2.6: Long Run Industry Equilibrium

ECON 306 · Microeconomic Analysis · Fall 2019

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microf19

microF19.classes.ryansafner.com

Firm's Long Run Supply Decisions

Firm Decisions in the Long Run I

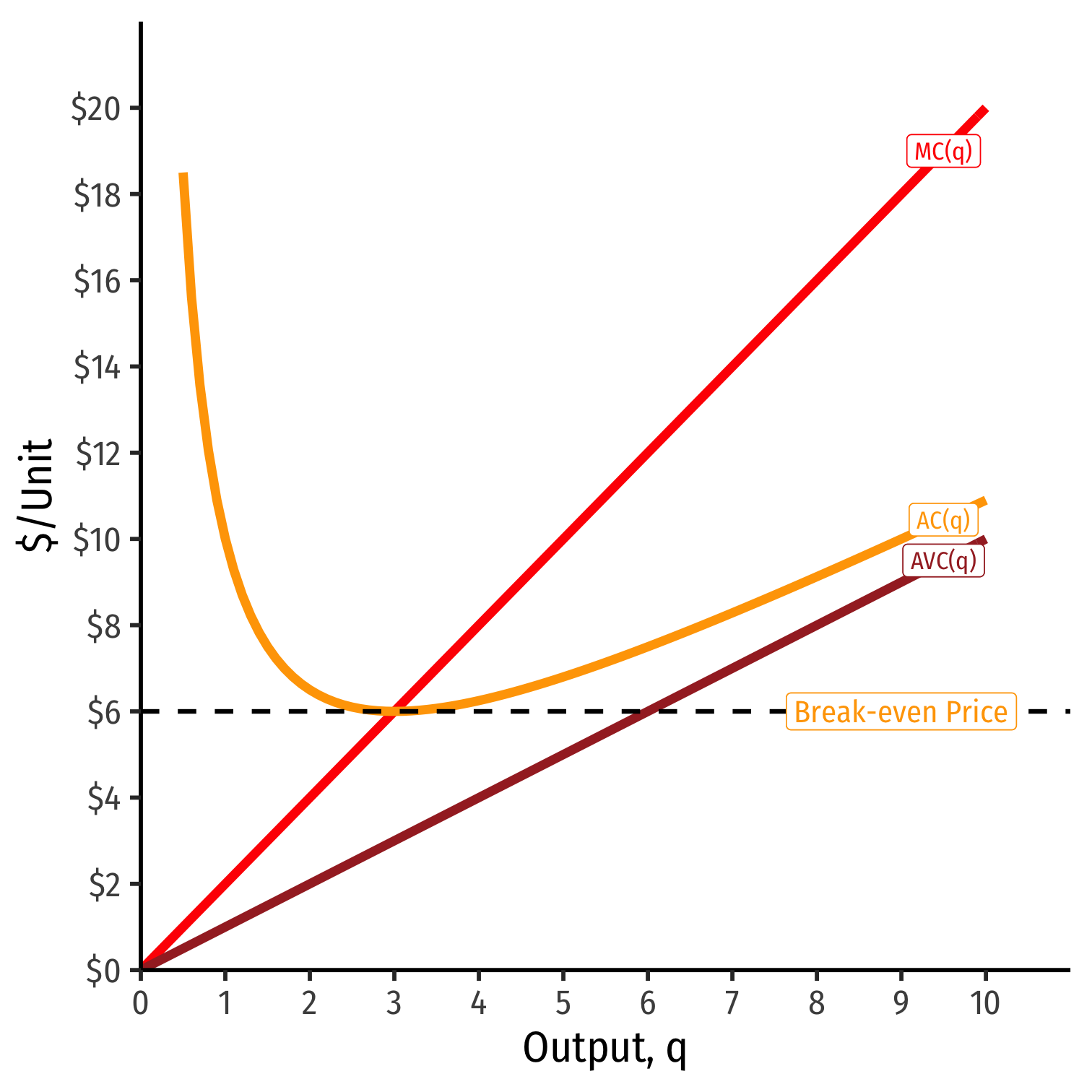

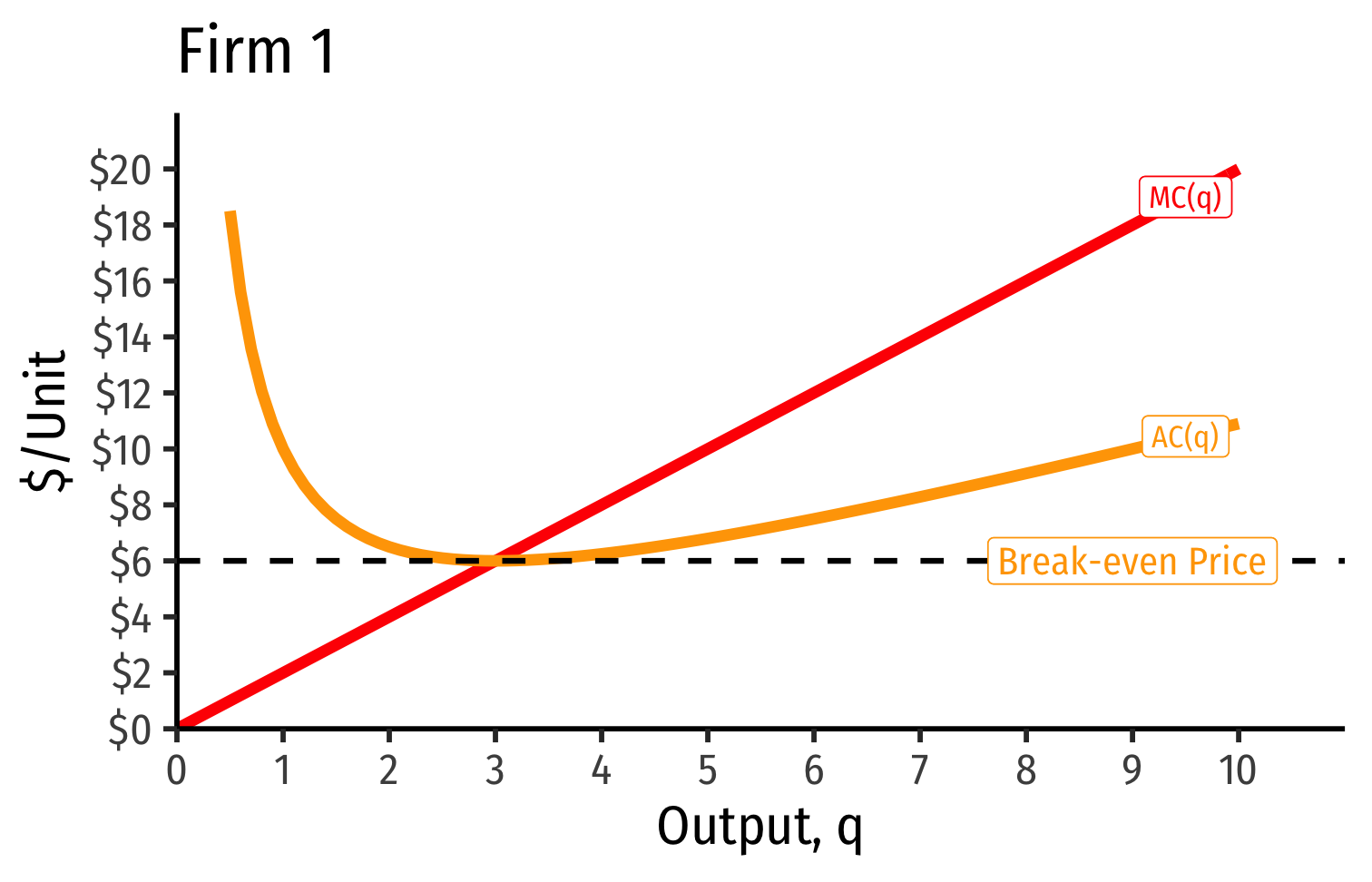

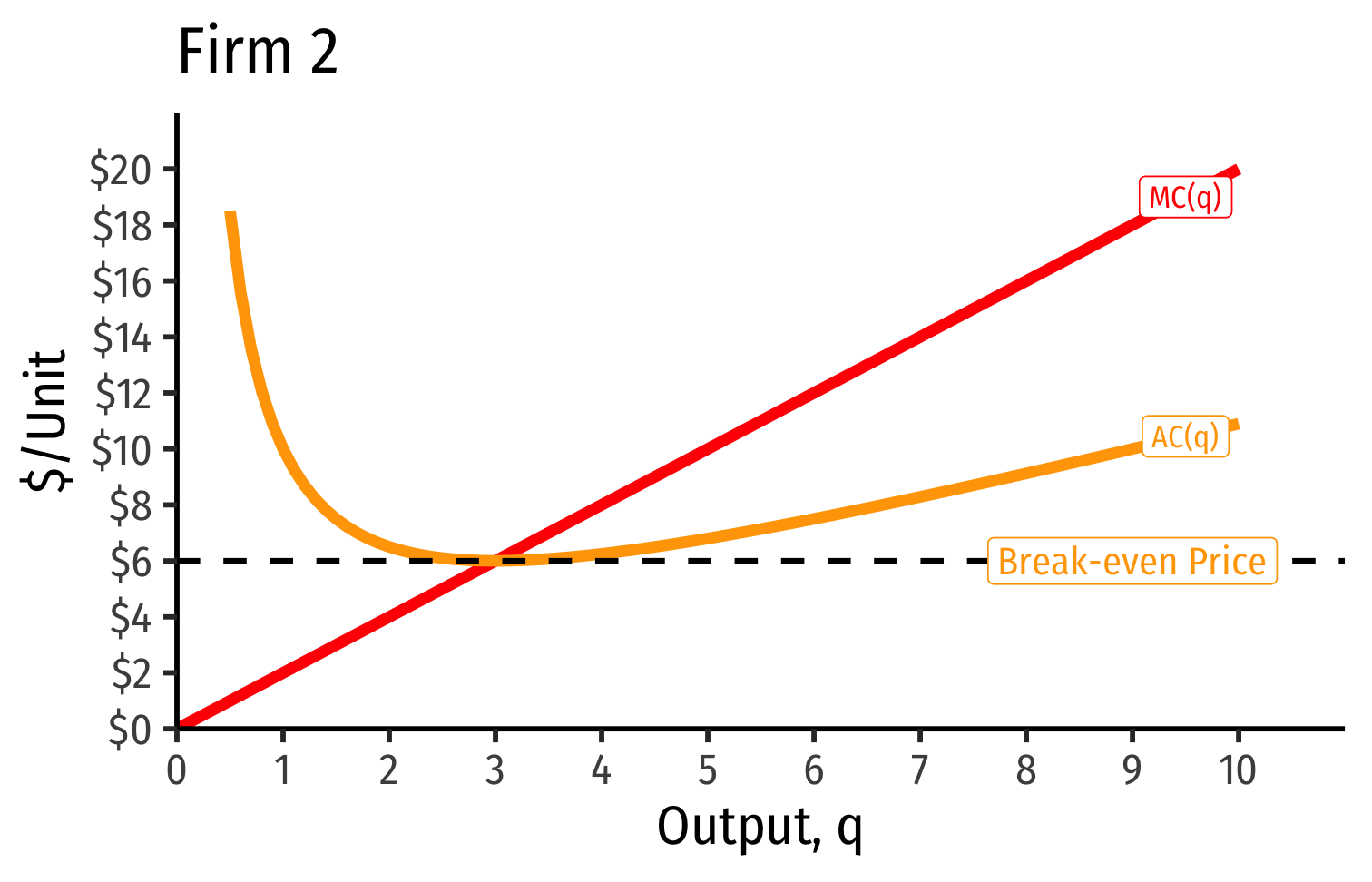

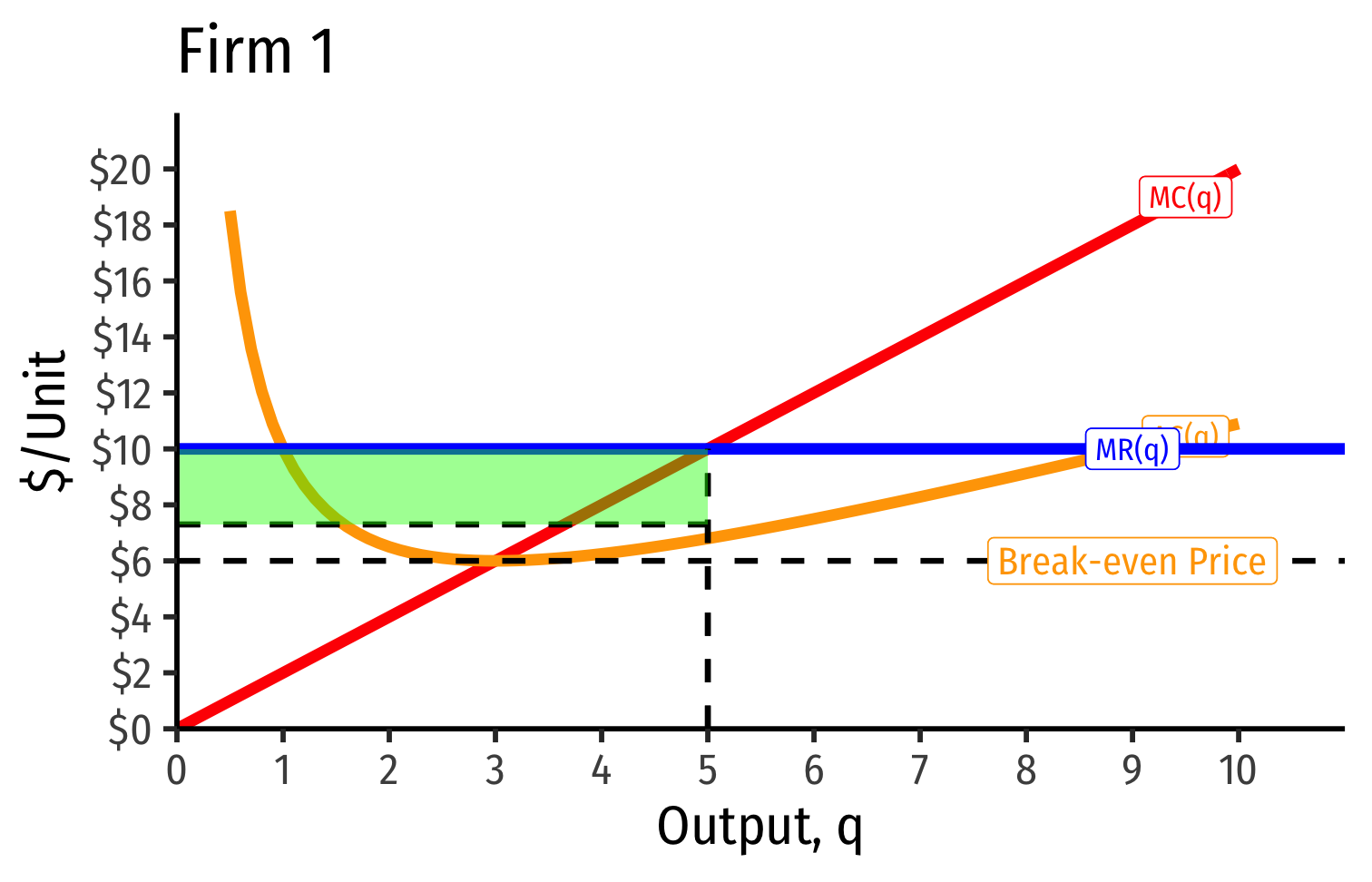

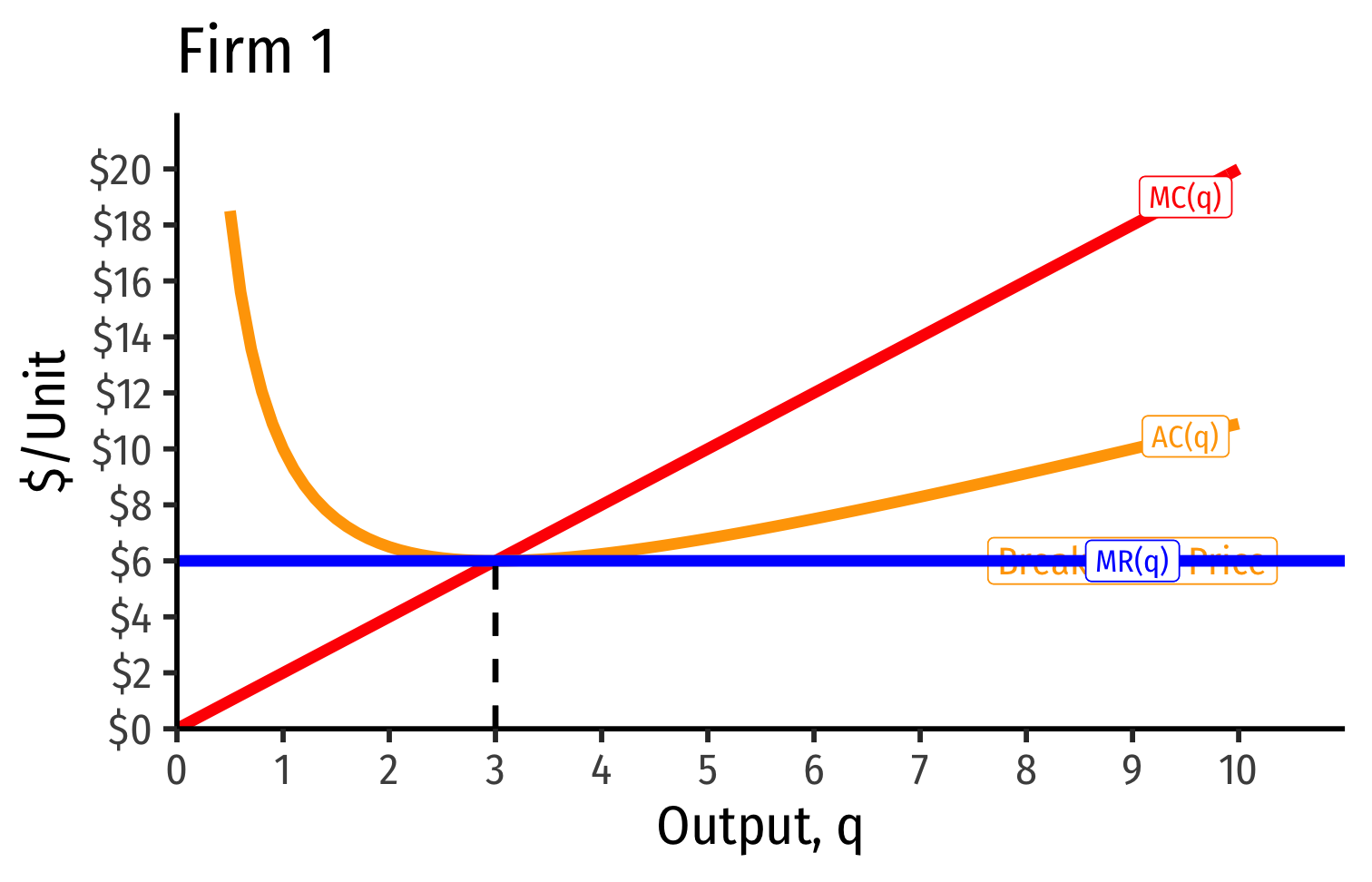

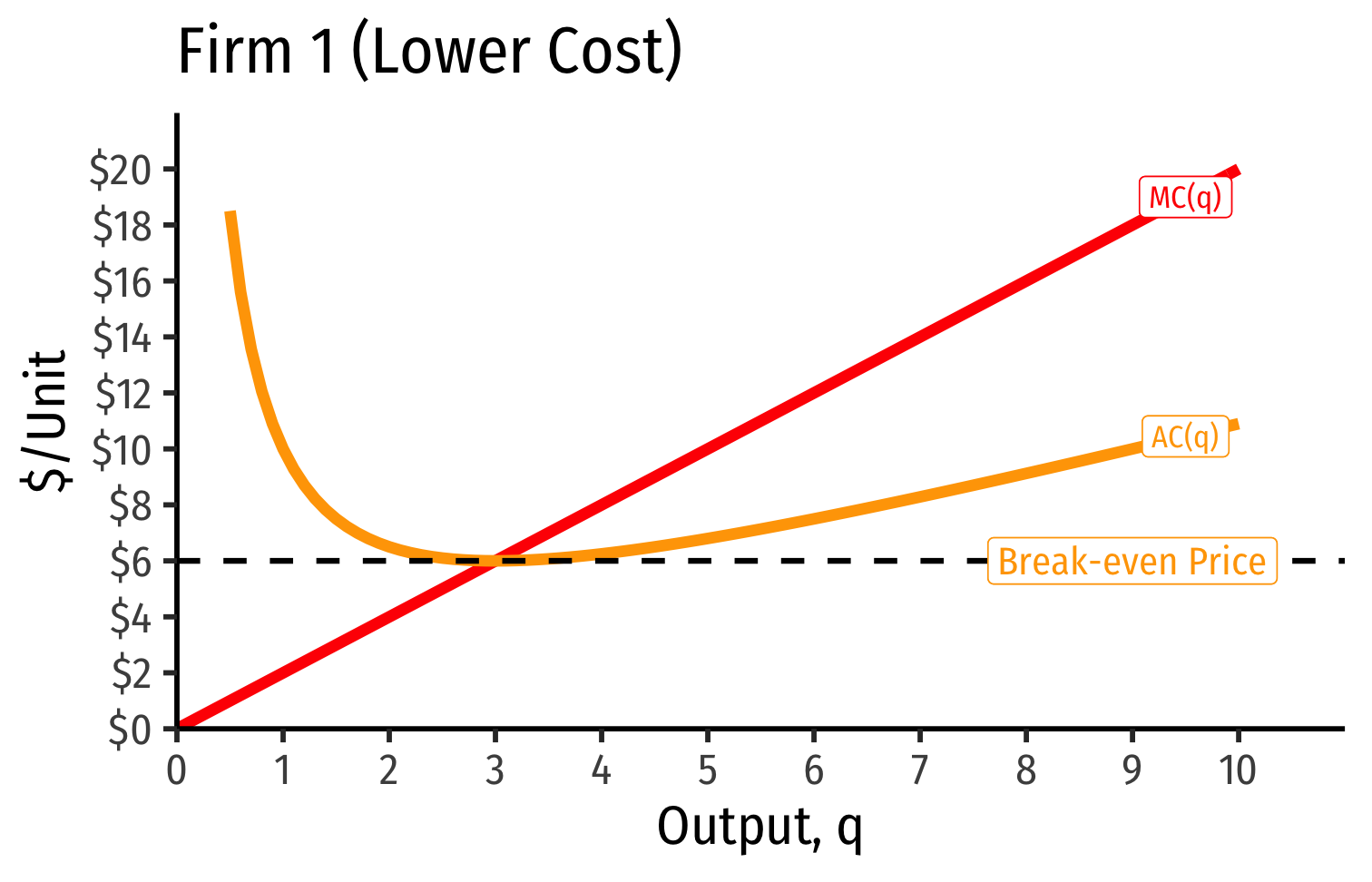

AC(q)min happens at a market price of $6.00

At $6.00, the firm earns "normal economic profits" of 0.

