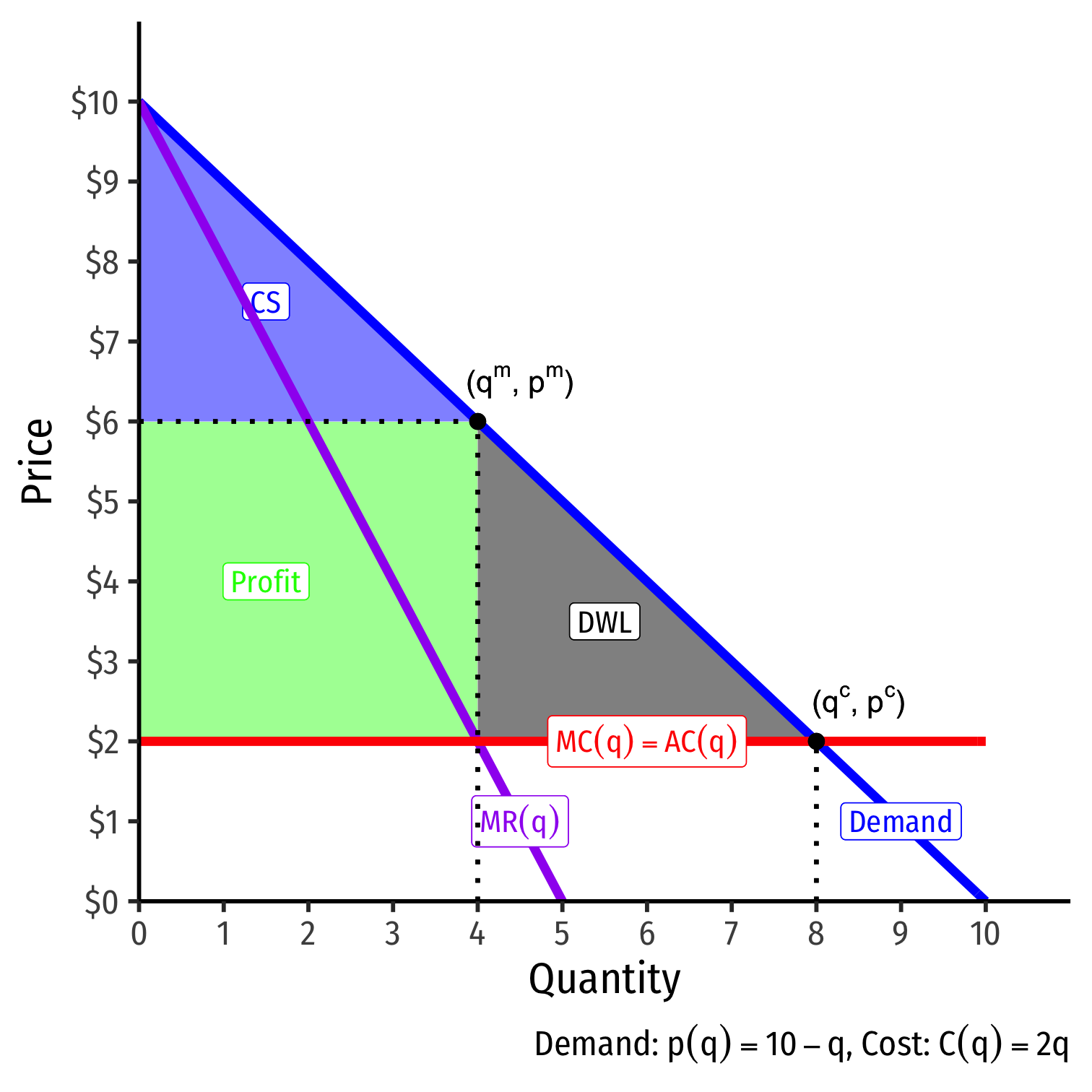

Ideal competitive market, qc where pc=MC

A pure monopolist would produce less qm at higher pm

- reduce consumer surplus and create deadweight loss

A transfer of surplus from consumers to producers

But price-discrimination allows a firm with market power to produce more than the pure monopoly level and reduce deadweight loss!

Is Price Discrimination Good or Bad? I

Ideal competitive market, qc where pc=MC

A pure monopolist would produce less qm at higher pm

- reduce consumer surplus and create deadweight loss

A price-discriminating monopolist transfers surplus from consumers to producers

But price-discrimination encourages monopolist to produce more than the pure monopoly level and reduce deadweight loss!

