3.3: The Social Functions of Market Prices

ECON 306 · Microeconomic Analysis · Fall 2019

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microf19

microF19.classes.ryansafner.com

The Model is Not the Reality I

This course is about economic modeling and formal theory

Applications in electives (this semester):

- Industrial Organization

- Labor Economics

- Public Economics

Models help us understand reality, but they are not reality!

- Don't mistake the map for the territory itself

"All models are wrong. Some are useful" - George Box

The Model is Not the Reality II

Our models so far have given us interesting results,

- Markets reach equilibrium

- Economic profits are zero in the long run in competitive markets

Both are fictional

But the models still show us useful insights about how a market economy works

Some readings in today's readings page to help you understand

Why Markets Tend to Equilibrate, Redux

The Law of One Price I

- Law of One Price: all units of the same good will tend to have the same market price (the market-clearing price, p∗)

The Law of One Price II

Consider if there are multiple different prices for same good:

Arbitrage opportunities: optimizing individuals recognize profit opportunity:

- Buy at low price, resell at high price!

- There are possible gains from trade or gains from innovation to be had

Entrepreneurship: recognizing profit opportunities and entering a market as a seller to try to capture gains from trade/innovation

Arbitrage and Entrepreneurship I

Arbitrage and Entrepreneurship II

Arbitrage and Entrepreneurship III

Entrepreneurship

Mark Zuckerberg

1984-

"Why were we the ones to build [Facebook]? We were just students. We had way fewer resources than big companies. If they had focused on this problem, they could have done it. The only answer I can think of is: we just cared more. While some doubted that connecting the world was actually important, we were building. While others doubted that this would be sustainable, we were forming lasting connections."

How Markets Get to Equilibrium I

Nobody knows "the right price" for things

Each Buyer and Seller only knows their own reservation prices

Buyers and sellers adjust their bids/asks

Markets do not start competitive, but monopolistic!

New entrepreneurs enter to try to capture gains from trade/innovation

As these gains are exhausted, prices converge to equilibrium

How Markets Get to Equilibrium II

Errors and imperfect information ⟹ multiple prices

- ⟹ arbitrage opportunities ⟹ entrepreneurship

- ⟹ correcting mistakes ⟹ people update their behavior & expectations

Markets are discovery processes that discover the right prices, the optimal uses of resources, and cheapest production methods, none of which can be known in advance!

How Markets Get to Equilibrium III

Consider the economy as a cat-and-mouse game between two sets of variables:

- "Underlying variables": preferences, technology, and resource availability

- "Induced variables": market prices, least-cost technologies

Induced variables always chasing underlying variables

- Underlying variables always changing

- Any time underlying and induced variables are different, profit opportunities

IF underlying variables froze, market would rest at equilibrium

When and Why Markets are Great

The Origins of Exchange I

Why do we trade?

Resources are in the wrong place!

People have better uses of resources than they are currently being used!

The Origins of Exchange II

Why are resources in the wrong place?

We have the same stuff but different preferences

The Origins of Exchange III

Why are resources in the wrong place?

We have the same stuff and/but different preferences

Transaction Costs and Exchange I

- But Transaction costs!

- Search costs: cost of finding trading partners

- Bargaining costs: cost of reaching an agreement

- Enforcement costs: trust between parties, cost of upholding agreement, dealing with unforeseen contingencies, punishing defection, using police and courts

Transaction Costs and Exchange II

With high transaction costs, resources cannot be traded

Resources cannot be switched to higher-valued uses

If others value goods higher than their current owners, resources are inefficiently allocated!

Transaction Costs and Exchange III

Markets are institutions that facilitate voluntary impersonal exchange and reduce transaction costs

There's a lot of institutions in the "bundle" we call "markets":

- Prices, profits and losses, property rights, rule of law, contract enforcement, dispute resolution, protection, trust

All of these things are assumed when we draw nice supply & demand graphs on the blackboard

- Much of this course: how do various political institutions enable these market institutions?

Social Problems that Markets Solve Well

Problem 1: Resources have multiple uses and are rivalrous

Problem 2: Different people have different subjective valuations for uses of resources

It is inefficient (immoral?) to use a resource in a way that prevents someone else who values it more from using it!