At any market price below $6.00, firm earns losses

- In the Short Run: firm shuts down production only if p<AVC(q)

At any market price above $6.00, firm earns "supernormal profits"

Firm Supply Decisions in the Short Run vs. Long Run

- Short run: firms that shut down (q∗=0) stuck in market, incur fixed costs π=−f

- Firms cannot change their fixed factor (capital k)

Firm Supply Decisions in the Short Run vs. Long Run

Short run: firms that shut down (q∗=0) stuck in market, incur fixed costs π=−f

- Firms cannot change their fixed factor (capital k)

Long run: firms earning losses (π<0) can exit the market and earn π=0

- No more fixed costs, firms can sell/abandon f at q∗=0

Firm Supply Decisions in the Short Run vs. Long Run

Short run: firms that shut down (q∗=0) stuck in market, incur fixed costs π=−f

- Firms cannot change their fixed factor (capital k)

Long run: firms earning losses (π<0) can exit the market and earn π=0

- No more fixed costs, firms can sell/abandon f at q∗=0

Entrepreneurs & Firms not currently in market can choose to enter and start producing, if entry would earn them π>0

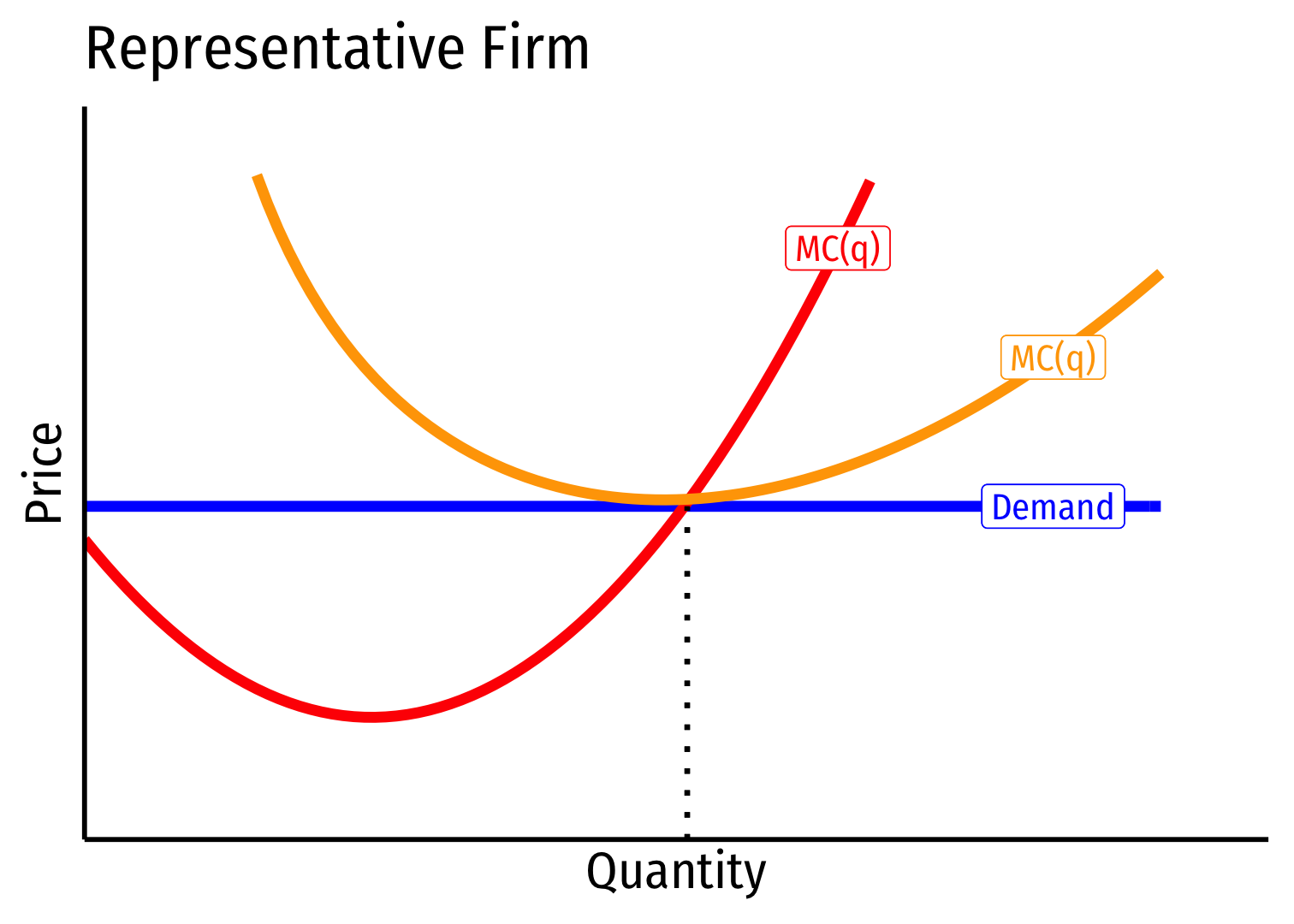

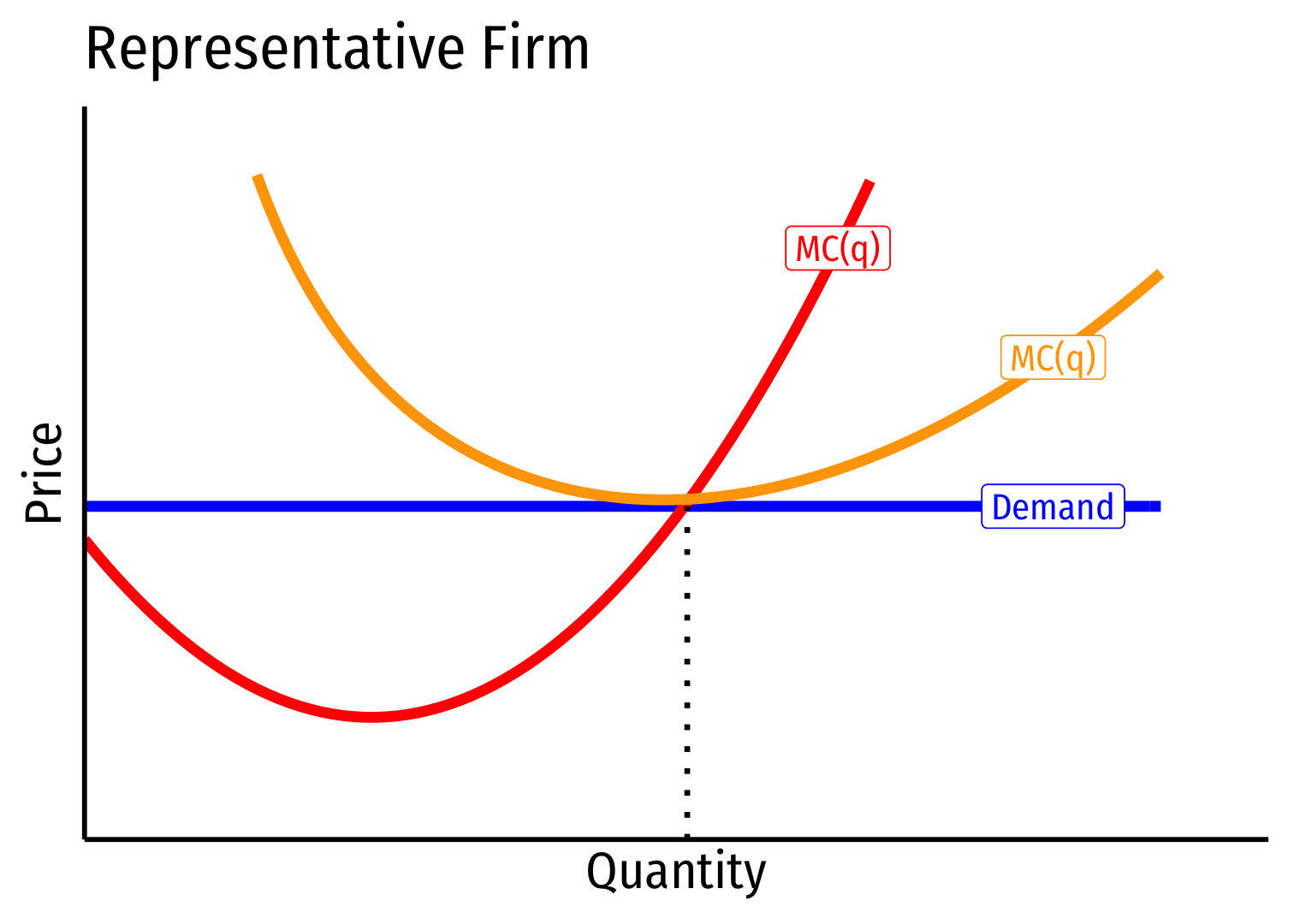

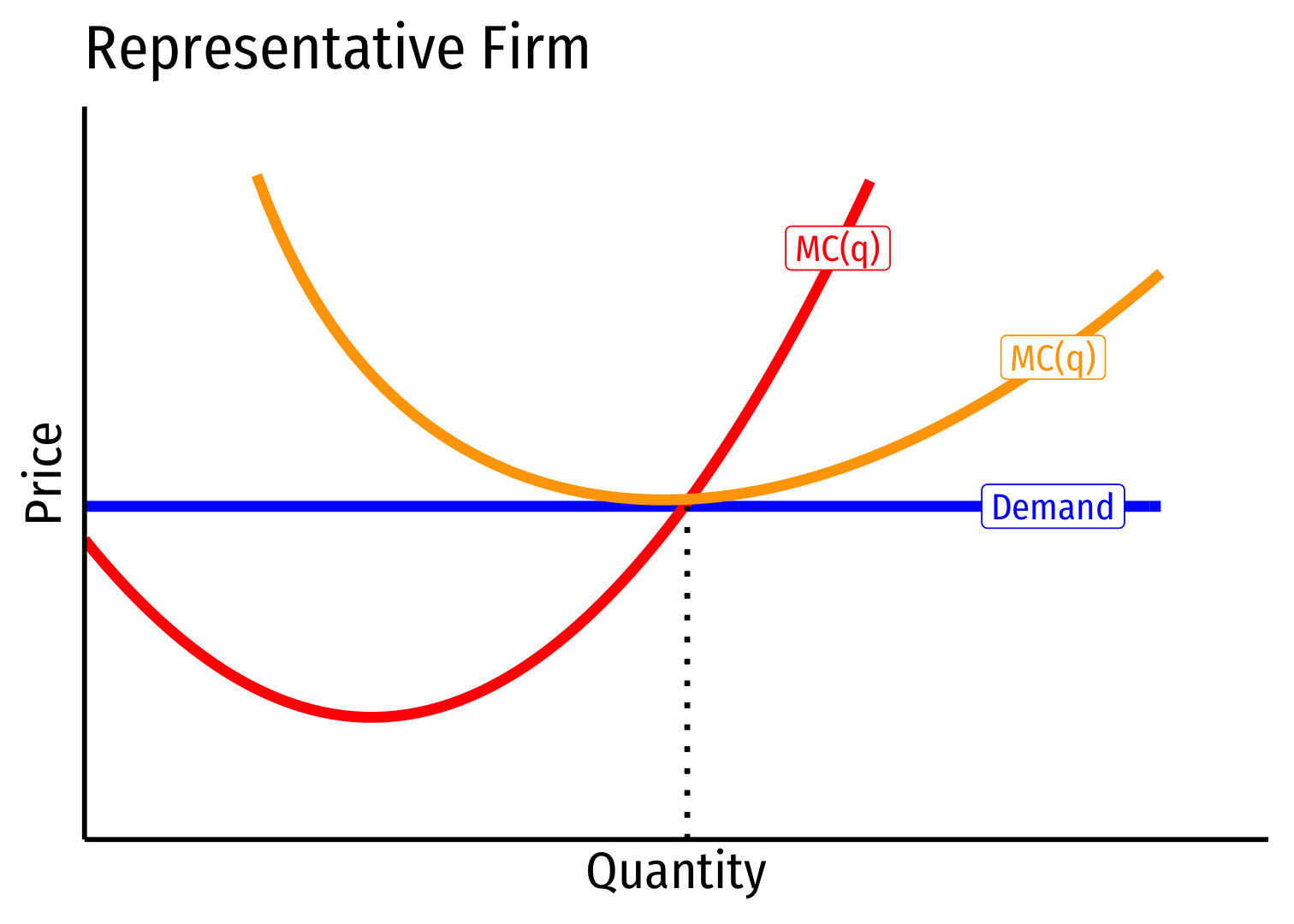

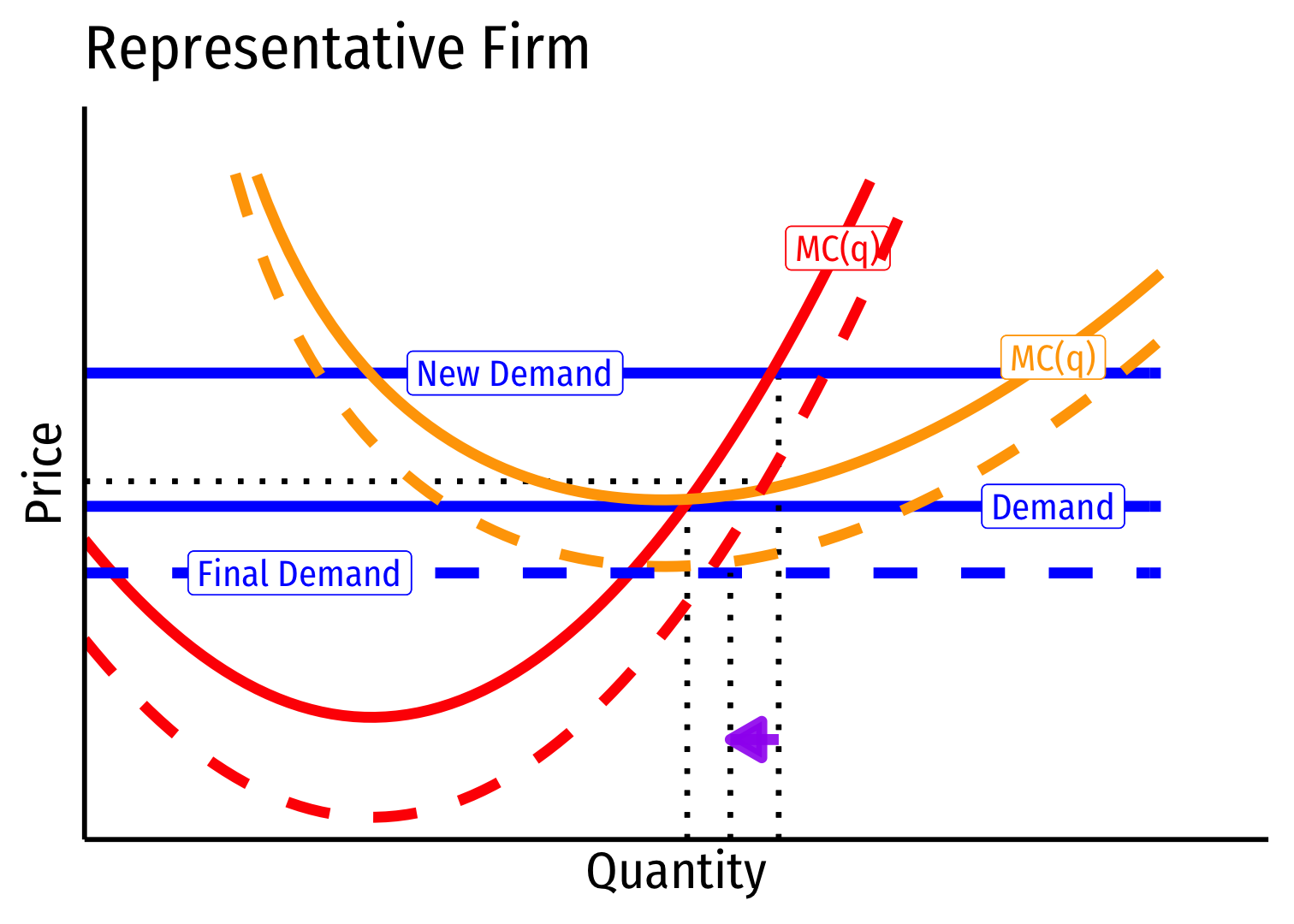

Firm's Long Run Supply: Visualizing

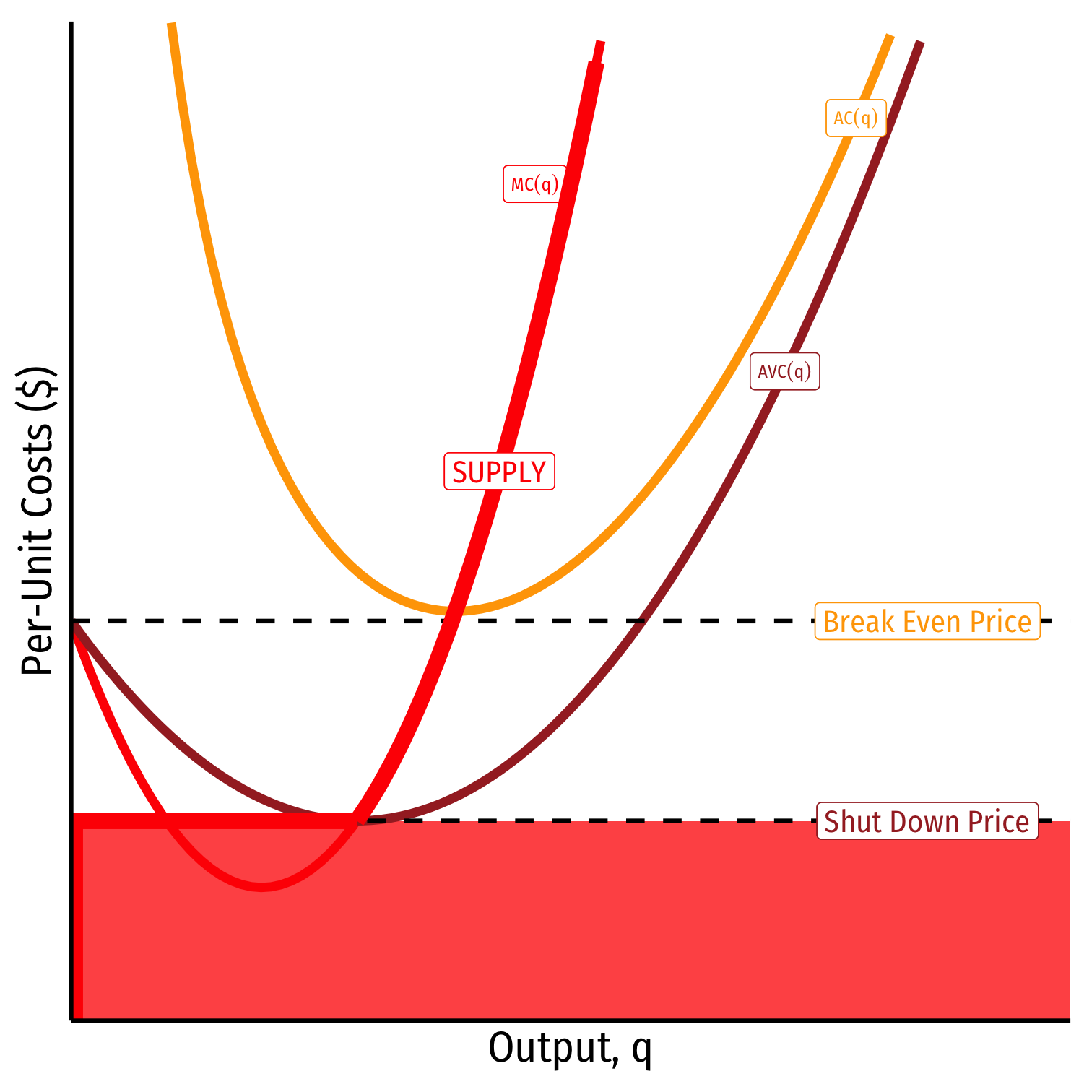

When p<AVC

Profits are negative

Short run: shut down production

- Firm loses more π by producing than by not producing

Long run: firms in industry exit the industry

- No new firms will enter this industry

Firm's Long Run Supply: Visualizing

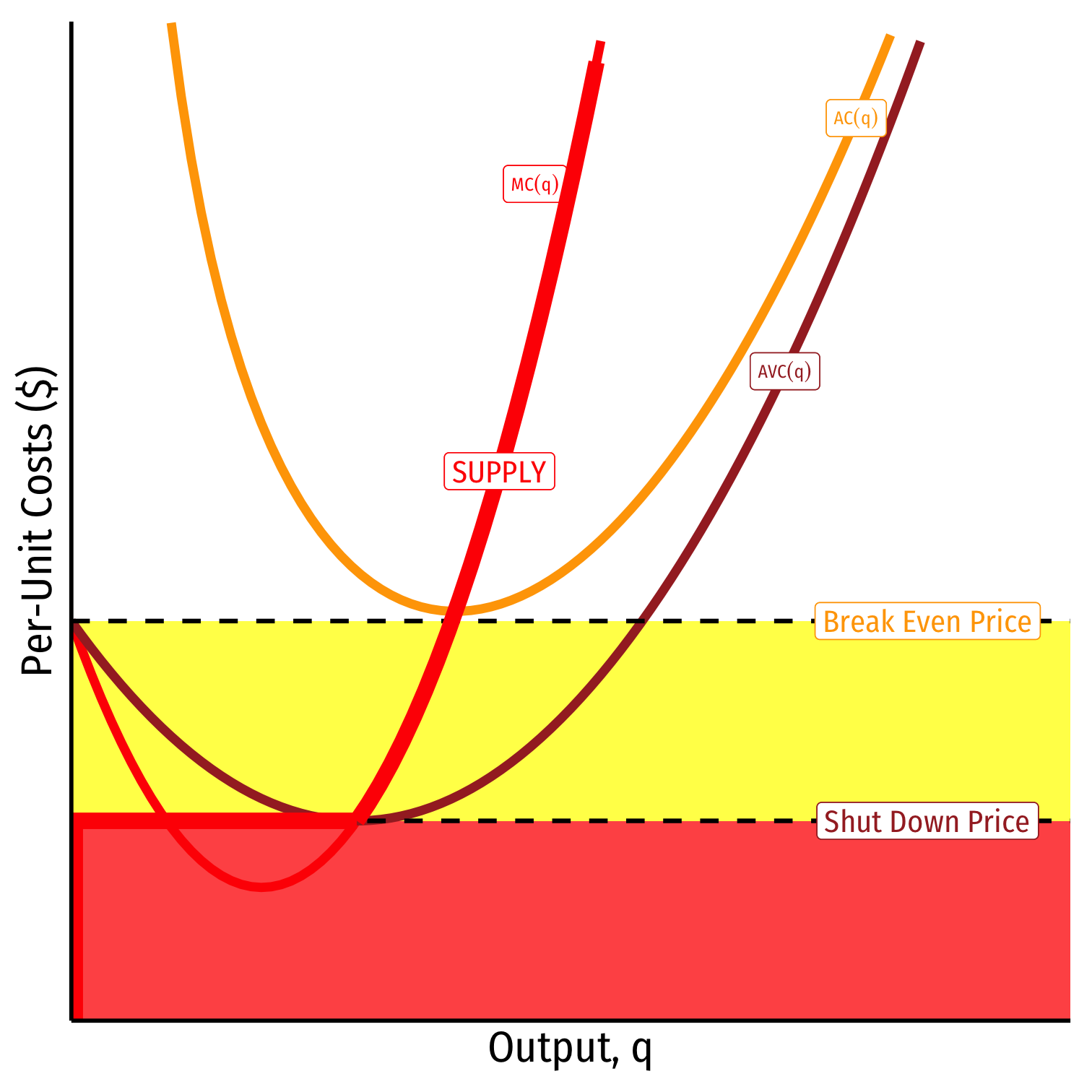

When AVC<p<AC

Profits are negative

Short run: continue production

- Firm loses less π by producing than by not producing

Long run: firms in industry exit the industry

- No new firms will enter this industry

Firm's Long Run Supply: Visualizing

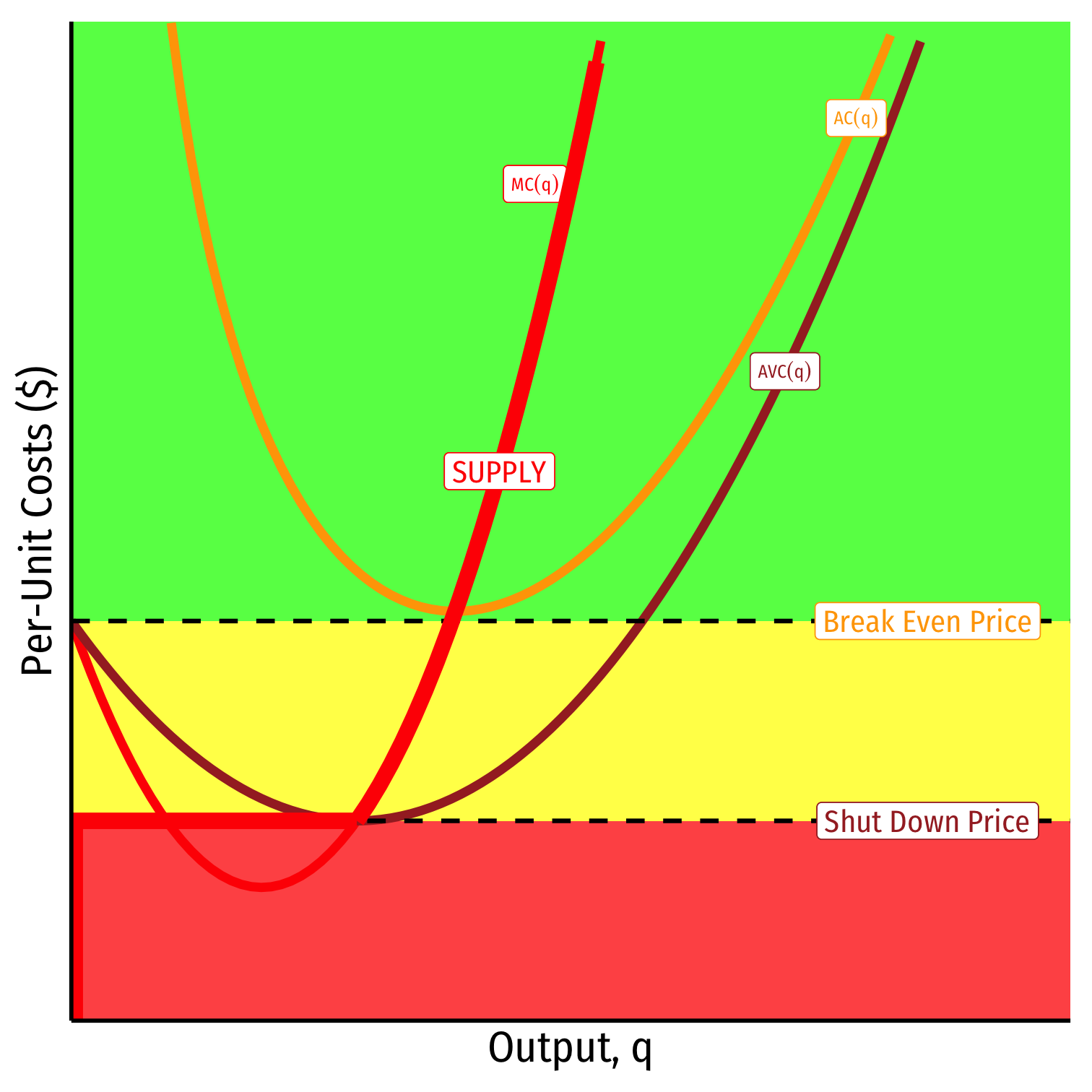

When AC<p

Profits are positive

Short run: continue production

- Firm earn profits

Long run: firms in industry stay in industry

- New new firms will enter this industry

Summary:

1. Choose q∗ such that MR(q)=MC(q)

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down in the short run if p<AVC(q)

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down in the short run if p<AVC(q)

Firm's short run (inverse) supply:

{p=MC(q)if p≥AVCq=0If p<AVC

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down in the short run if p<AVC(q)

Firm's short run (inverse) supply:

{p=MC(q)if p≥AVCq=0If p<AVC