Is Price Discrimination Good or Bad? II

Price-discrimination creates incentives for innovation and risk-taking

Firms with high fixed costs of investment earn great profits, can recover their fixed costs

Might not do so without ability to price-discriminate

Is Price Discrimination Good or Bad? III

As with markups in general, price discrimination has everything to do with price elasticity

If you are paying too much and losing consumer surplus, the real "problem" is that your demand is very inelastic

- fewer options, a particular brand, or a necessity, limited time, etc

If you want to pay less, buy generic (elastic)

Tying I

Firms often tie multiple goods together, where you must buy both goods in order to consume the product

- One good often the "base" and the other are "refills" that you may need to buy more of

This is actually a method of intertemporal price-discrimination!

Tying II

Companies often sell printers at marginal cost (no markup) and sell the ink/refills at a much higher markup

Reduce arbitrage:

- printer requires specific ink

- ink only words with that specific printer

Segmenting the market into:

- High-volume users: buy more ink over time; pay more per sheet printed

- Low-volume users: buy less ink; pay less per sheet printed

Indirect price-discrimination: firms don't know what kind of user you are in advance

Tying: Good or Bad?

Again, a tradeoff between benefits and costs:

Increased profits and reduced consumer surplus, reduced deadweight loss

Spreads fixed cost of research & development over more users

If printers & ink were not tied, printers would be more expensive, and ink cheaper

- High-volume users would keep buying ink and save money (vs. tied)

- Low-volume users might not buy the (now expensive) printer at all!

Bundling I

Firms often bundle products together as a single package, and refuse to offer individual parts of the package

Often, consumers do not want all products in the bundle

Or, if they were able to buy just part of the bundle, they would not buy the other parts

Bundling II

Example: Consider two consumers, each have different reservation prices to buy components in Microsoft Office bundle

| Amy's WTP | Ben's WTP | |

|---|---|---|

| MS Word | $70 | $40 |

| MS Excel | $50 | $60 |

- Microsoft could charge separate prices for MS Word and MS Excel

Bundling II

Example: Consider two consumers, each have different reservation prices to buy components in Microsoft Office bundle

| Amy's WTP | Ben's WTP | |

|---|---|---|

| MS Word | $70 | $40 |

| MS Excel | $50 | $60 |

Microsoft could charge separate prices for MS Word and MS Excel

MS Word: both would buy at $40, generating $80 of revenues

Bundling II

Example: Consider two consumers, each have different reservation prices to buy components in Microsoft Office bundle

| Amy's WTP | Ben's WTP | |

|---|---|---|

| MS Word | $70 | $40 |

| MS Excel | $50 | $60 |

Microsoft could charge separate prices for MS Word and MS Excel

MS Word: both would buy at $40, generating $80 of revenues

MS Excel: both would buy at $50, generating $100 of revenues

Bundling II

Example: Consider two consumers, each have different reservation prices to buy components in Microsoft Office bundle

| Amy's WTP | Ben's WTP | |

|---|---|---|

| MS Word | $70 | $40 |

| MS Excel | $50 | $60 |

Microsoft could charge separate prices for MS Word and MS Excel

MS Word: both would buy at $40, generating $80 of revenues

MS Excel: both would buy at $50, generating $100 of revenues

Total revenues of individual sales: $180

Bundling II

Example: Consider two consumers, each have different reservation prices to buy components in Microsoft Office bundle

| Amy's WTP | Ben's WTP | |

|---|---|---|

| MS Word | $70 | $40 |

| MS Excel | $50 | $60 |

| Bundle | $120 | $100 |

Microsoft could charge separate prices for MS Word and MS Excel

MS Word: both would buy at $40, generating $80 of revenues

MS Excel: both would buy at $50, generating $100 of revenues

Total revenues of individual sales: $180

Microsoft can instead add their individual reservation prices and bundle products together to force both consumers to buy both products

Bundle: both would buy at $100, generating $200 of revenues

Bundling: Good or Bad?

Again, a tradeoff between benefits and costs:

Increased profits and reduced consumer surplus, reduced deadweight loss

Spreads fixed cost of research & development over more users

Goods with high fixed costs and low marginal costs (software, TV, music) increase profits from bundling

- increases innovation and investment in these industries

Price Discrimination vs. Different Prices

Surprisingly very hard to differentiate between price discrimination (different prices for the same product) and price differences (from genuine cost differences)

Need to find something that changes the price elasticity of demand buy not changing the costs