Social Problems that Markets Solve Well

Problem 1: Resources have multiple uses that are rivalrous

Problem 2: Different people have different subjective valuations for uses of resources

It is inefficient (immoral?) to use a resource in a way that prevents someone else who values it more from using it!

Solution: Prices in a functioning market accurately measure opportunity cost of using resources in a particular way

- The price of a resource is the amount someone else is willing to pay to acquire it from its current use/owner

Markets and Pareto Efficiency

Voluntary exchange is a Pareto improvement: change in allocation that makes at least one person better off and making nobody worse off

An allocation of resources is Pareto efficient when there are no possible Pareto improvements

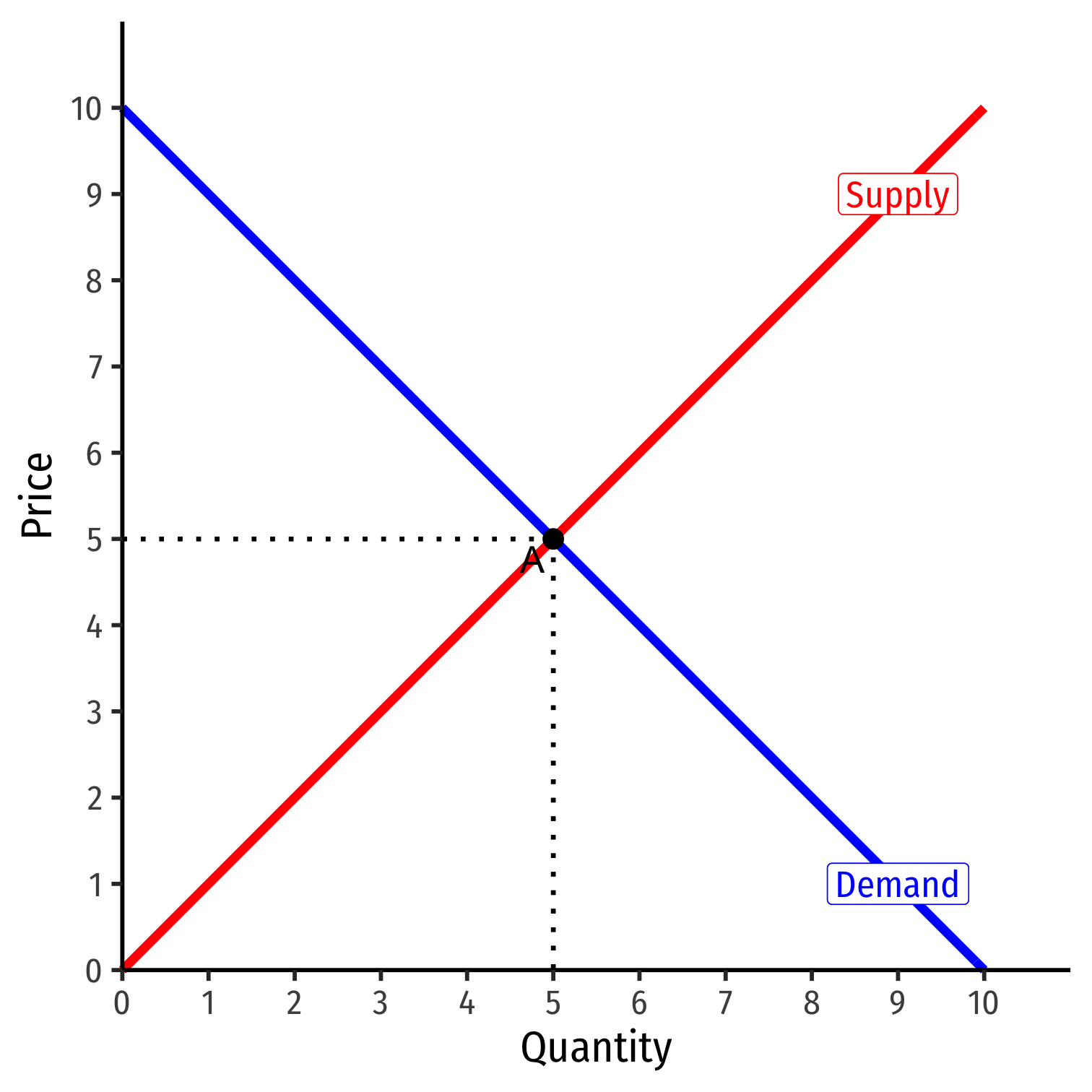

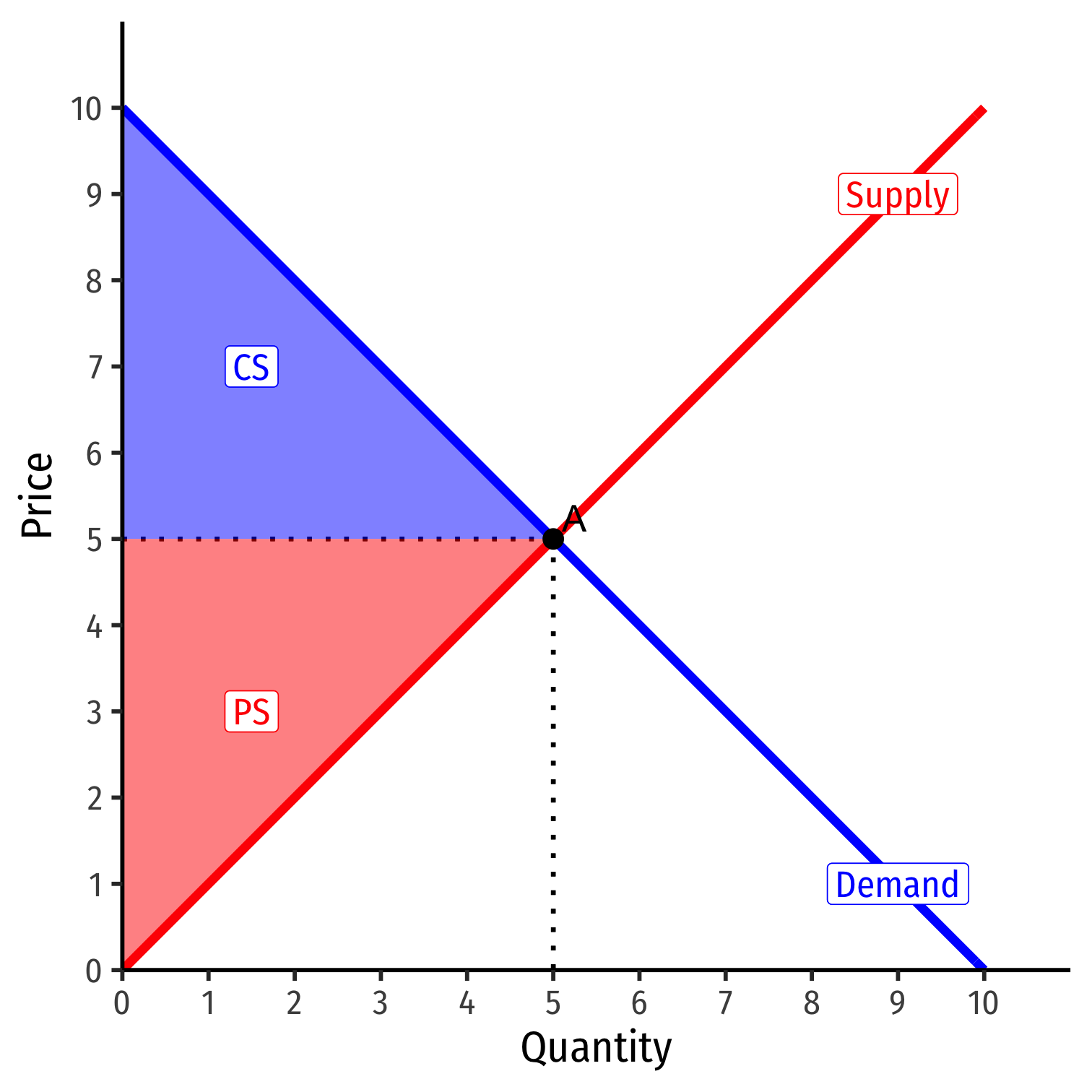

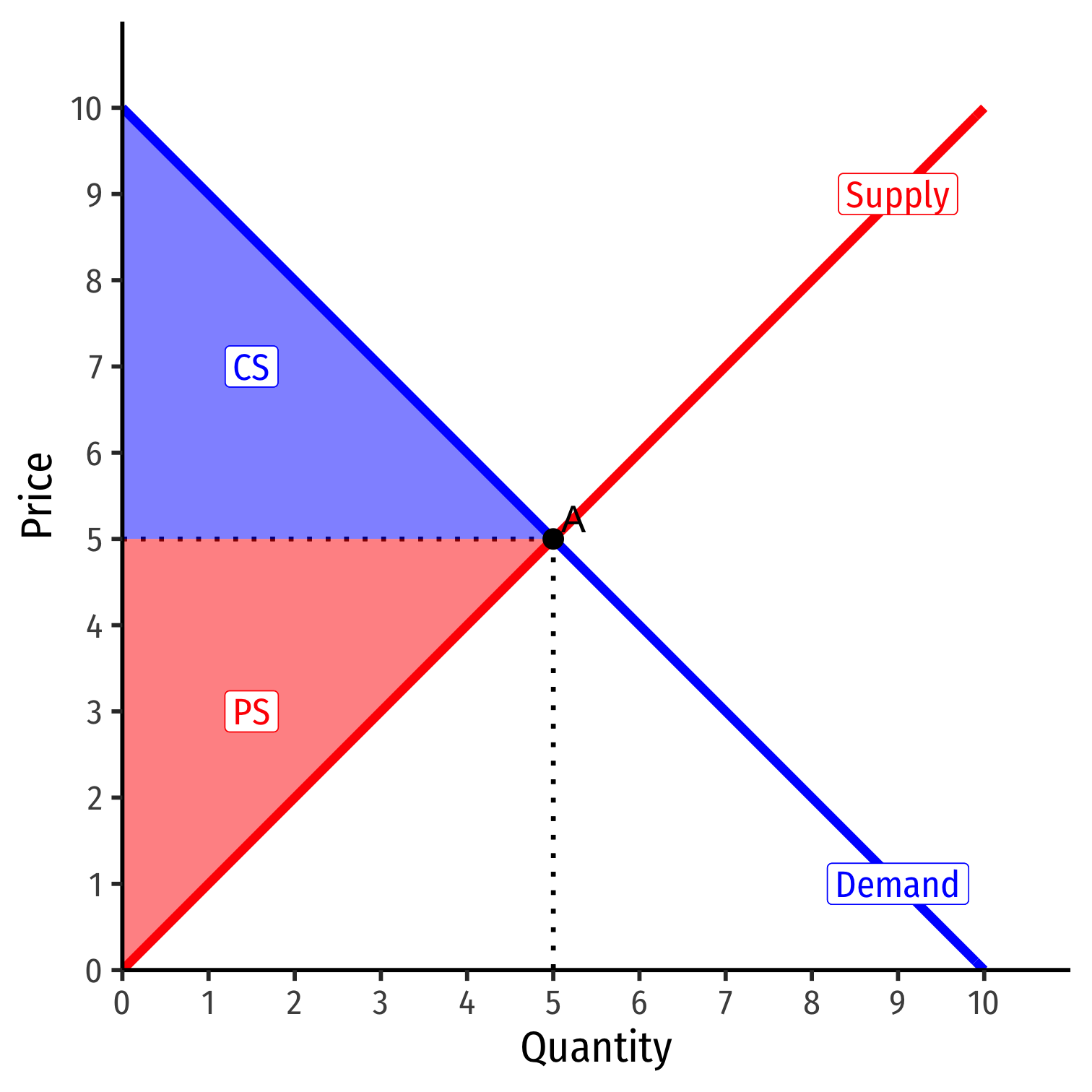

Market Efficiency in Competitive Equilibrium I

Allocative efficiency: resources are allocated to highest-valued uses

- Goods produced up to the point where MB=MC (p=MC)

Pareto efficient: no possible Pareto improvements exist

All potential gains from trade are fully exhausted

Market Efficiency in Competitive Equilibrium II

Economic surplus = Consumer surplus + Producer surplus

Maximized in competitive equilibrium

Resources flow away from those who value them the lowest to those that value them the highest

The social value of resources is maximized by allocating them to their highest valued uses!