4. Exit in the long run if p<AC(q)

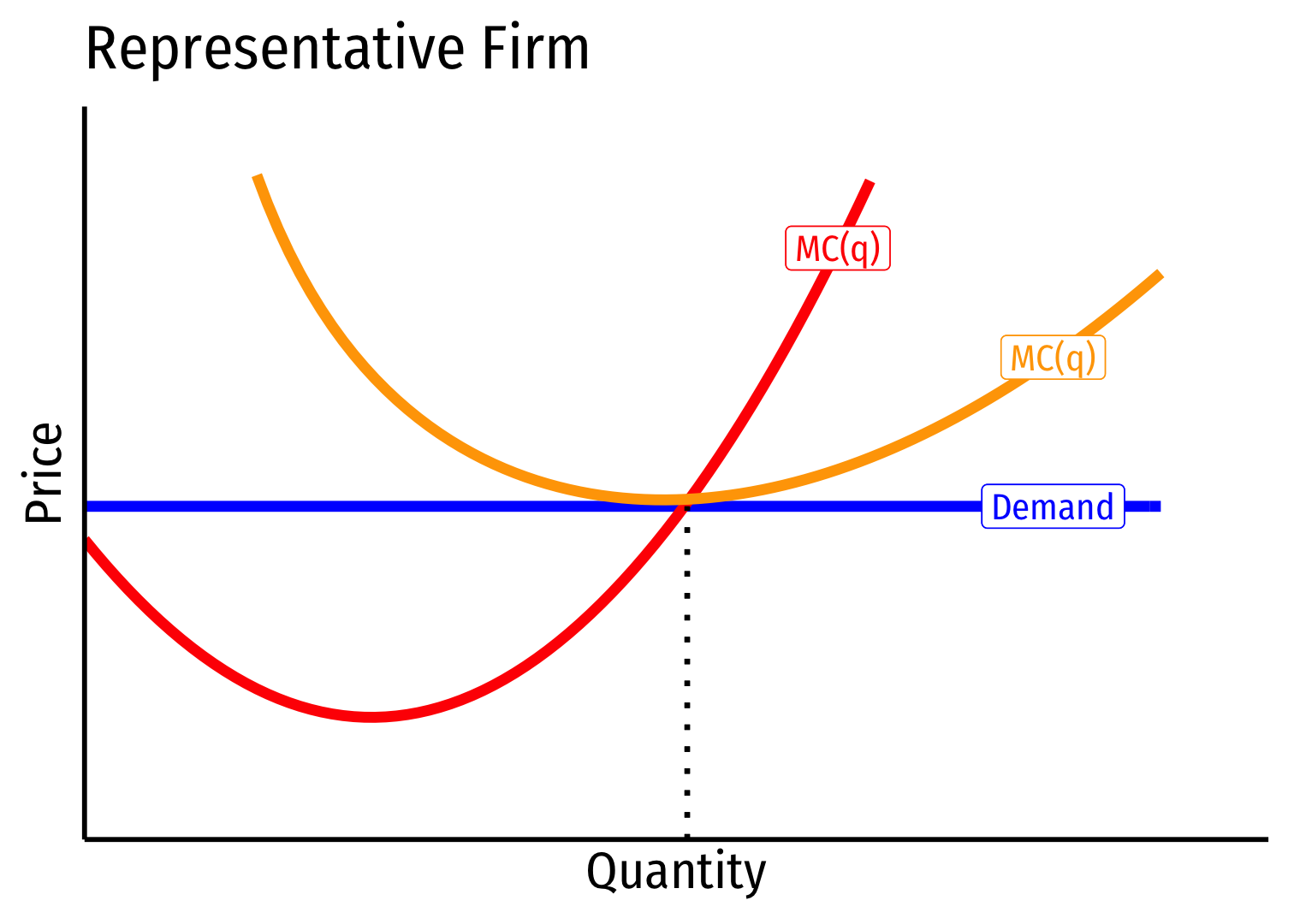

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down in the short run if p<AVC(q)

Firm's short run (inverse) supply:

{p=MC(q)if p≥AVCq=0If p<AVC

4. Exit in the long run if p<AC(q)

Firm's long run (inverse) supply:

{p=MC(q)if p≥ACq=0If p<AC

Recall: The Two Major Models of Economics as a "Science"

Optimization

Agents have objectives they value

Agents face constraints

Make tradeoffs to maximize objectives within constraints

Recall: The Two Major Models of Economics as a "Science"

Optimization

Agents have objectives they value

Agents face constraints

Make tradeoffs to maximize objectives within constraints

Equilibrium

Agents face competition from others that affect prices

Agents adjust their behaviors based on prices

Stable outcomes result where all agents cease adjusting

Recall: Optimization and Equilibrium

If people can learn and change their behavior, they will always switch to a higher-valued option

If there are no alternatives that are better, people are at an optimum

If everyone is at an optimum, the system is in equilibrium

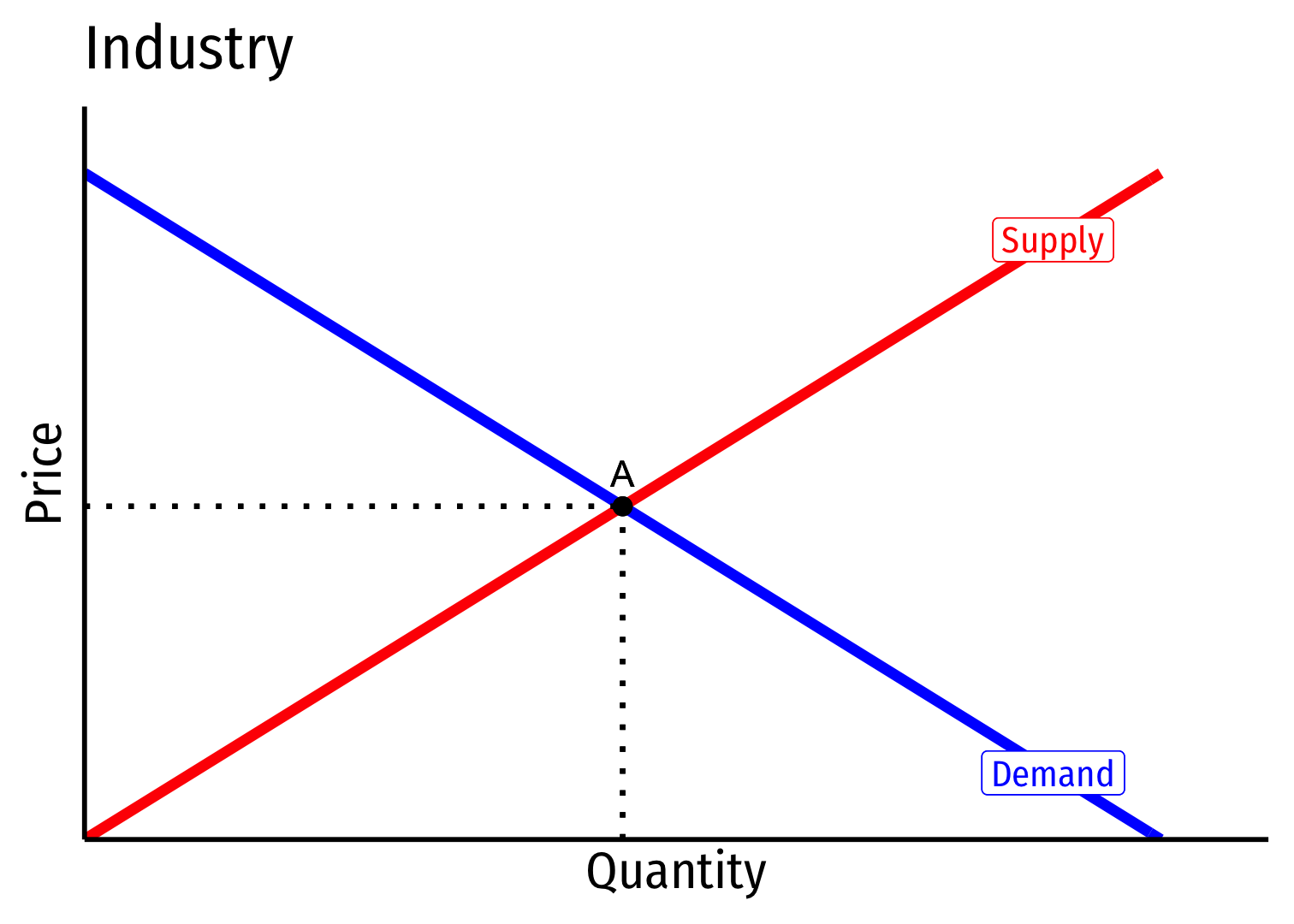

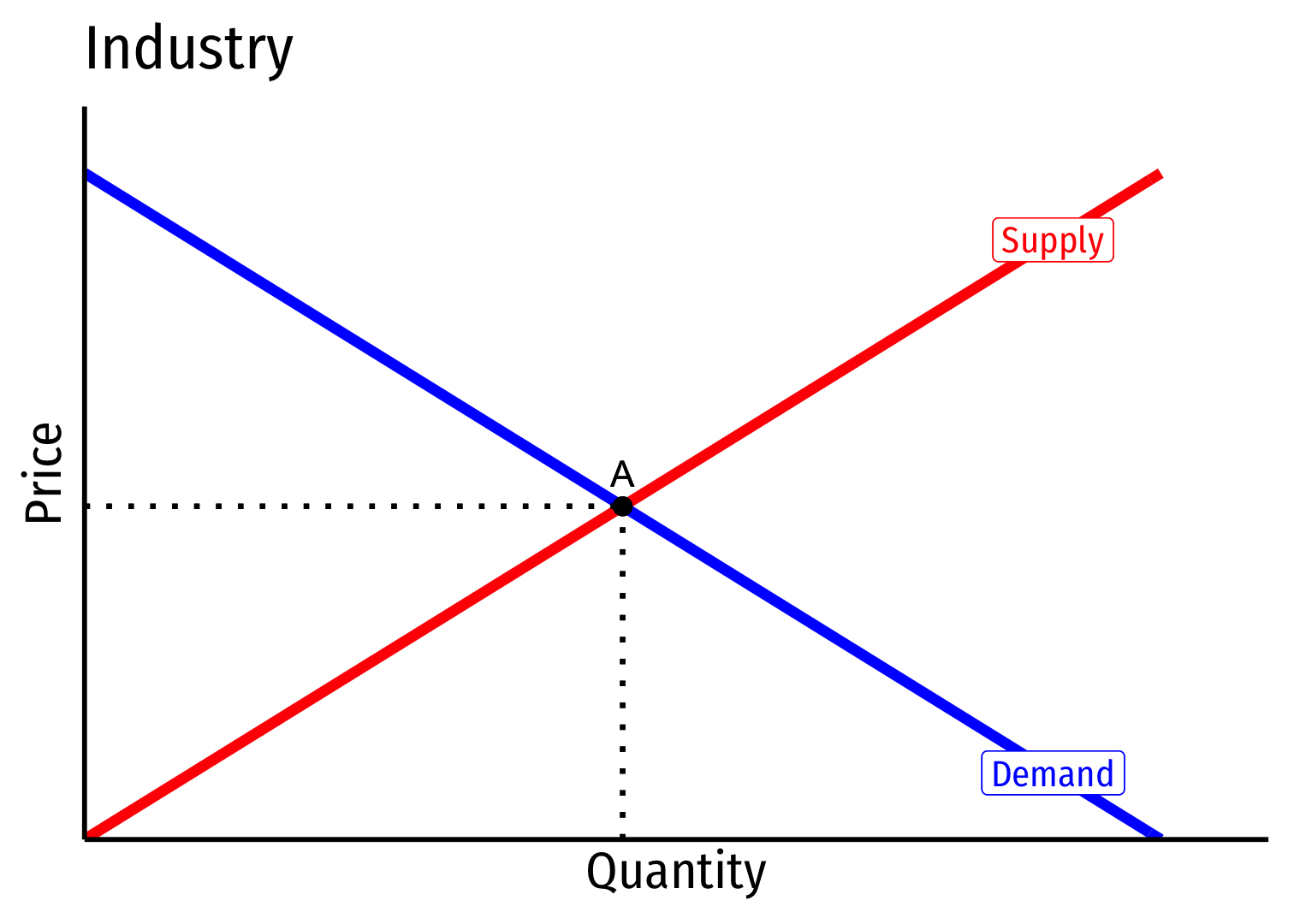

Market Entry and Exit

Exit, Entry, and Long Run Industry Equilibrium I

Now we must combine optimizing individual firms with market-wide adjustment to equilibrium

Since π=[p−AC(q)]q, in the long run, profit-seeking firms will:

Exit, Entry, and Long Run Industry Equilibrium I

Now we must combine optimizing individual firms with market-wide adjustment to equilibrium

Since π=[p−AC(q)]q, in the long run, profit-seeking firms will:

- Enter markets where p>AC(q)

Exit, Entry, and Long Run Industry Equilibrium I

Now we must combine optimizing individual firms with market-wide adjustment to equilibrium

Since π=[p−AC(q)]q, in the long run, profit-seeking firms will:

- Enter markets where p>AC(q)

- Exit markets where p<AC(q)

Exit, Entry, and Long Run Industry Equilibrium II

- Long-run equilibrium: entry and exist cases when p=AC(q) for all firms, implying normal economic profits of π=0

Exit, Entry, and Long Run Industry Equilibrium II

Long-run equilibrium: entry and exist cases when p=AC(q) for all firms, implying normal economic profits of π=0

Zero Profits Theorem: long run economic profits for all firms in a competitive industry are 0

Firms must earn an accounting profit to stay in business

A constant tendency as output prices are pushed down and input prices are bid up, squeezing economic profits to 0