Welfare Economics

The 1st Fundamental Welfare Theorem: markets in competitive equilibrium maximize allocative efficiency of resources and are Pareto efficient

Markets are great when they:

Are Competitive: many buyers and many sellers

Reach equilibrium (prices are free to adjust): absence of transactions costs or policies preventing prices from adjusting to meet supply and demand

No externalities are present: costs and benefits are fully internalized by the parties to transactions

- If any of these conditions are not met, we have market failure

- May be a role for government, other institutions, or entrepreneurs to fix

The Social Function of Market Prices

Prices are Signals I

Prices are Signals II

Markets are social processes that generate information via prices

Efficiency of prices: use distributed knowledge and incentivize local actors to exploit opportunities, which reduce error and bring about greater social coordination

Prices are never "given", prices emerge dynamically from negotiation and market decisions of entrepreneurs and consumers

Competition: is a discovery process which discovers what consumer preferences are and what technologies are lowest cost, and how to allocate resources accordingly

The Social Functions of Prices I

A relatively high price

Information conveyed: good is relatively scarce

Incentivizes:

- Buyers: conserve use of this good, seek substitites

- Sellers: produce more of this good

- Entrepreneurs: find substitutes and innovations to satisfy this unmet need

The Social Functions of Prices II

A relatively low price

Information conveyed: good is relatively abundant

Incentivizes:

- Buyers: substitute away from expensive goods towards this good

- Sellers: Produce less of this good, talents better served elsewhere

- Entrepreneurs: talents better served elsewhere: find more severe unmet needs

Uncertainty, Tacit Information, and Profit I

Economic theory: in a perfectly competitive market, in the long run, profit falls to zero

Real world: there are often economic profits

Our blackboard models assume perfect information

In reality we have to deal with uncertainty

Uncertainty, Tacit Information, and Profit II

People don't know what the right price is - mispricing and multiple prices → arbitrage/profit opportunities

- Some people recognize opportunities ($20 bills) that others do not see

In a world of no uncertainty, there would be no profit

Uncertainty, Tacit Information, and Profit III

Reminder: Profits and Entrepreneurship

In markets, production must face the profit test:

- Is consumer's willingness to pay > opportunity cost of inputs?

Profits are an indication that value is being created for society

Losses are an indication that value is being destroyed for society

Survival for sellers in markets requires firms continually create value and earn profits or die

Why We Need Prices, Profits, and Losses I

People often confuse the economic problem with a technological problem

Technological problem: how to allocate scarce resources to accomplish a particular goal

- e.g. buy the right combination of goods to maximize utility

- e.g. buy the right combination of inputs and produce output to maximize profits

- given stable prices, preferences, and technologies, a computer can solve this problem

Why We Need Prices, Profits, and Losses II

Economic calculation problem: how to determine which of the infinite technologically-feasible options are economically viable?

How to best make use of dispersed knowledge to coordinate conflicting plans of individuals for their own ends?

ONLY through prices, profits, and losses

What if there Were No Prices? I

What if there Were No Prices? II

So What's the Point of the Model?

In perfect competition (model):

- price-taking firms set price equal to marginal cost

- long run economic profits are zero

- allocative efficiency: consumer and producer surplus maximized

This is a tendency only because of free entry and exit

So What's the Point of the Model?

In perfect competition (model):

- price-taking firms set price equal to marginal cost

- long run economic profits are zero

- allocative efficiency: consumer and producer surplus maximized

This is a tendency only because of free entry and exit

Don't judge real world markets by their similarity to perfect competition, judge them on their level of competition (ease of entry)!