In real life, constant changes in underlying prices, technology, preferences

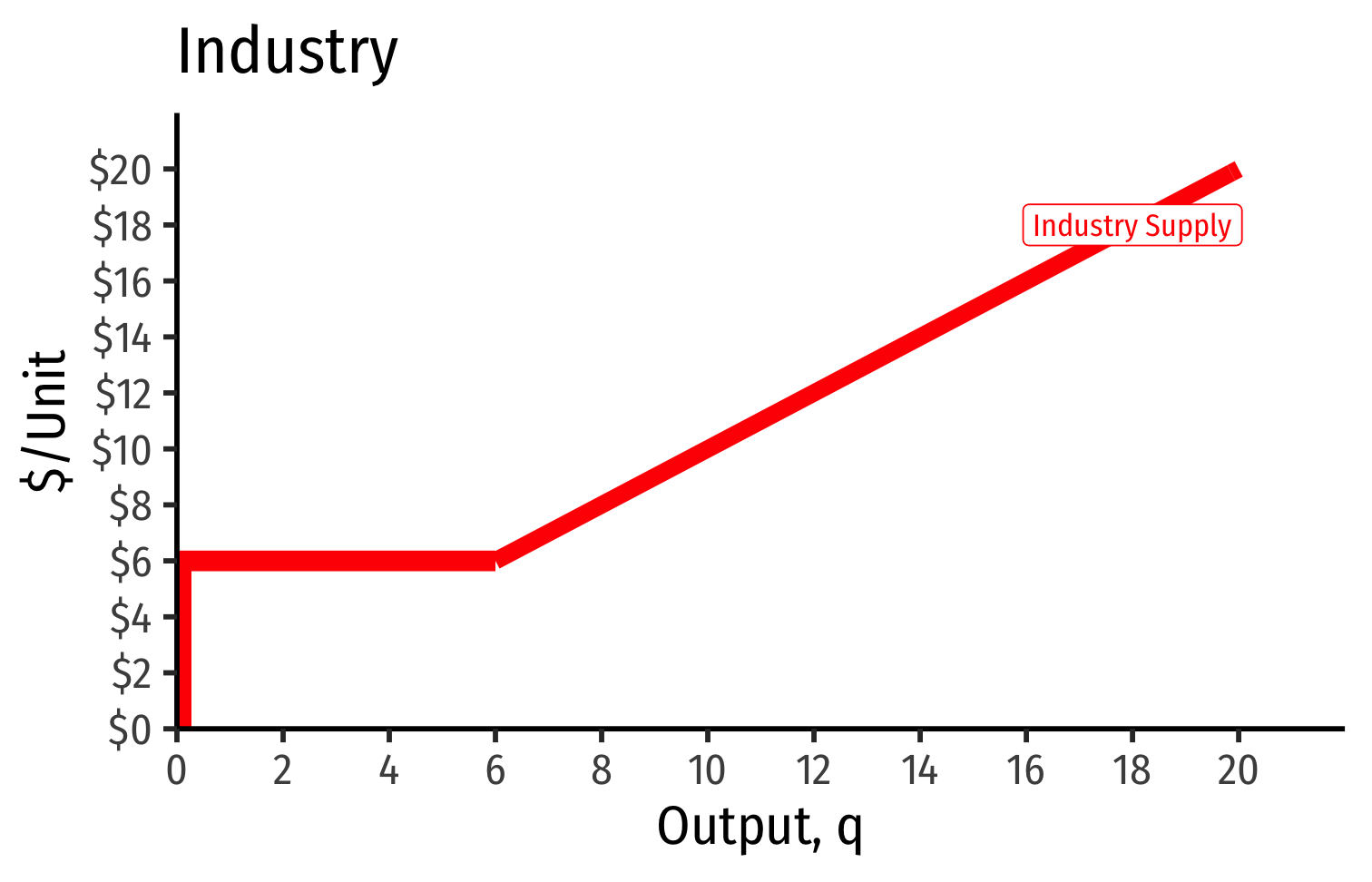

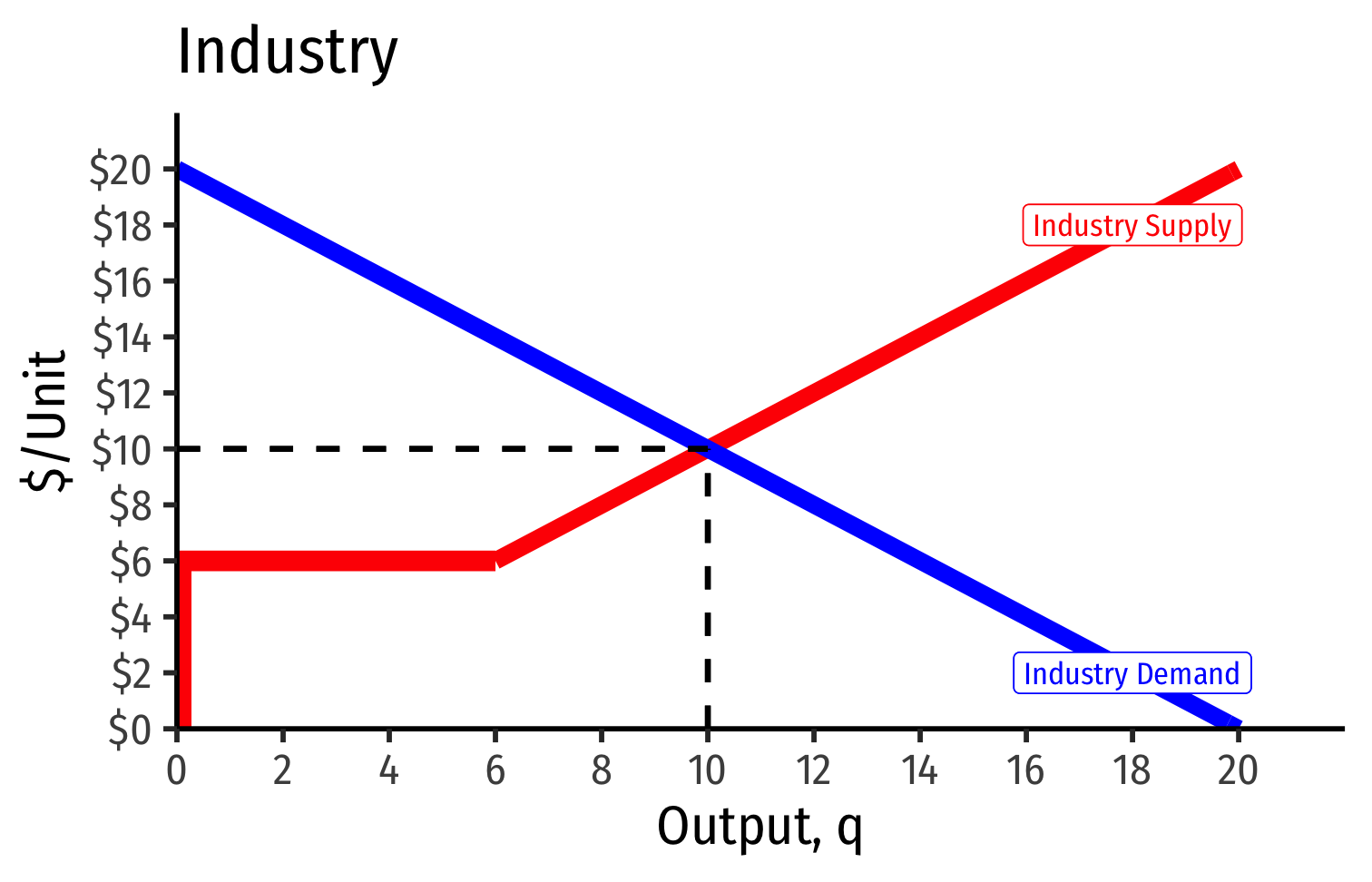

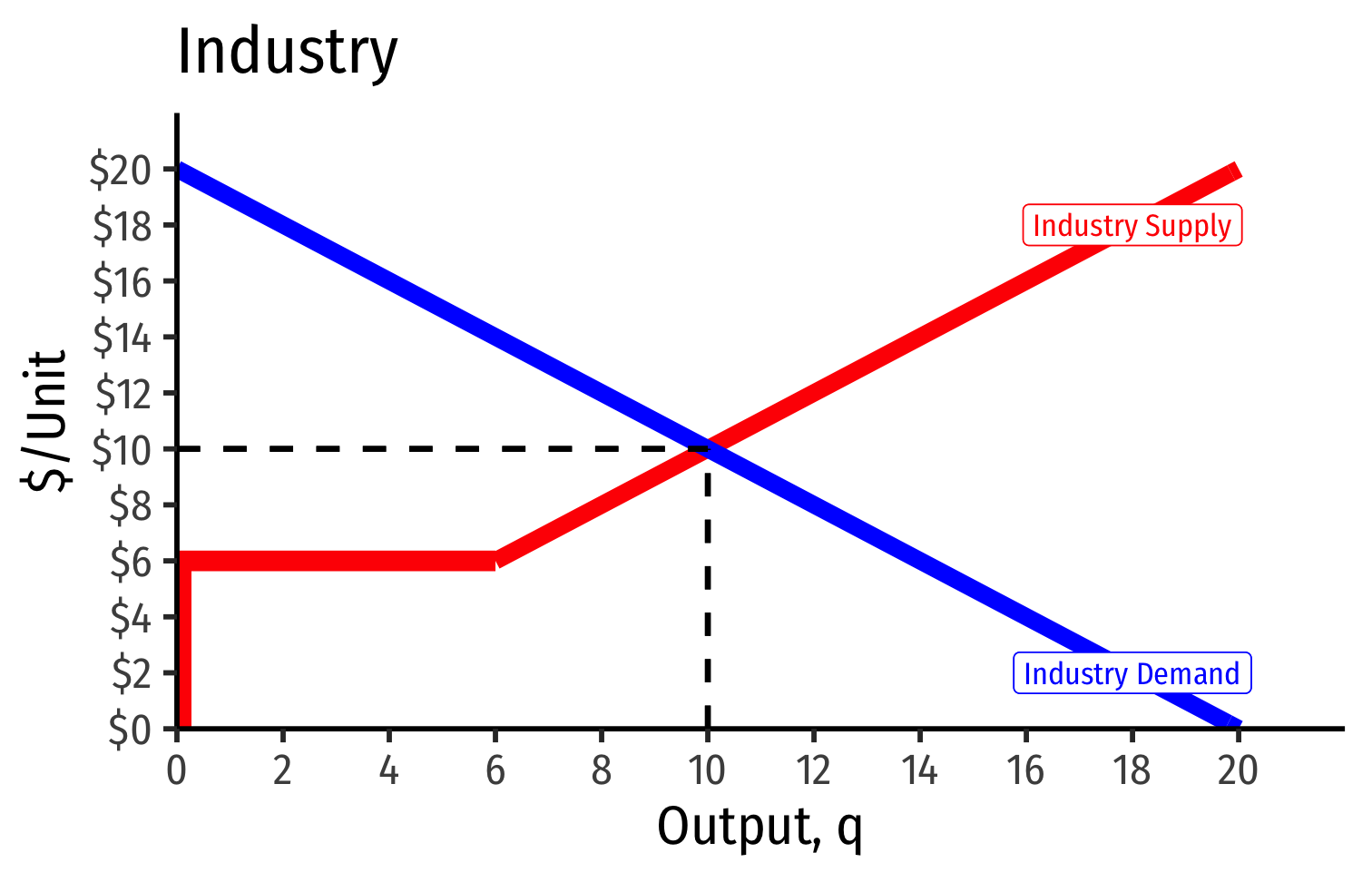

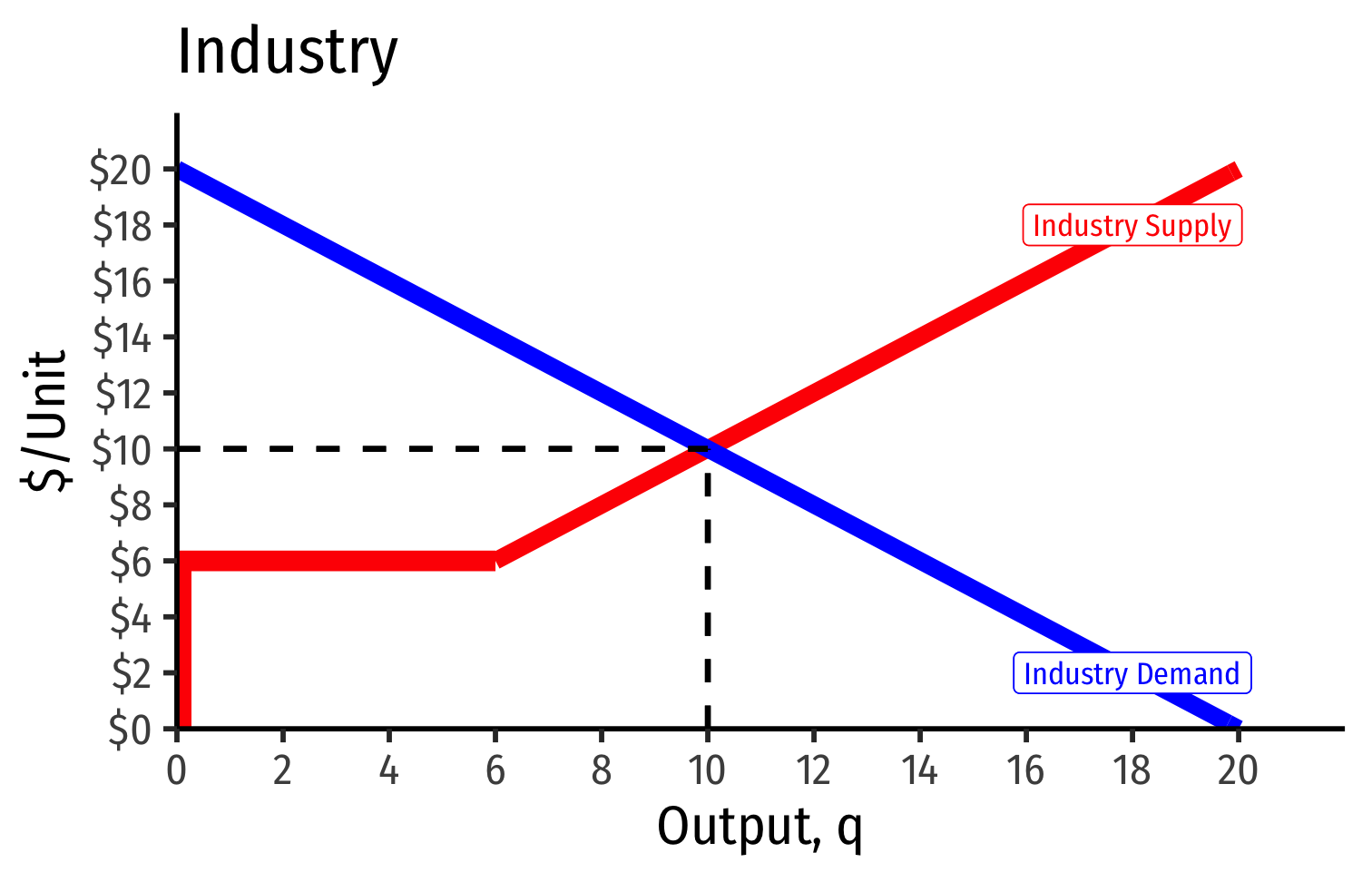

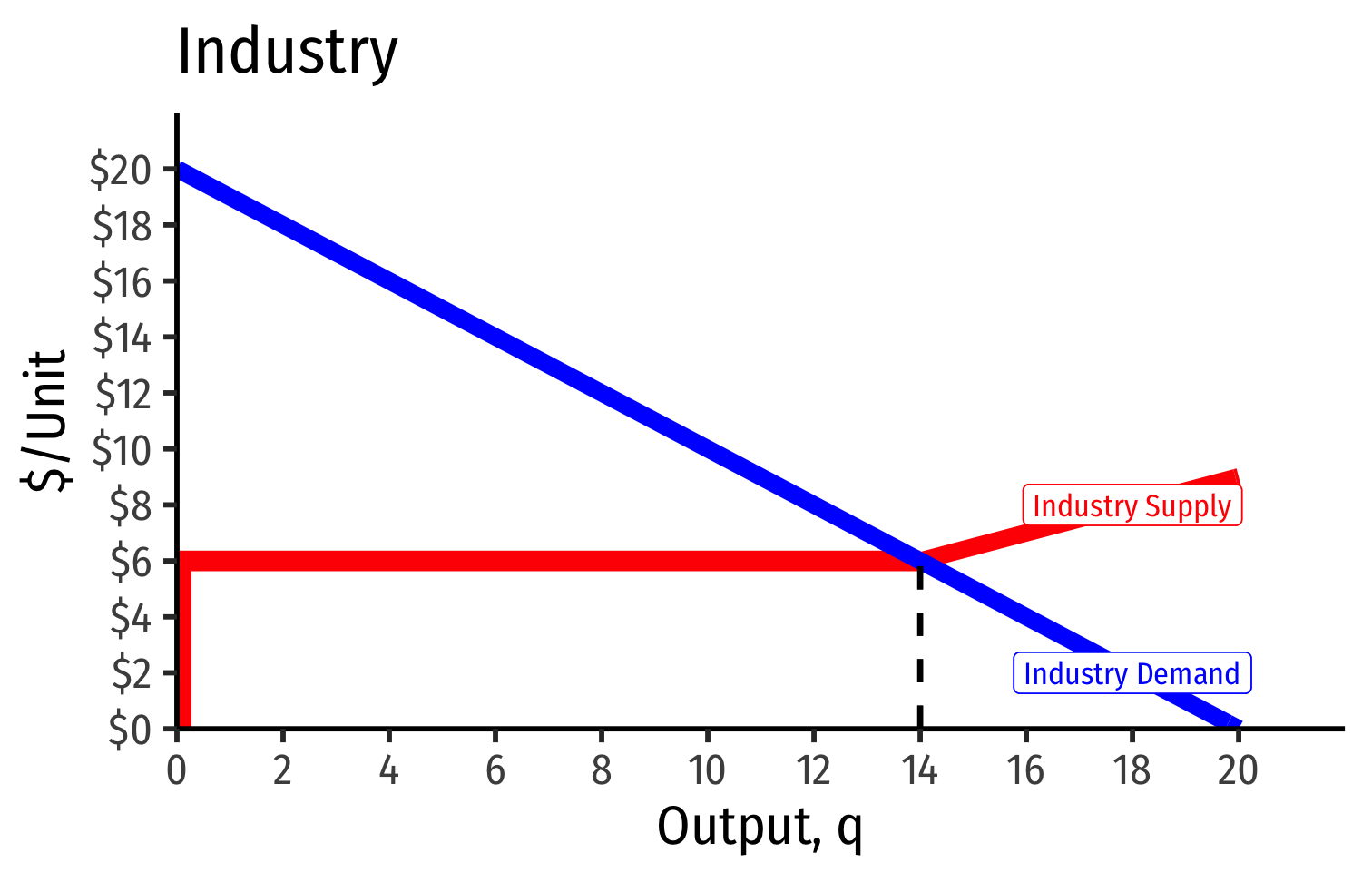

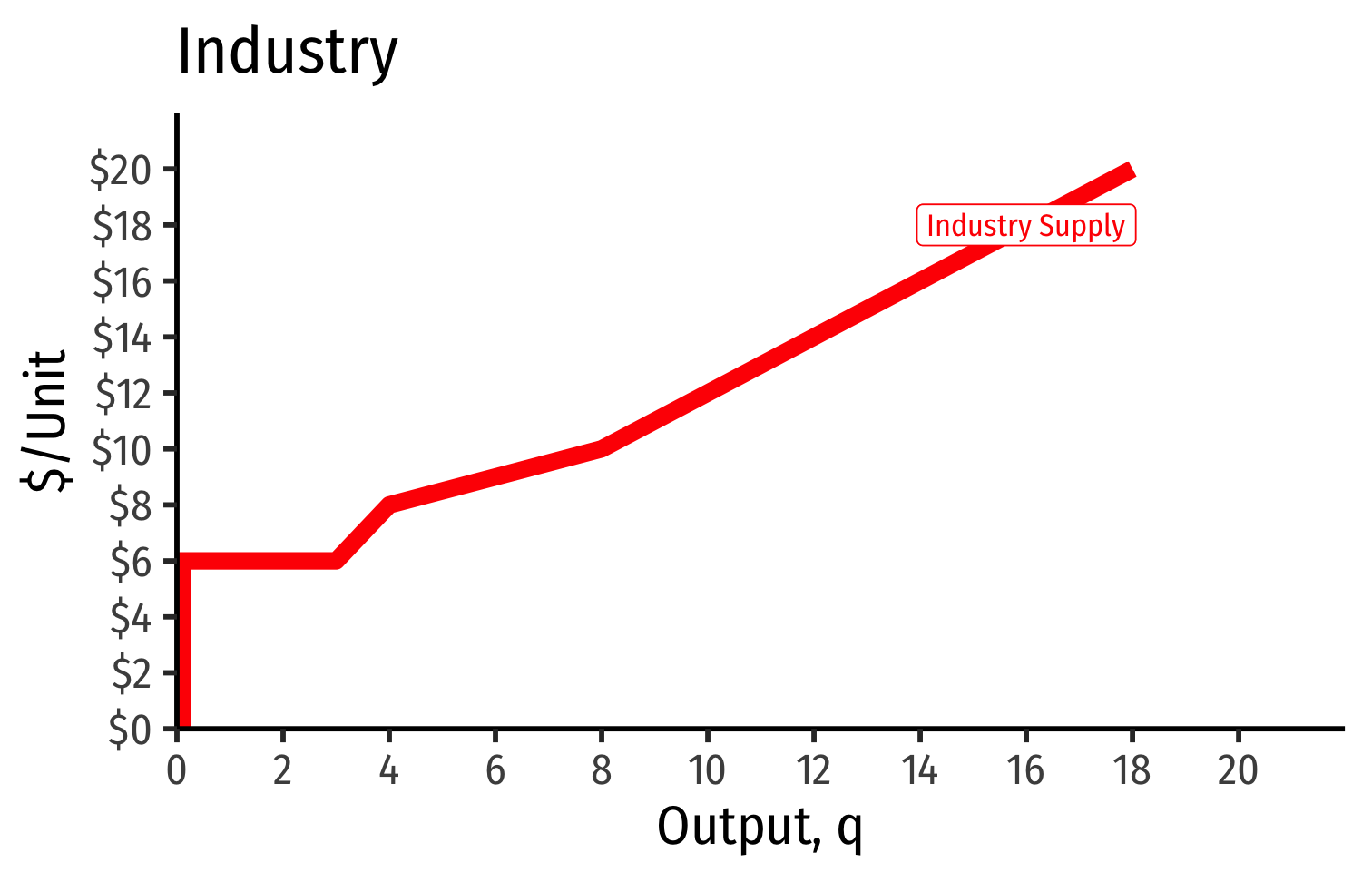

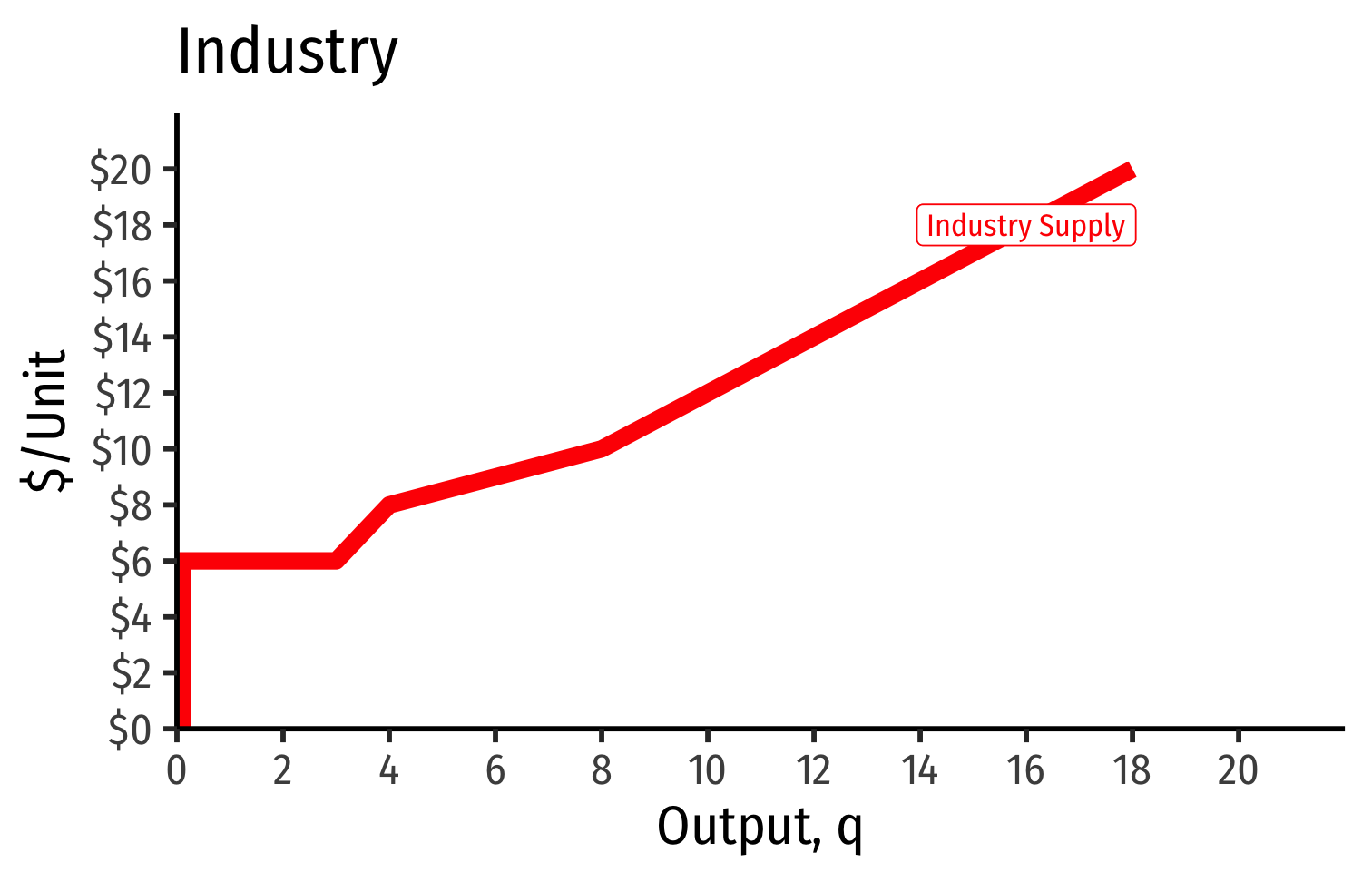

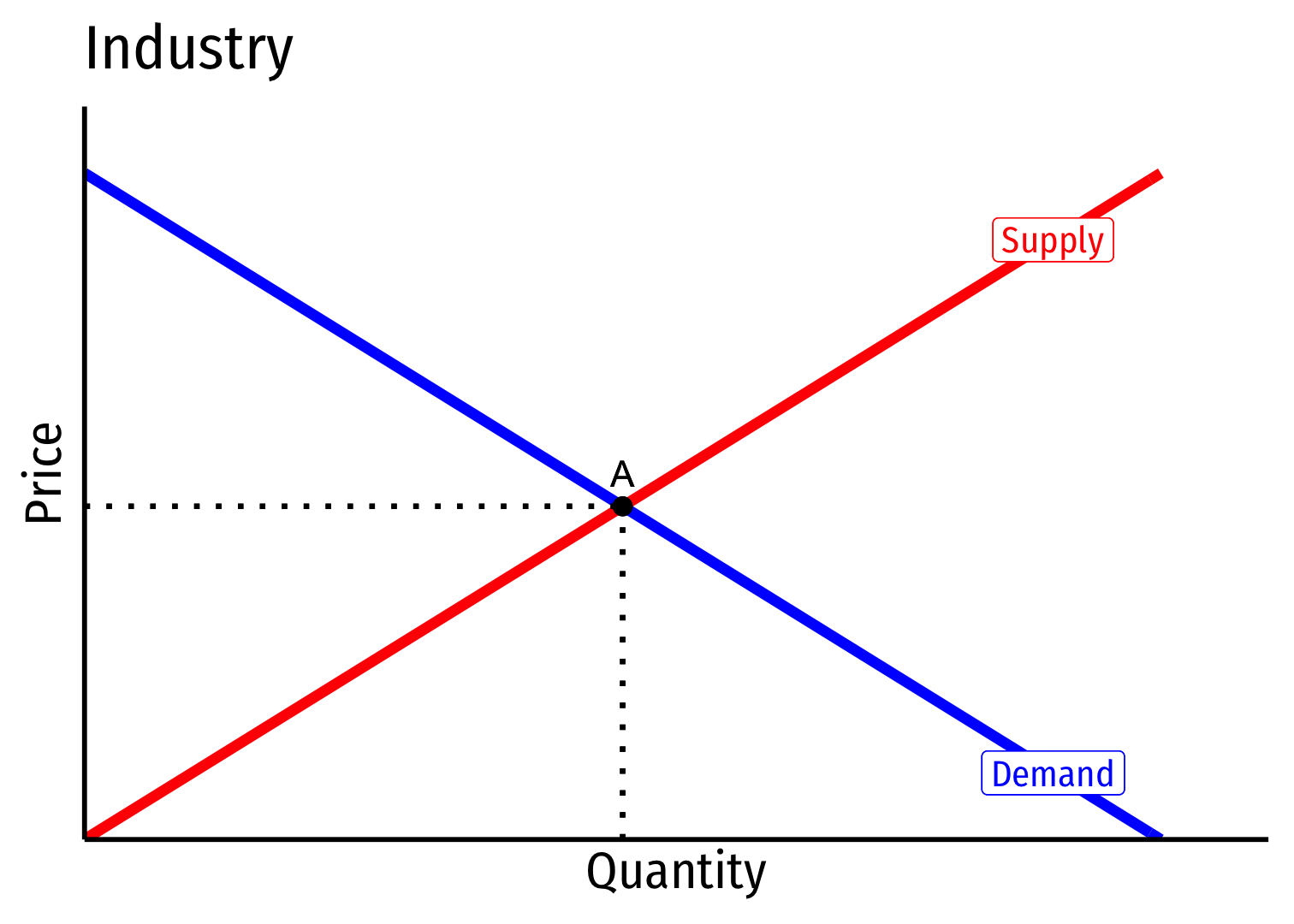

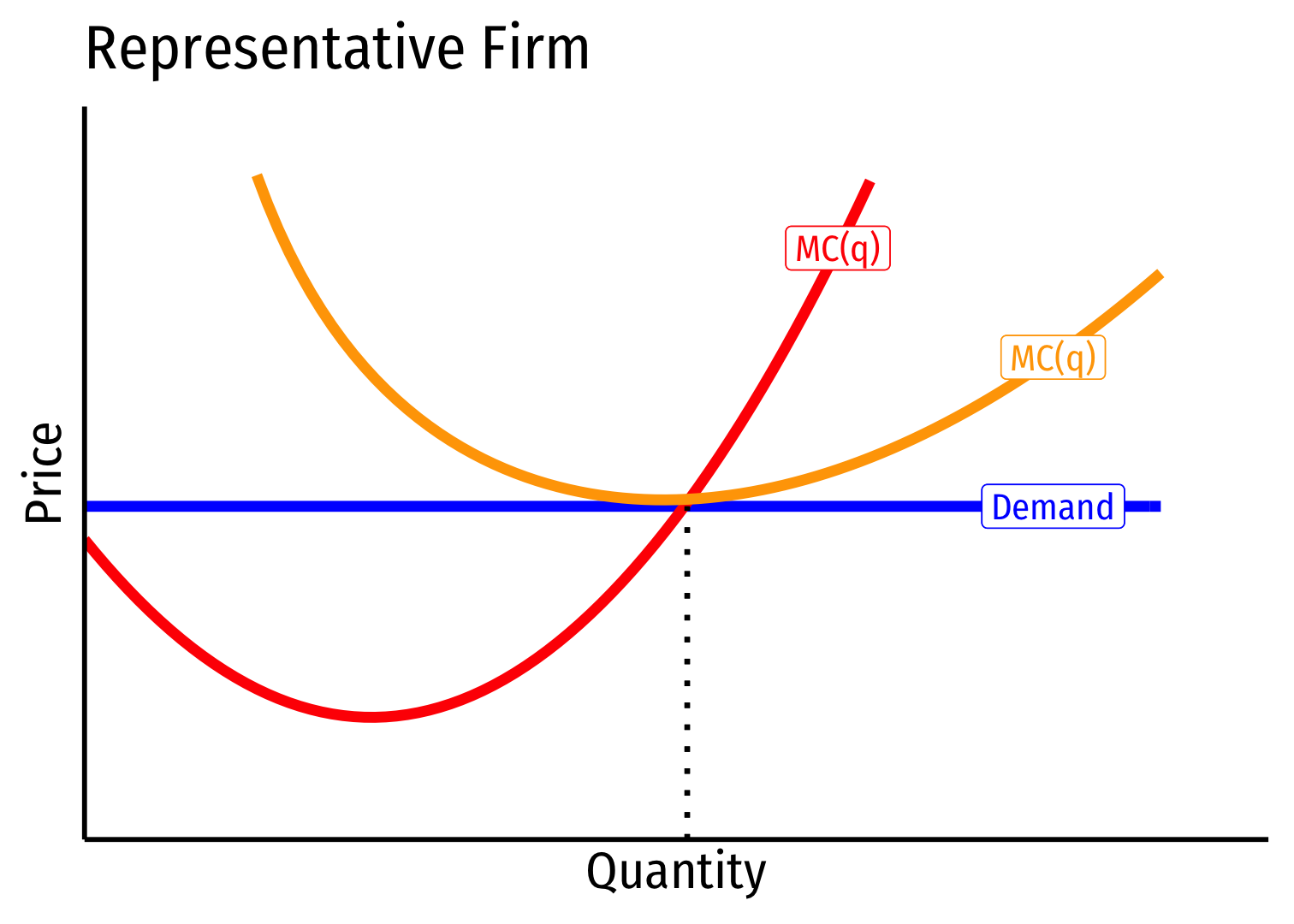

The Industry Supply Curve

Industry supply curve: sum of all individual firms' supply curves (MC(q) curve above AVCmin)

To keep it simple on the following slides:

- assume no fixed costs, so AC(q)=AVC(q)

- then industry supply curve is sum of individual MC(q) curves above AC(q)min

- see 2.4 class notes for more explanation

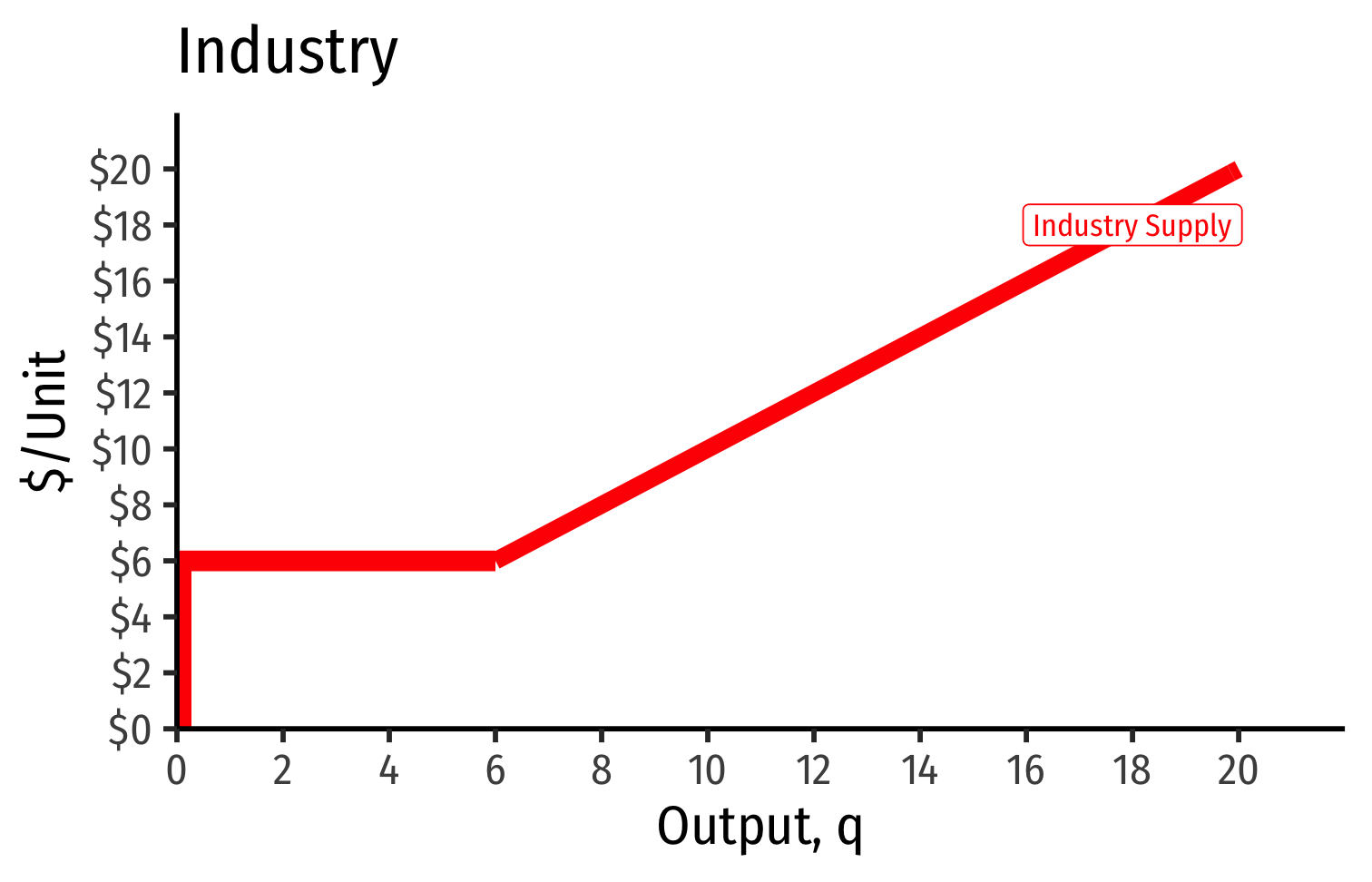

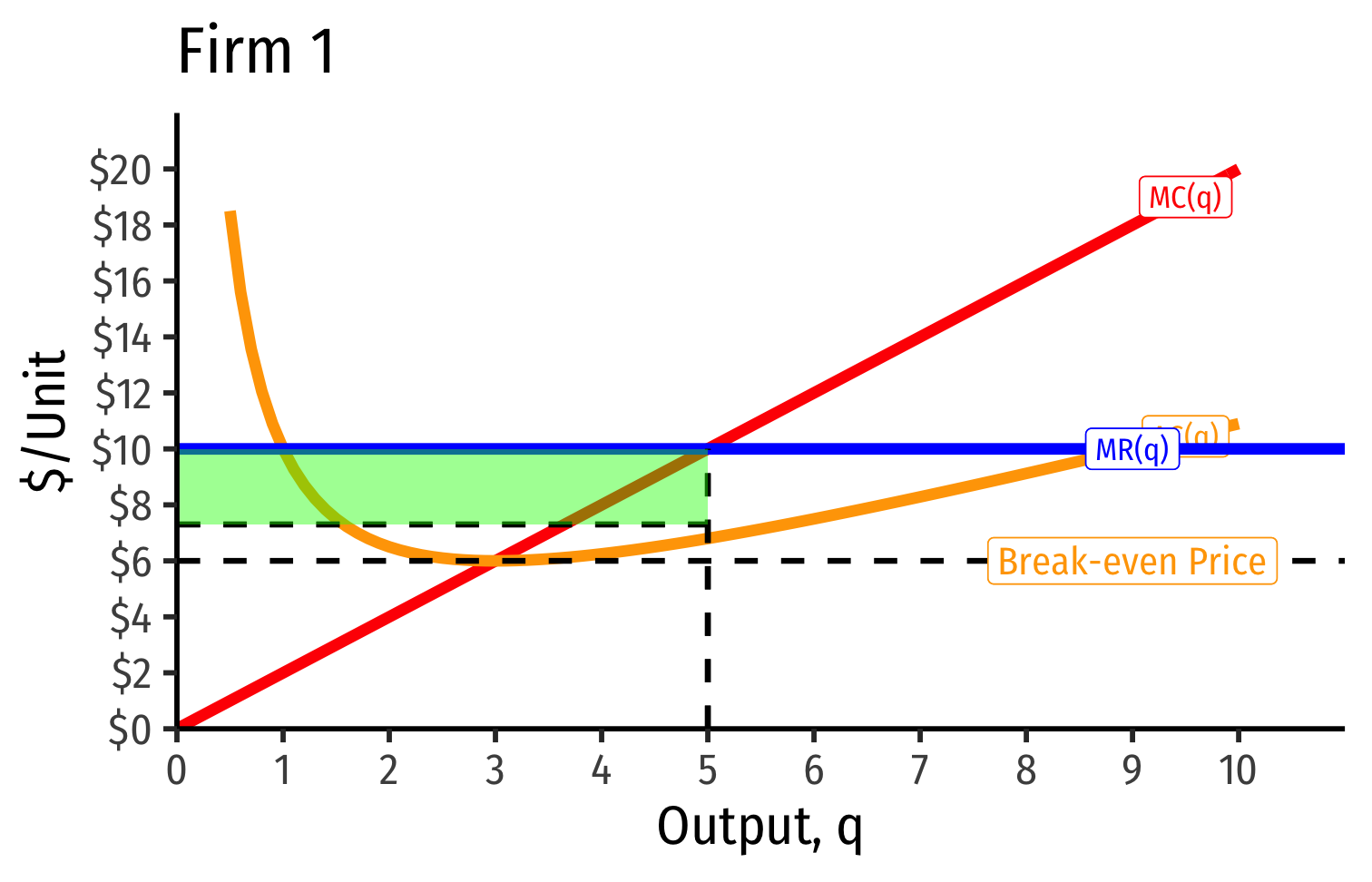

Industry Supply Curves (Identical Firms)

Industry Supply Curves (Identical Firms)

- Industry supply curve is the horizontal sum of all individual firm's supply curves

- Which are each firm's marginal cost curve above its breakeven price

Industry Supply Curves (Identical Firms)

- Industry demand curve (where equal to supply curve) sets market price, demand for each firm

Industry Supply Curves (Identical Firms)

Industry demand curve (where equal to supply curve) sets market price, demand for each firm

Short Run: each firm is earning profits p>AC(q)

Long run: induces entry by firm 3, firm 4, ⋯, firm n

Industry Supply Curves (Identical Firms)

Industry demand curve (where equal to supply curve) sets market price, demand for each firm

Short Run: each firm is earning profits p>AC(q)

Long run: induces entry by firm 3, firm 4, ⋯, firm n

Long run industry equilibrium:

Industry Supply Curves (Identical Firms)

Industry demand curve (where equal to supply curve) sets market price, demand for each firm

Short Run: each firm is earning profits p>AC(q)

Long run: induces entry by firm 3, firm 4, ⋯, firm n

Long run industry equilibrium: p=AC(q)min, π=0 at p= $6

- Supply becomes more elastic (more firms supplying more output)

Zero Profit Theorem & Economic Rents

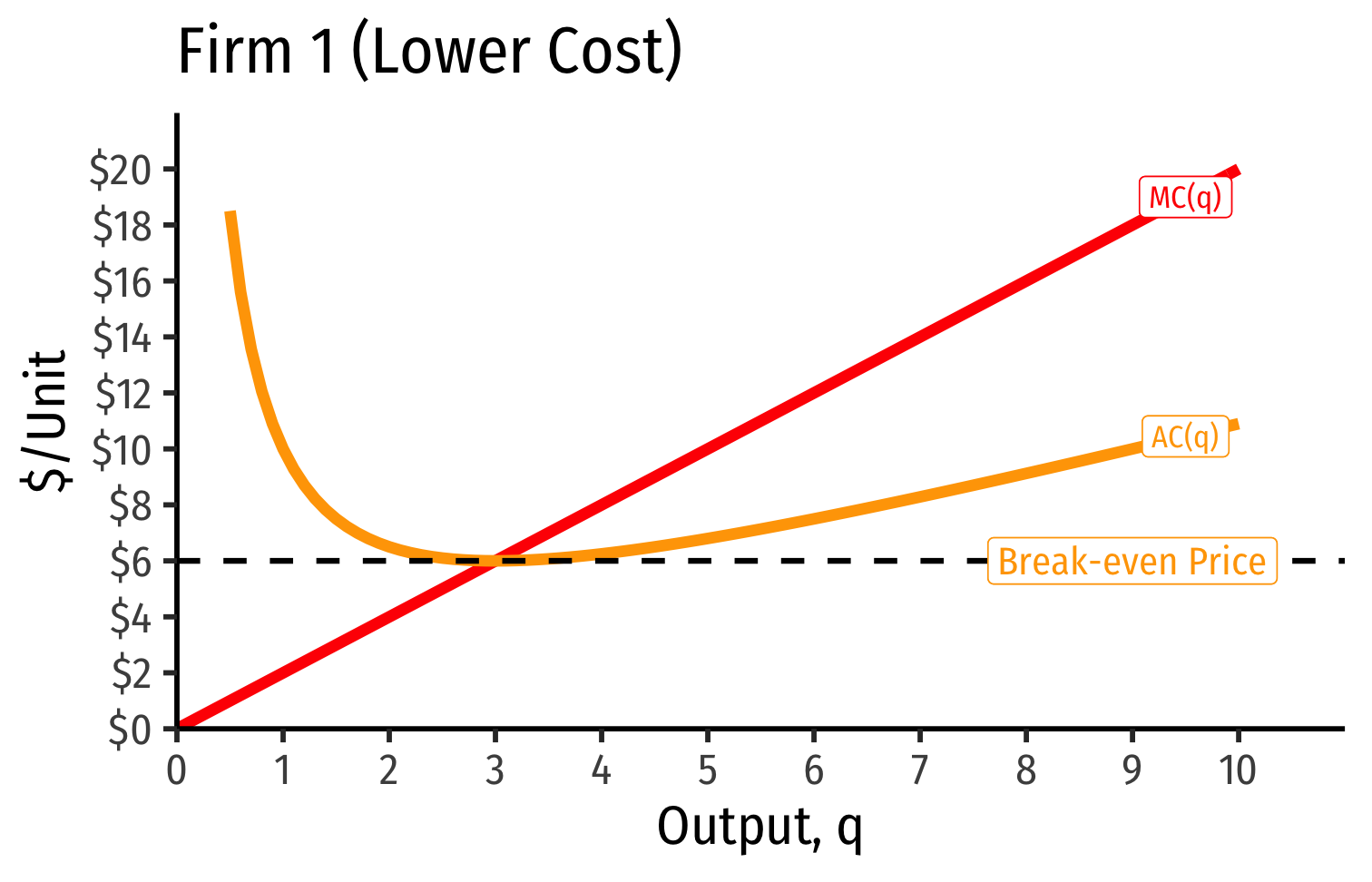

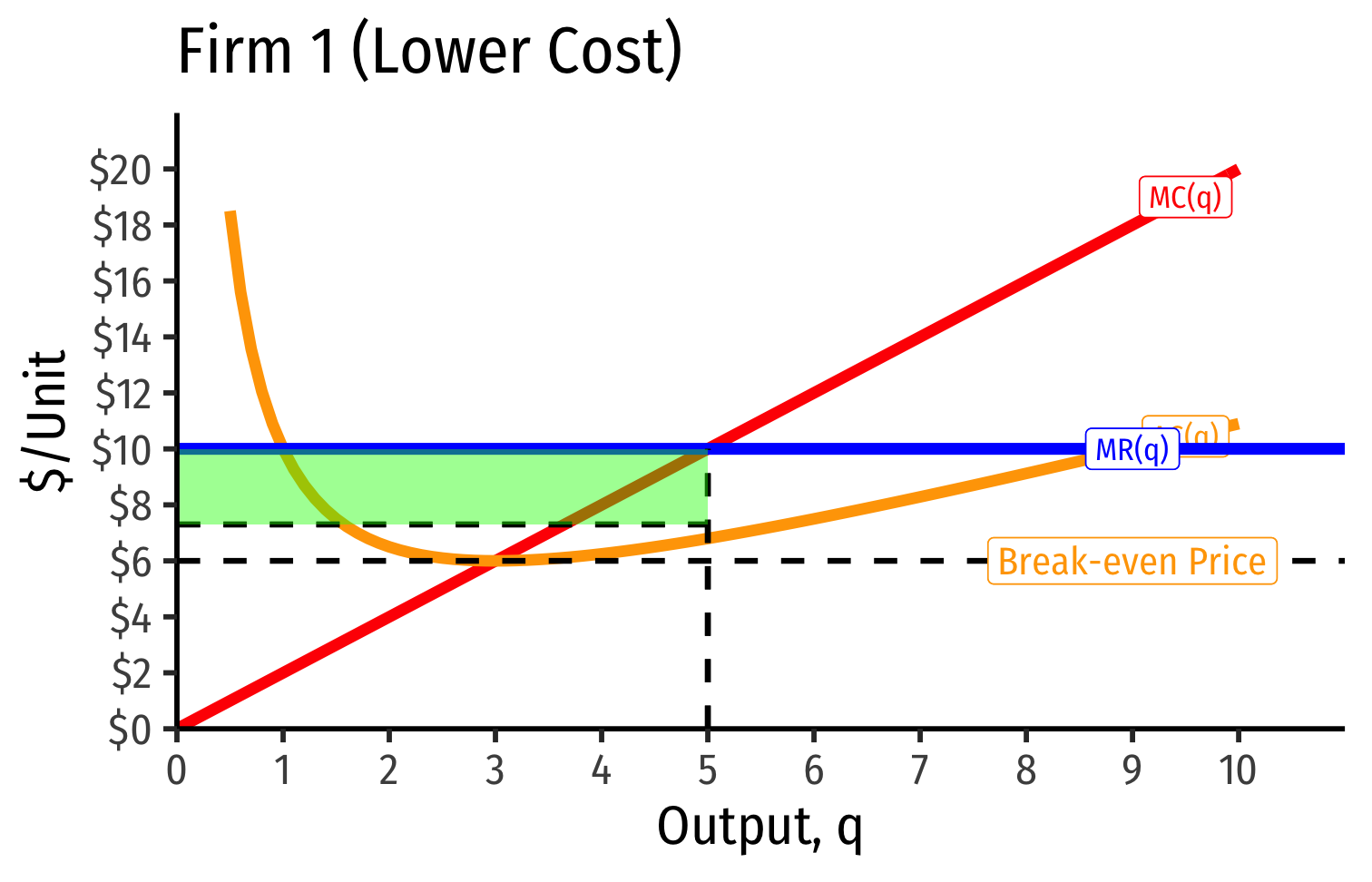

Industry Supply Curves (Different Firms) I

- Firms may have different cost structures due to differences in:

- Managerial talent

- Worker talent

- Location

- First-mover advantage

- Technological secrets/IP

- License/permit access

- Political connections

- Lobbying

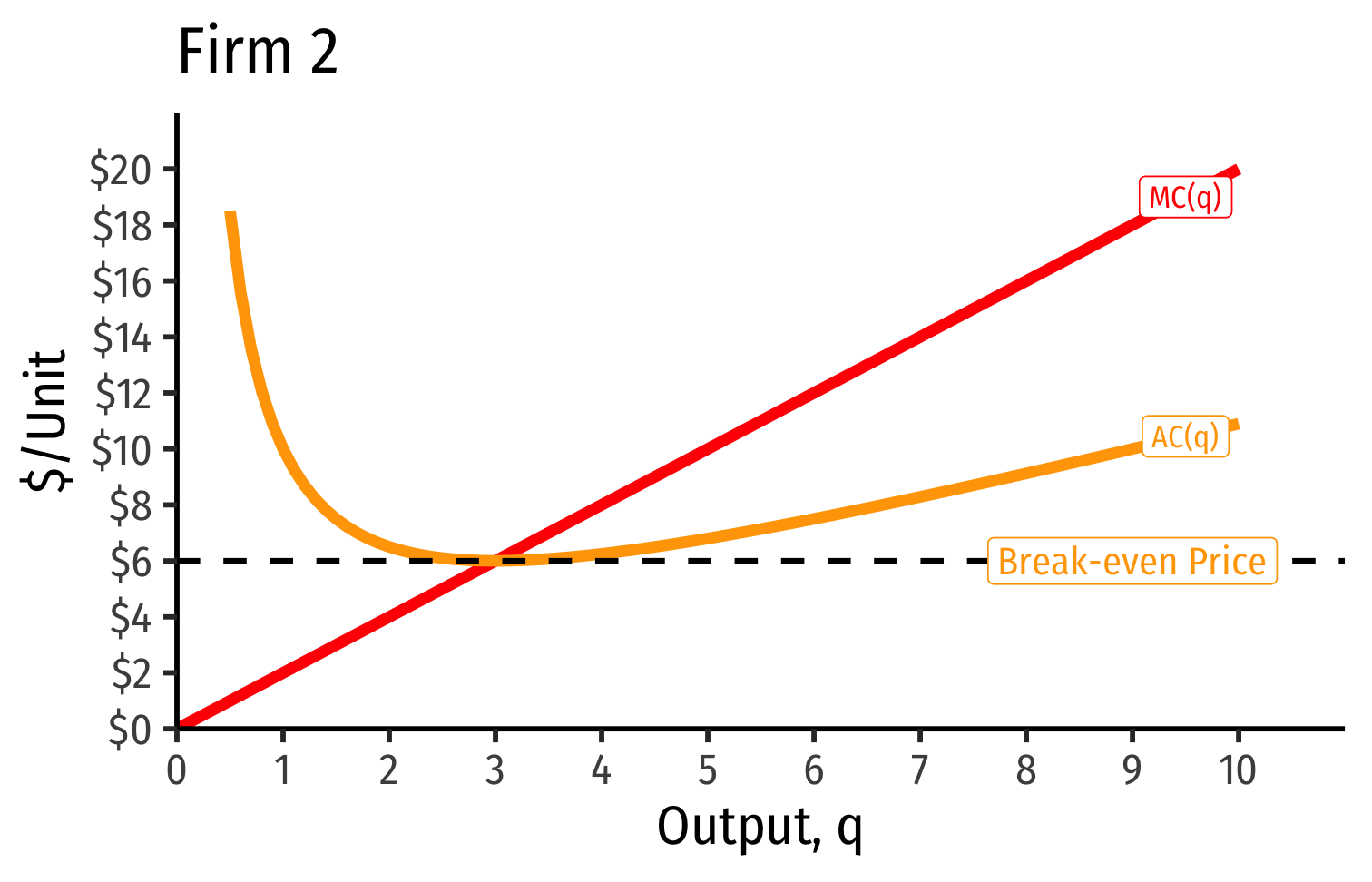

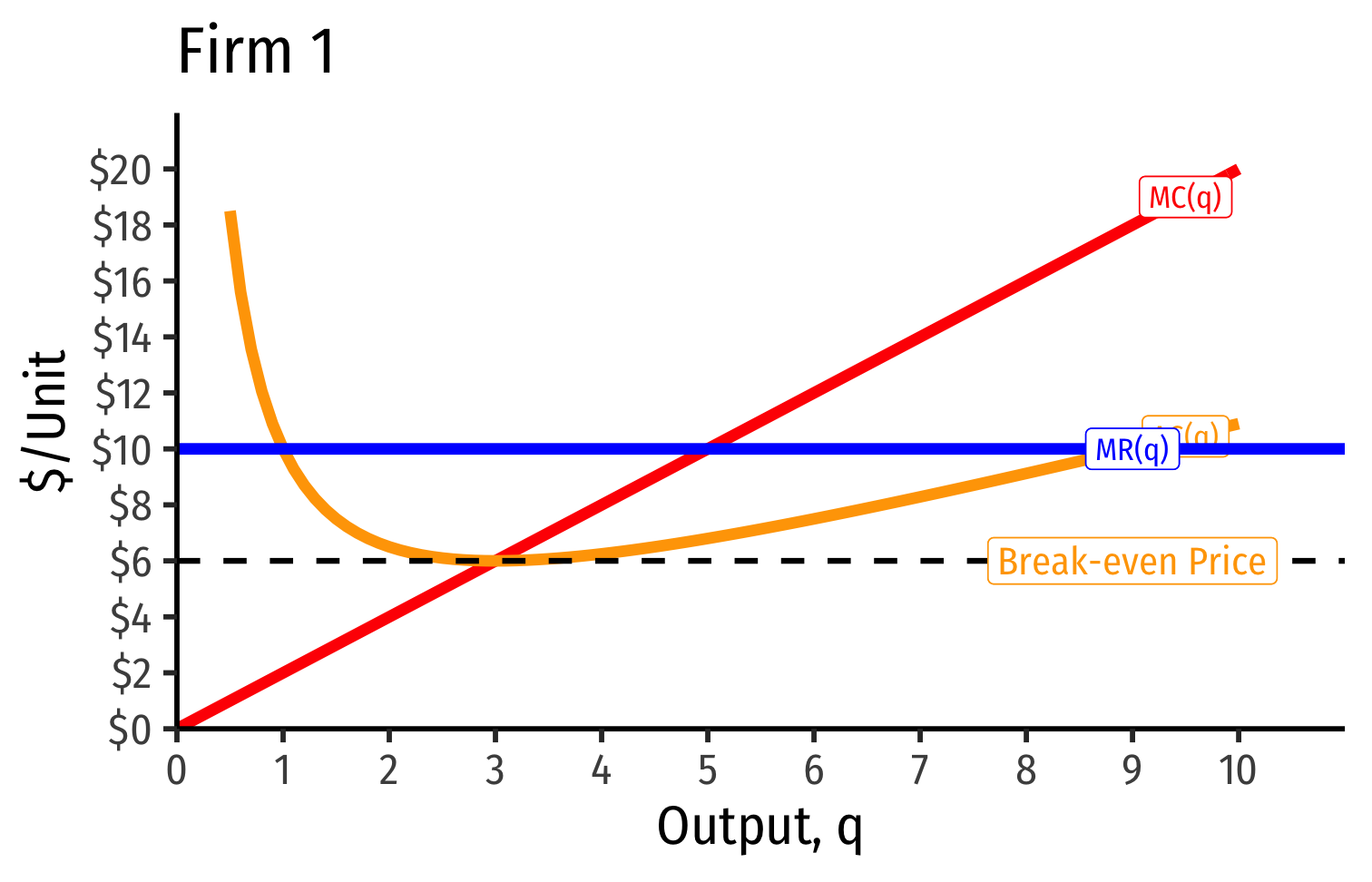

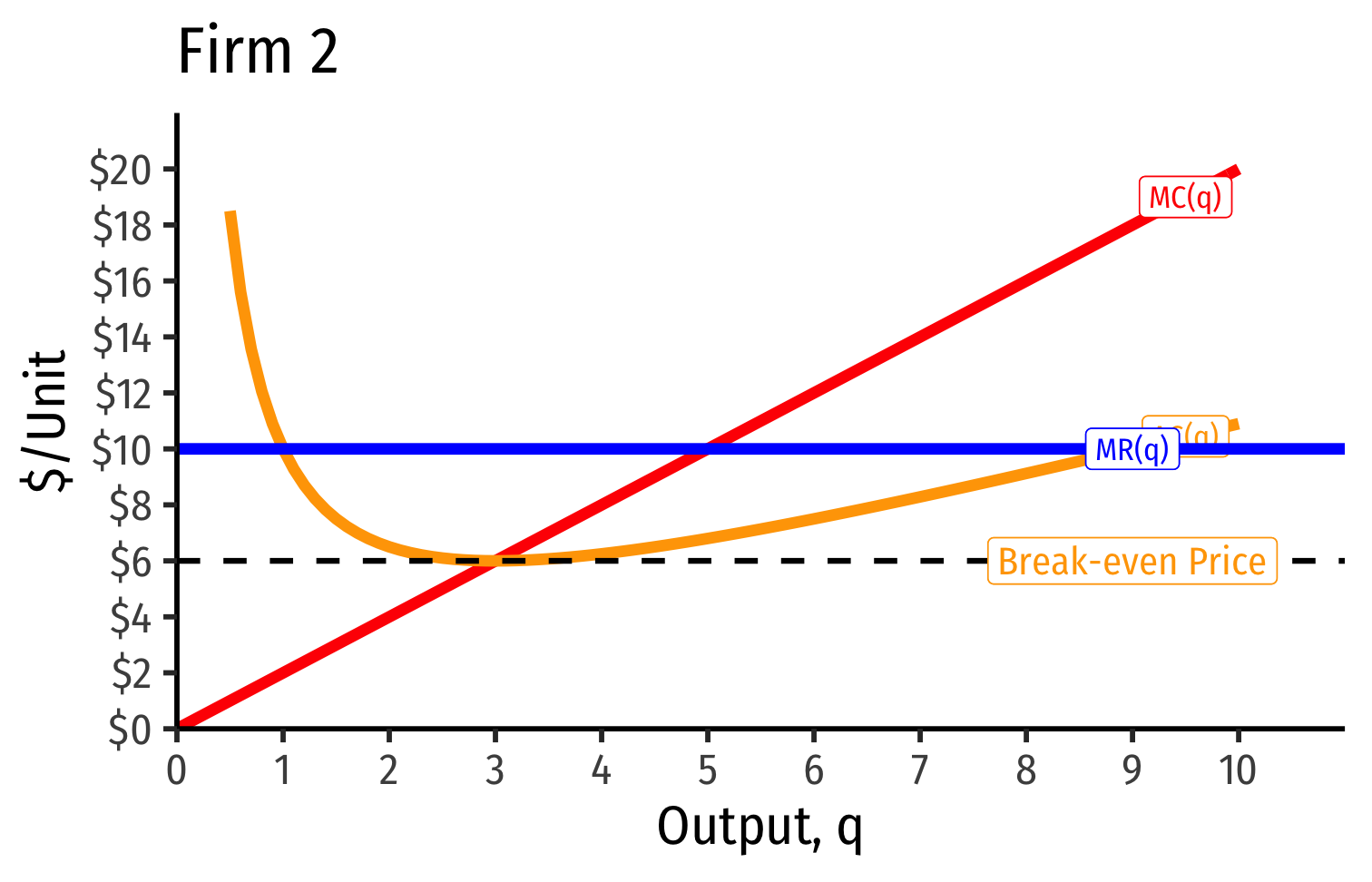

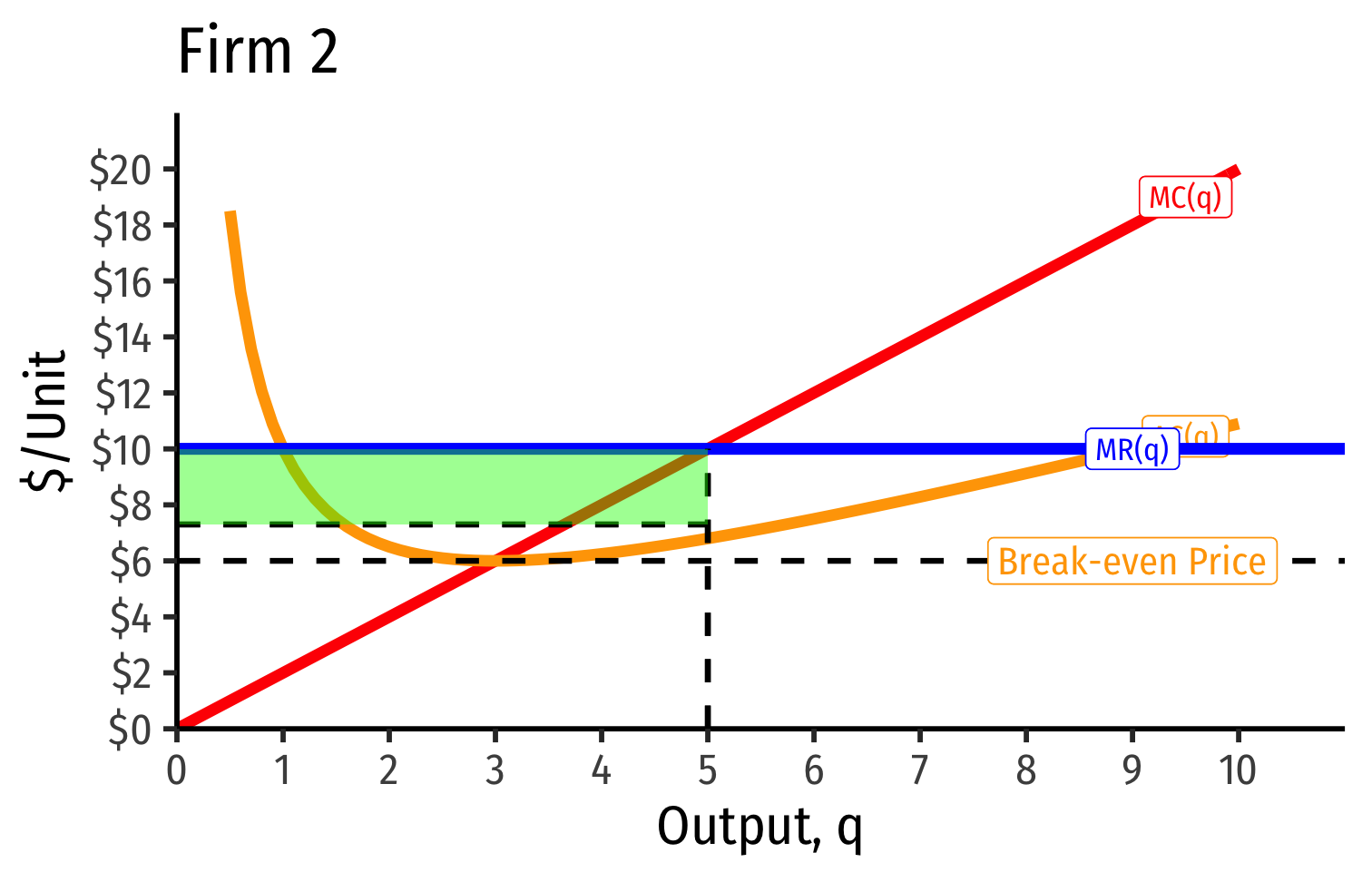

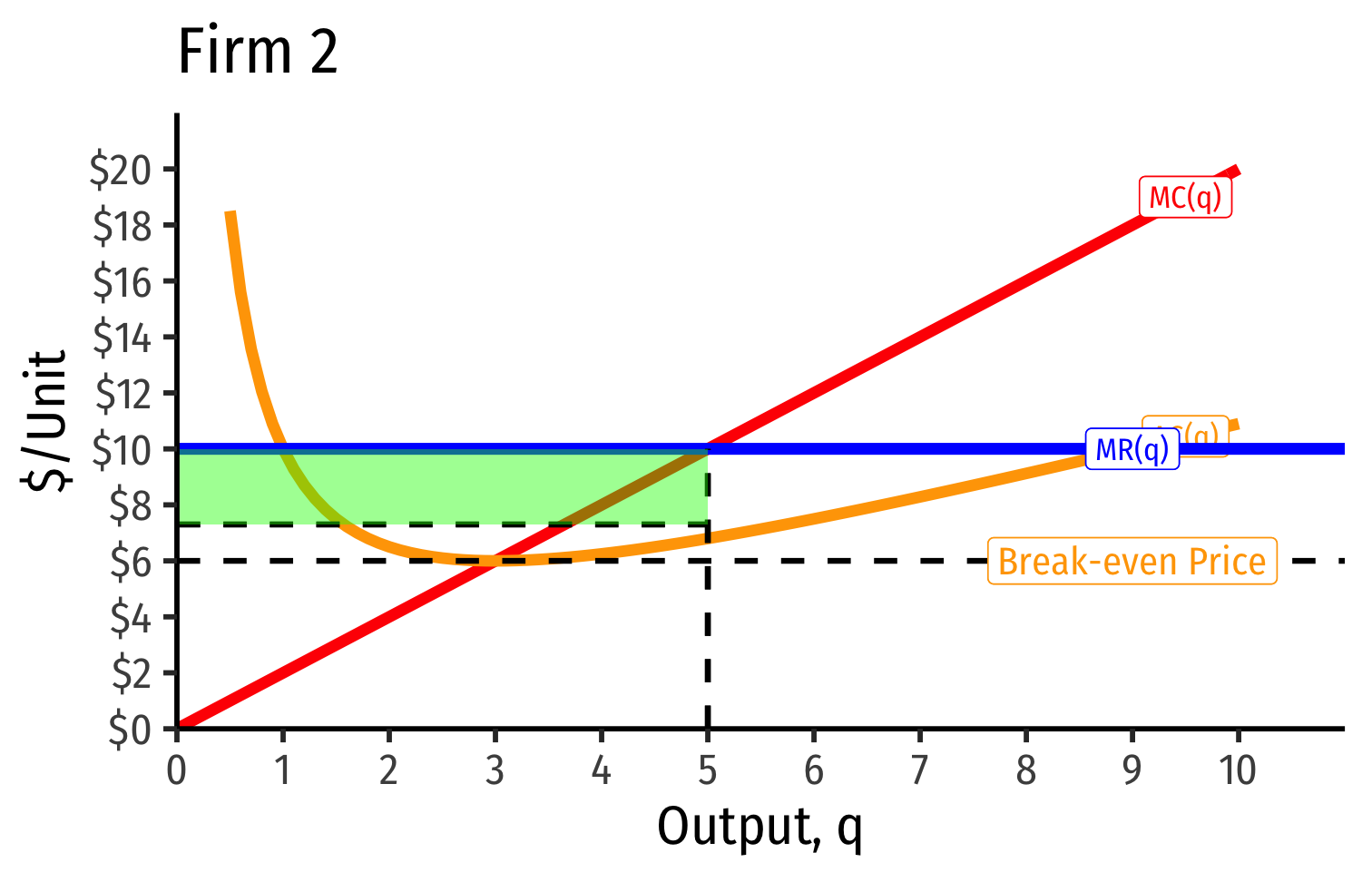

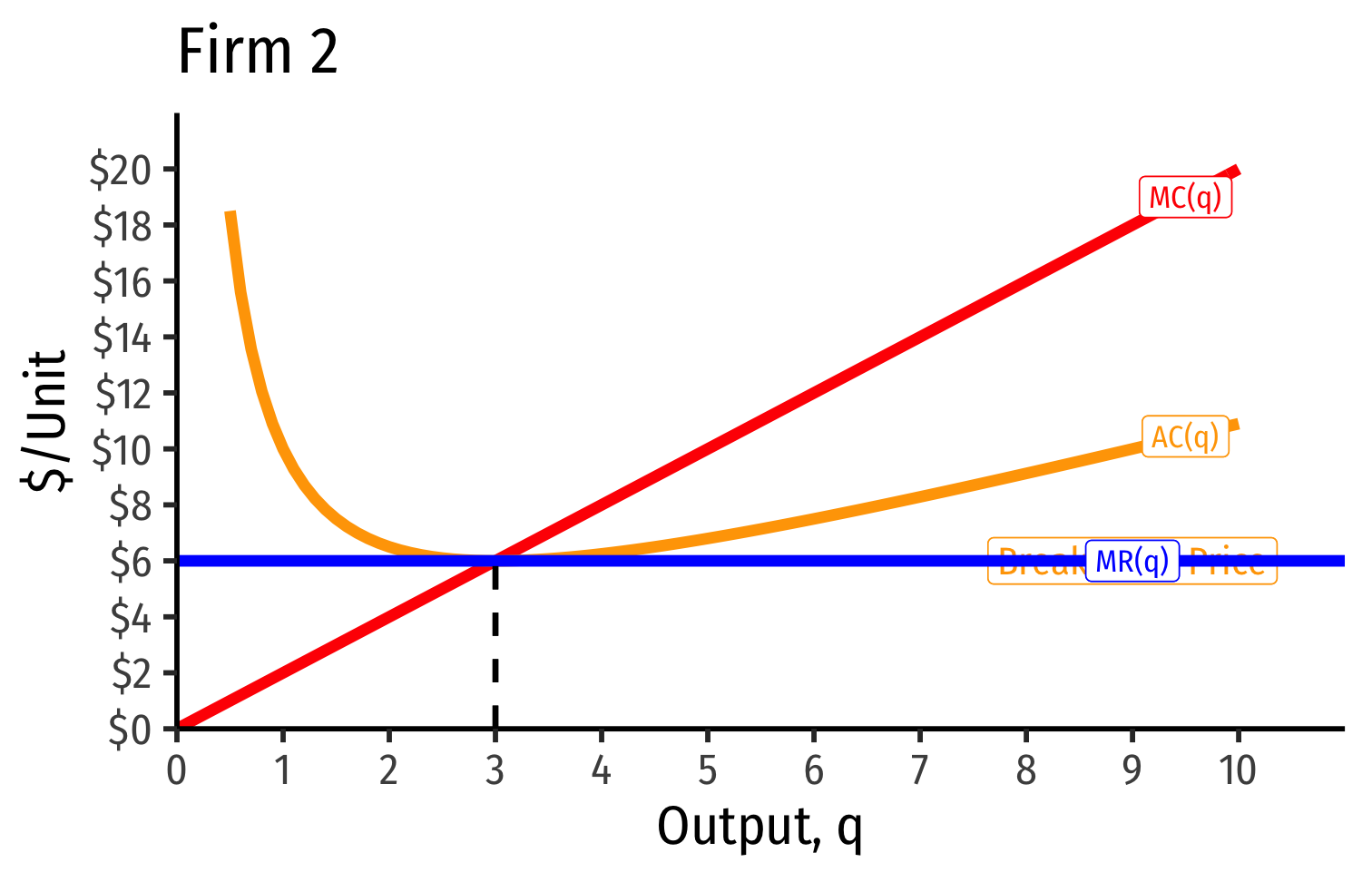

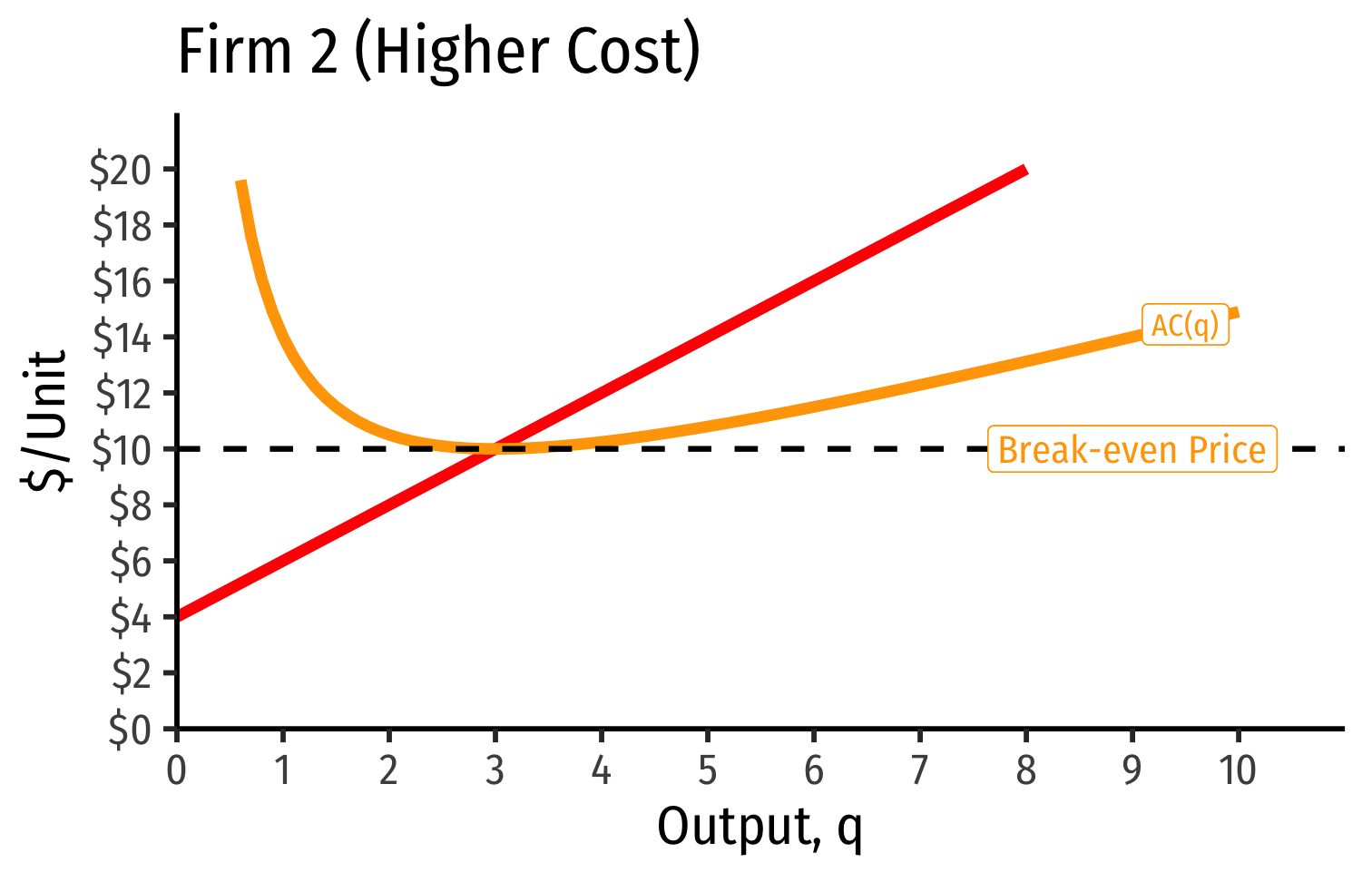

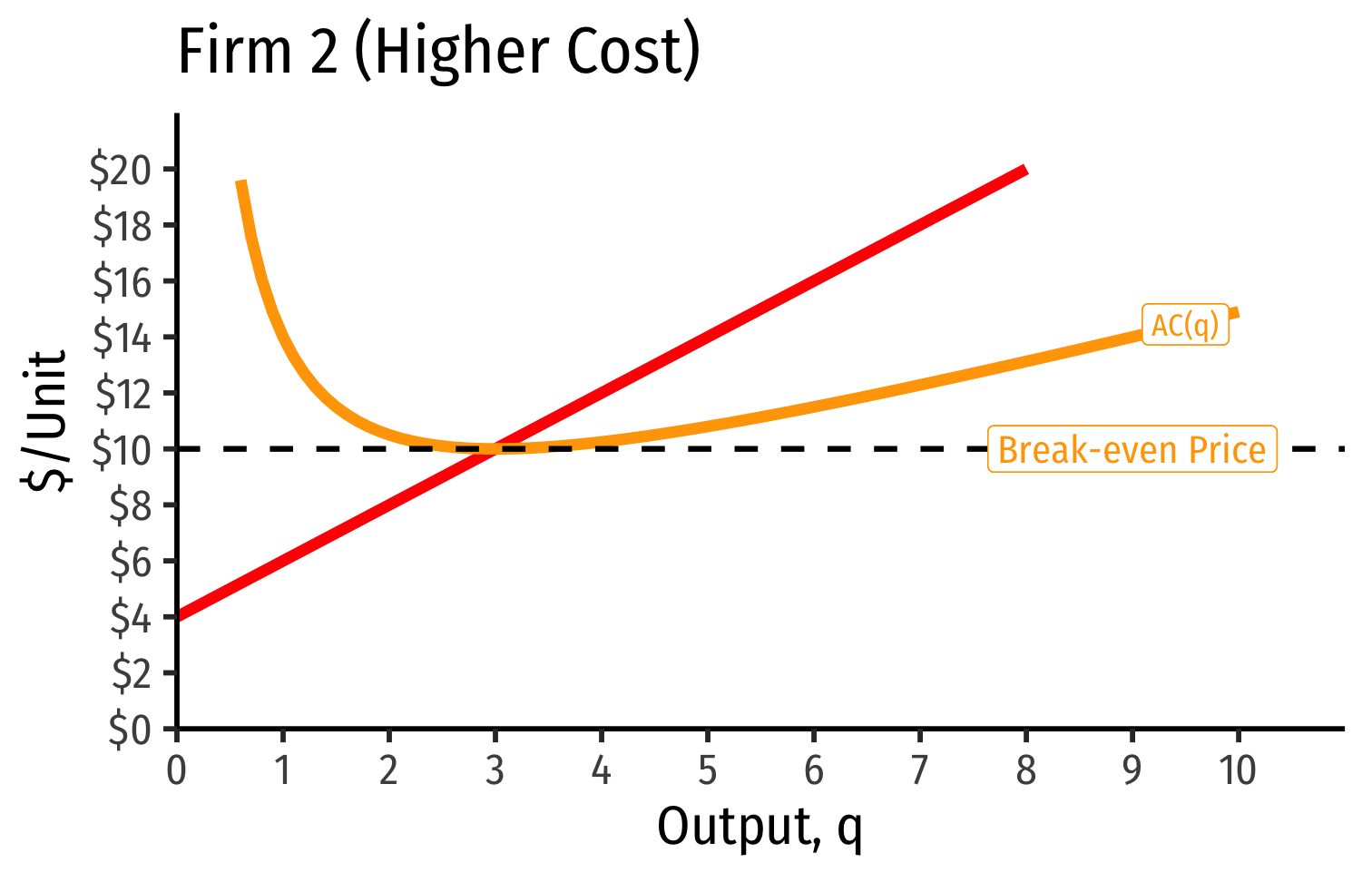

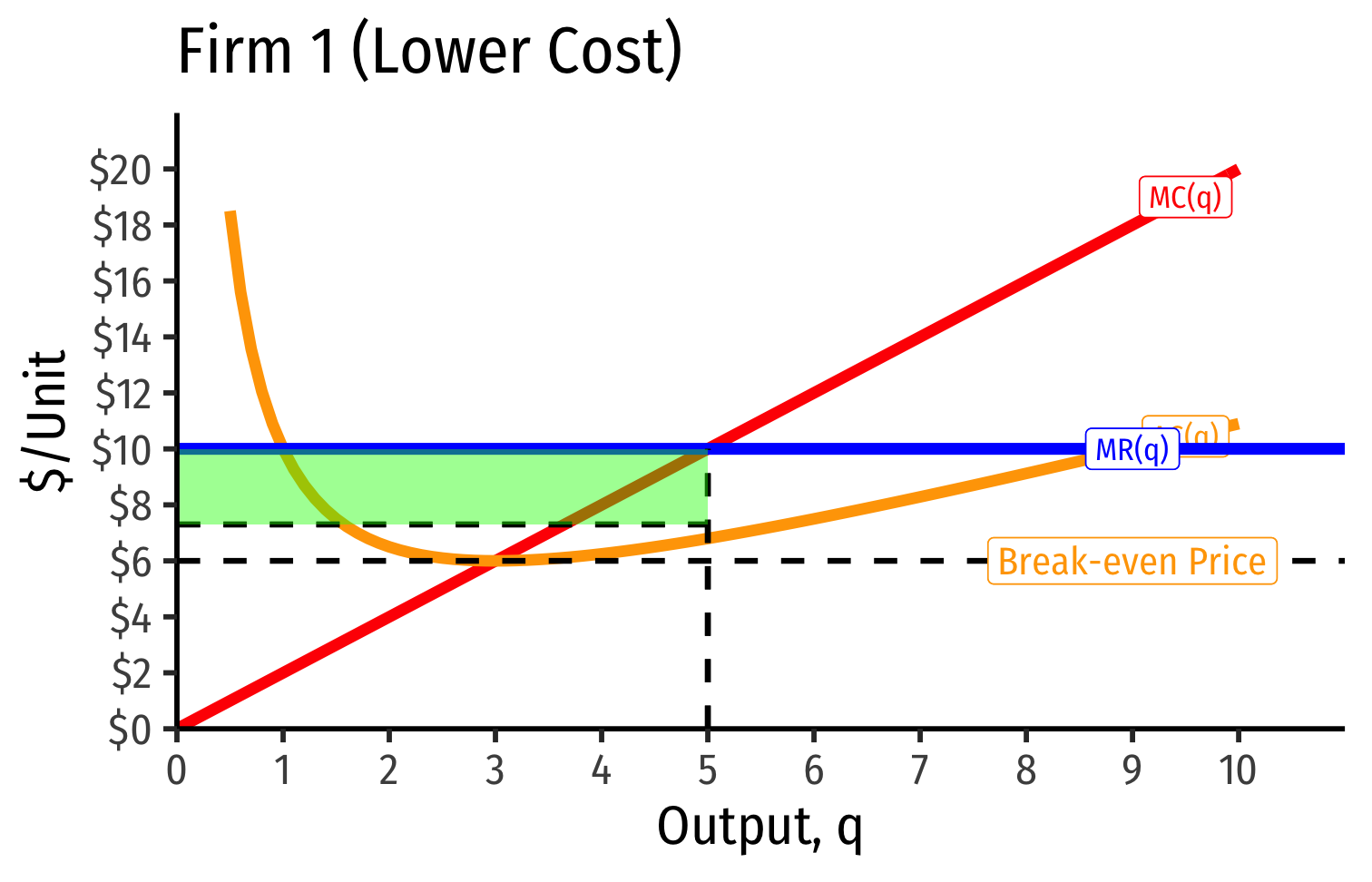

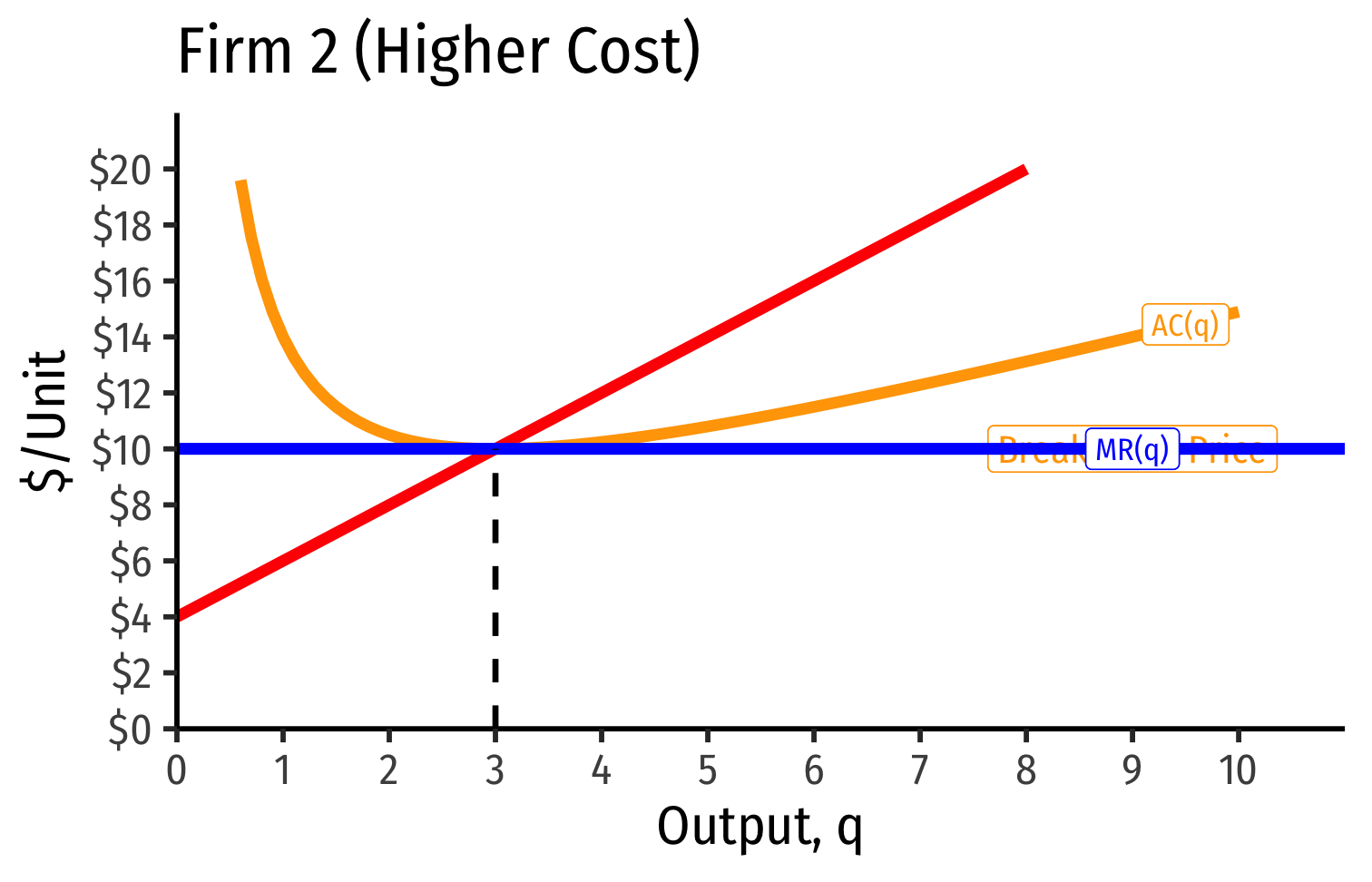

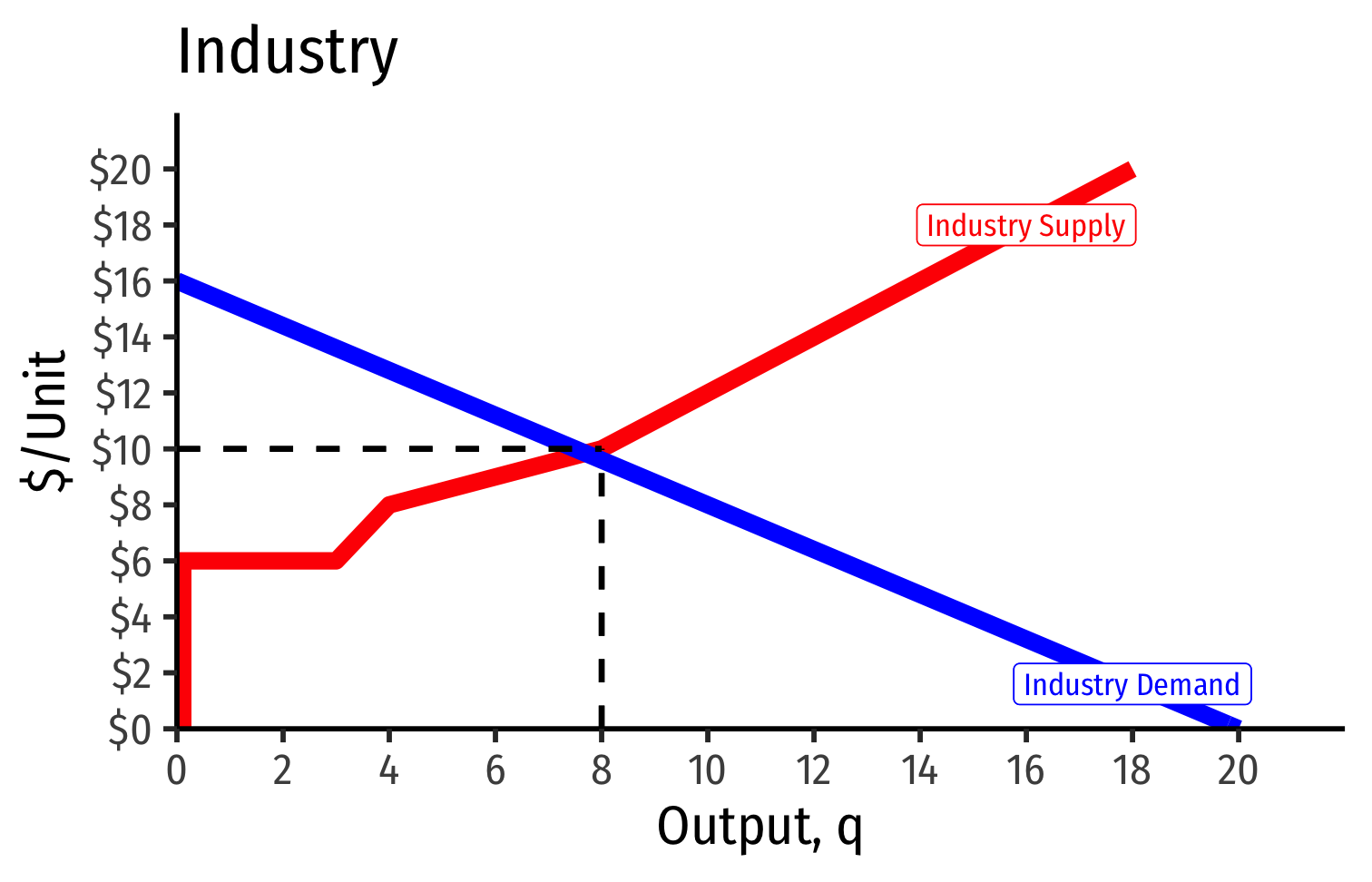

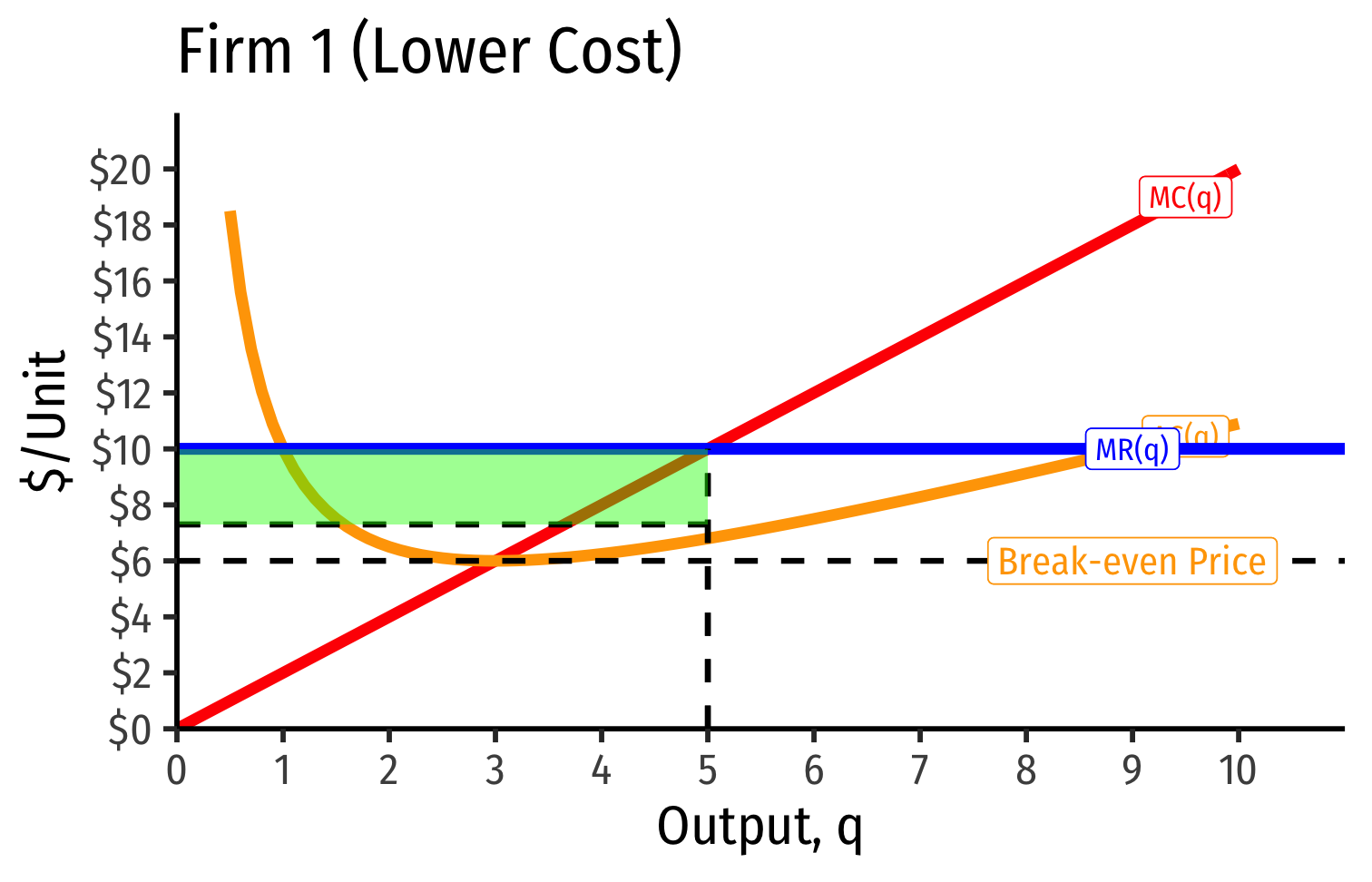

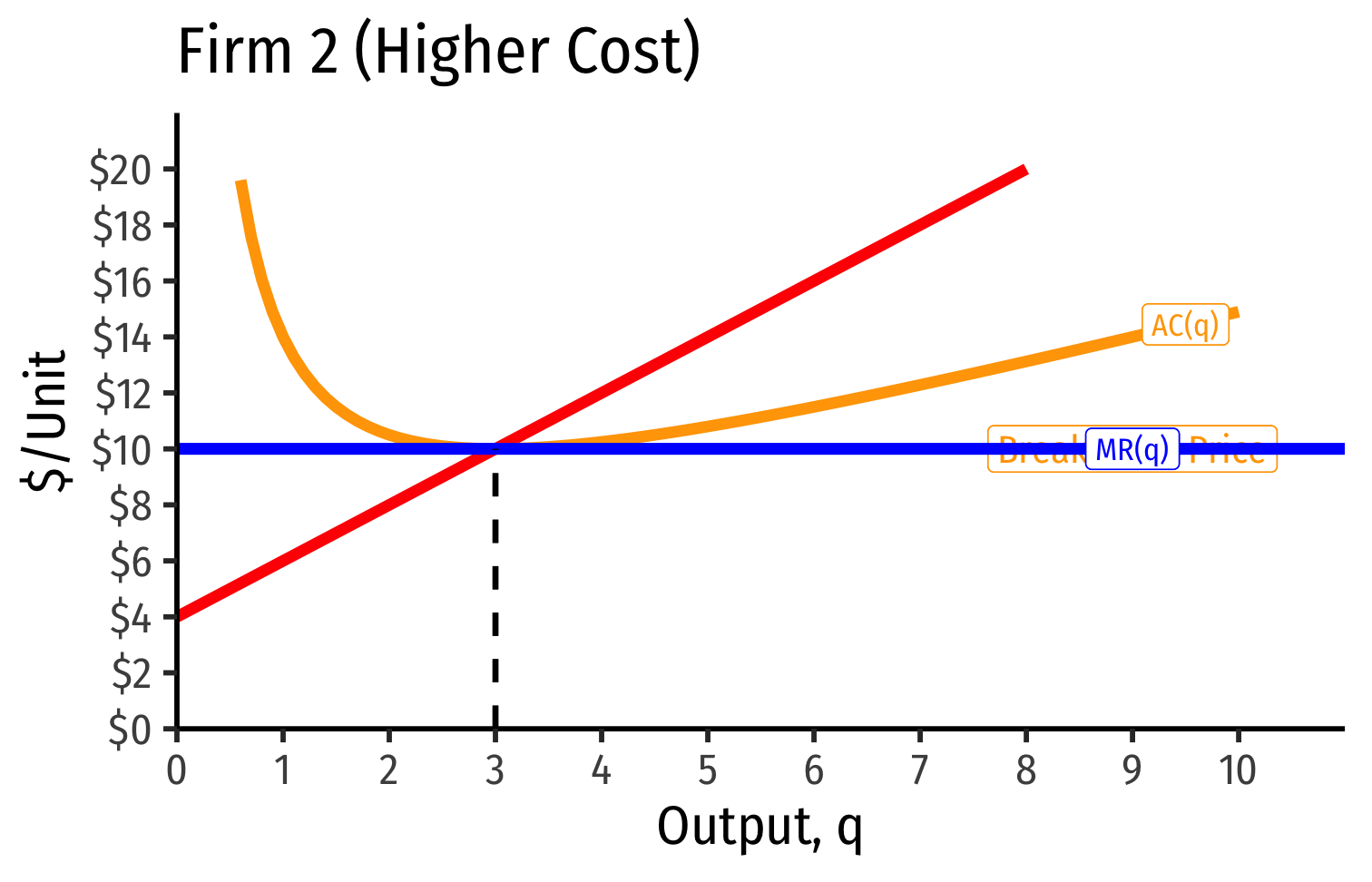

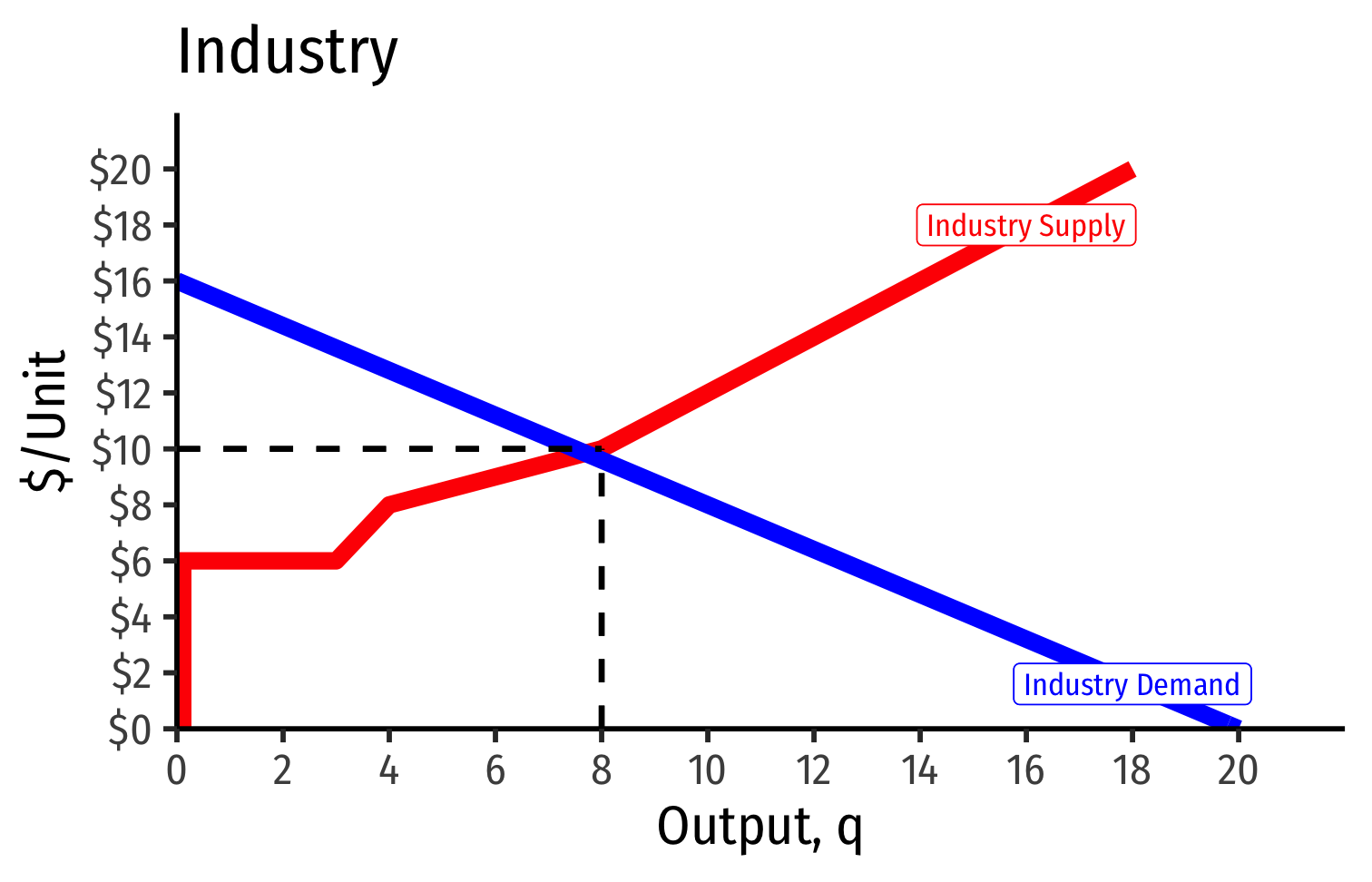

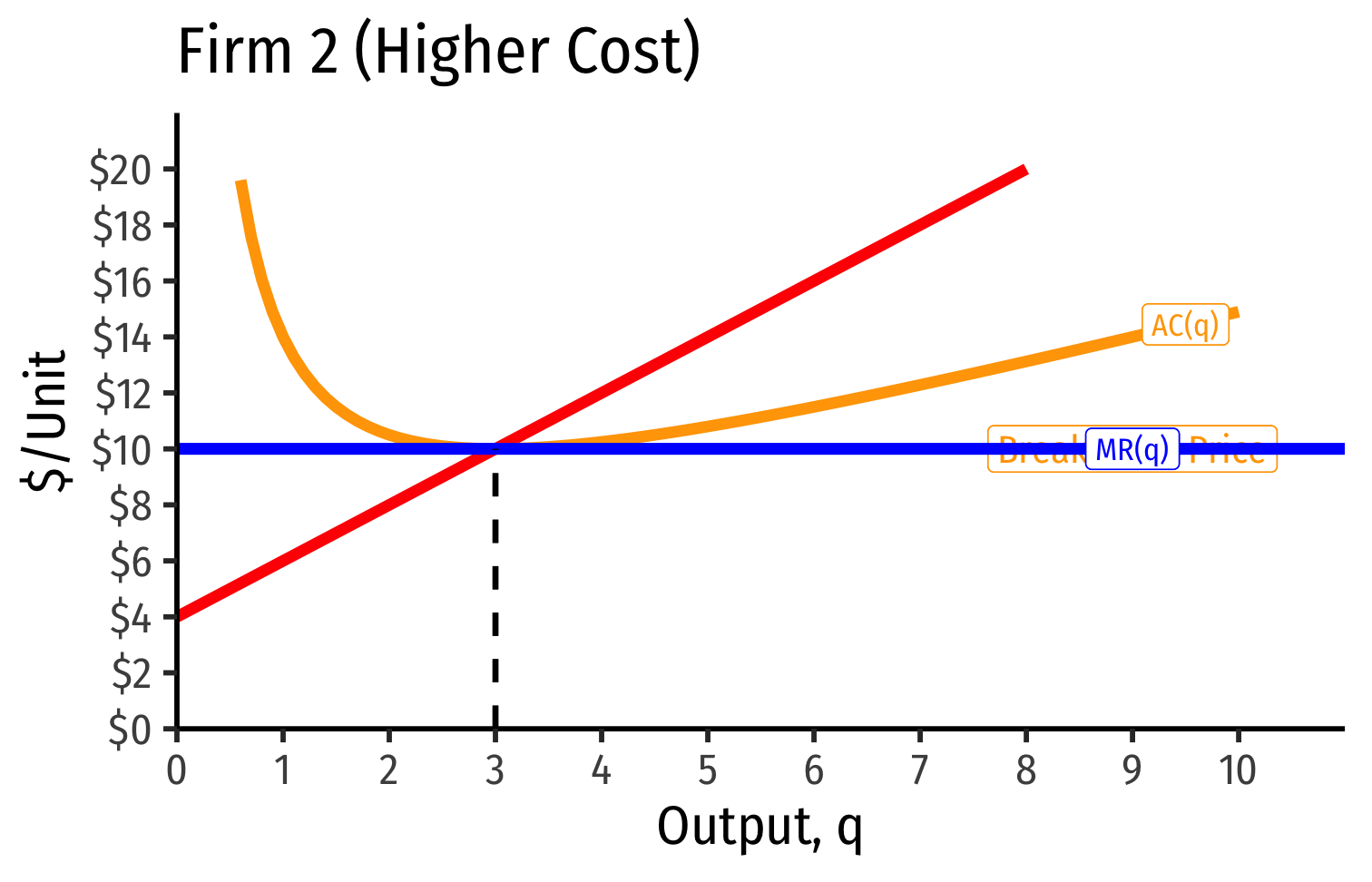

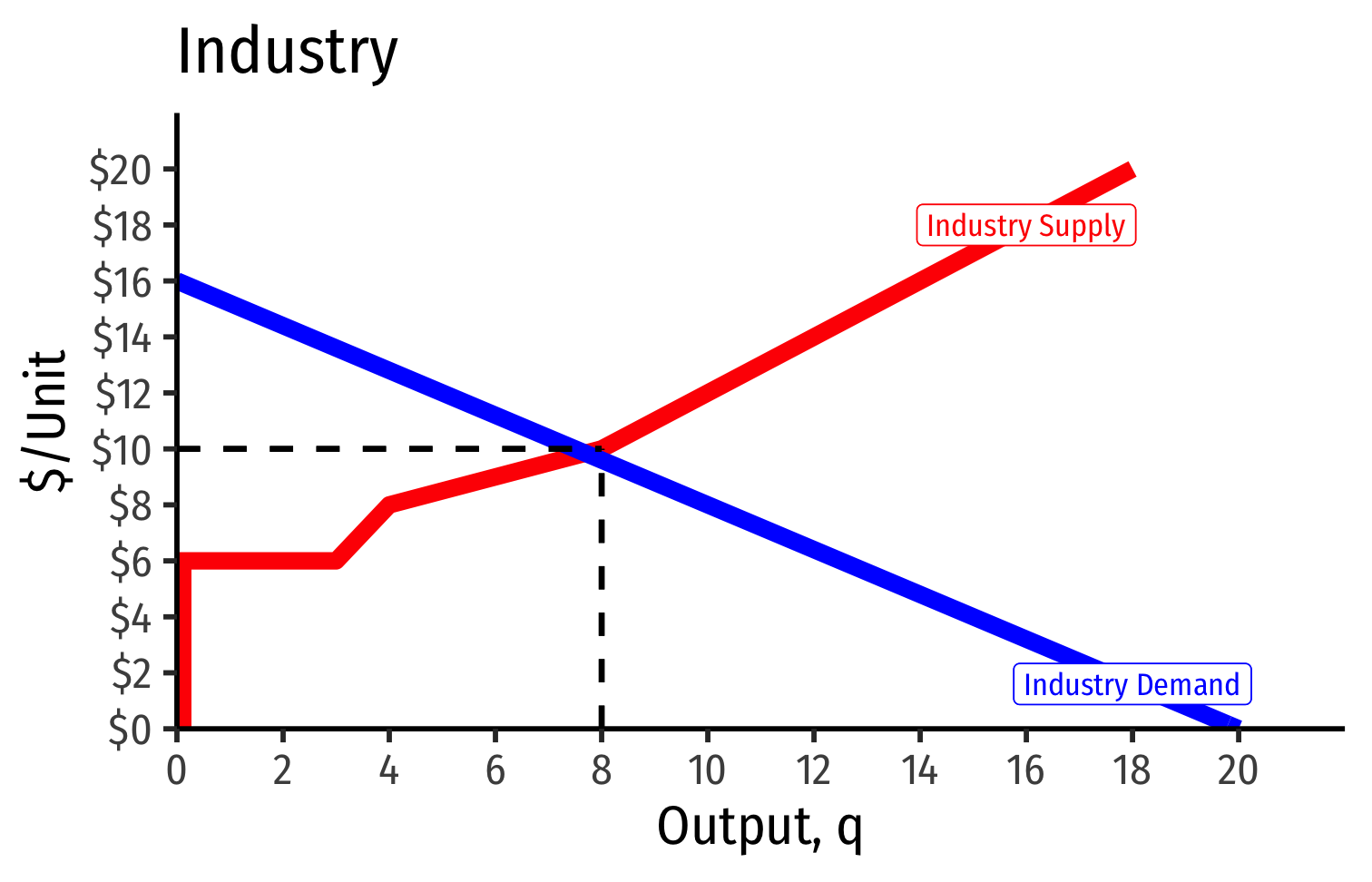

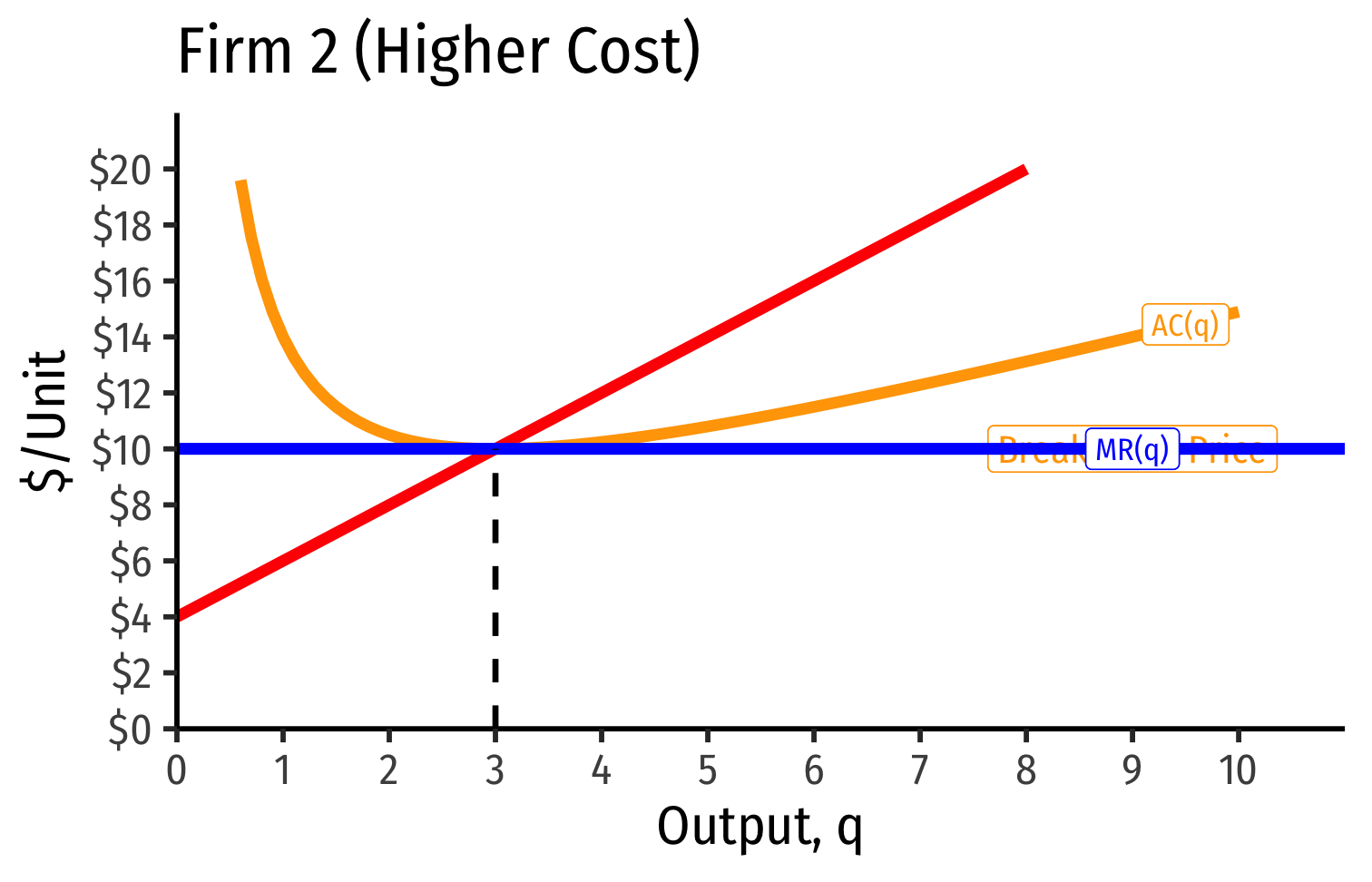

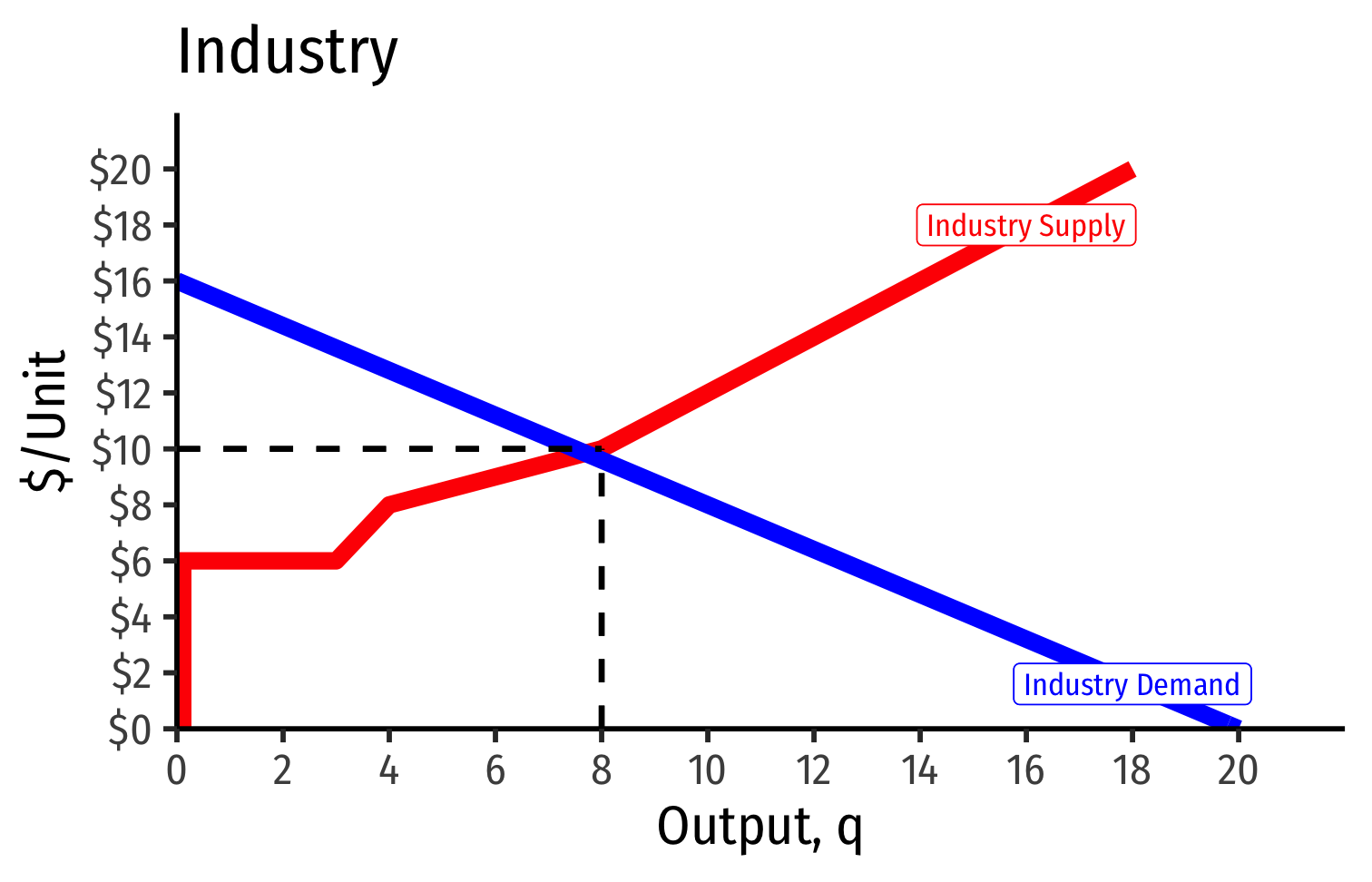

Industry Supply Curves (Different Firms) II

Industry Supply Curves (Different Firms) II

- Industry supply curve is the horizontal sum of all individual firm's supply curves

- Which are each firm's marginal cost curve above its breakeven price

Industry Supply Curves (Different Firms) II

Industry Supply Curves (Different Firms) II

- Industry demand curve (where equal to supply curve) sets market price, demand for each firm

Industry Supply Curves (Different Firms) II

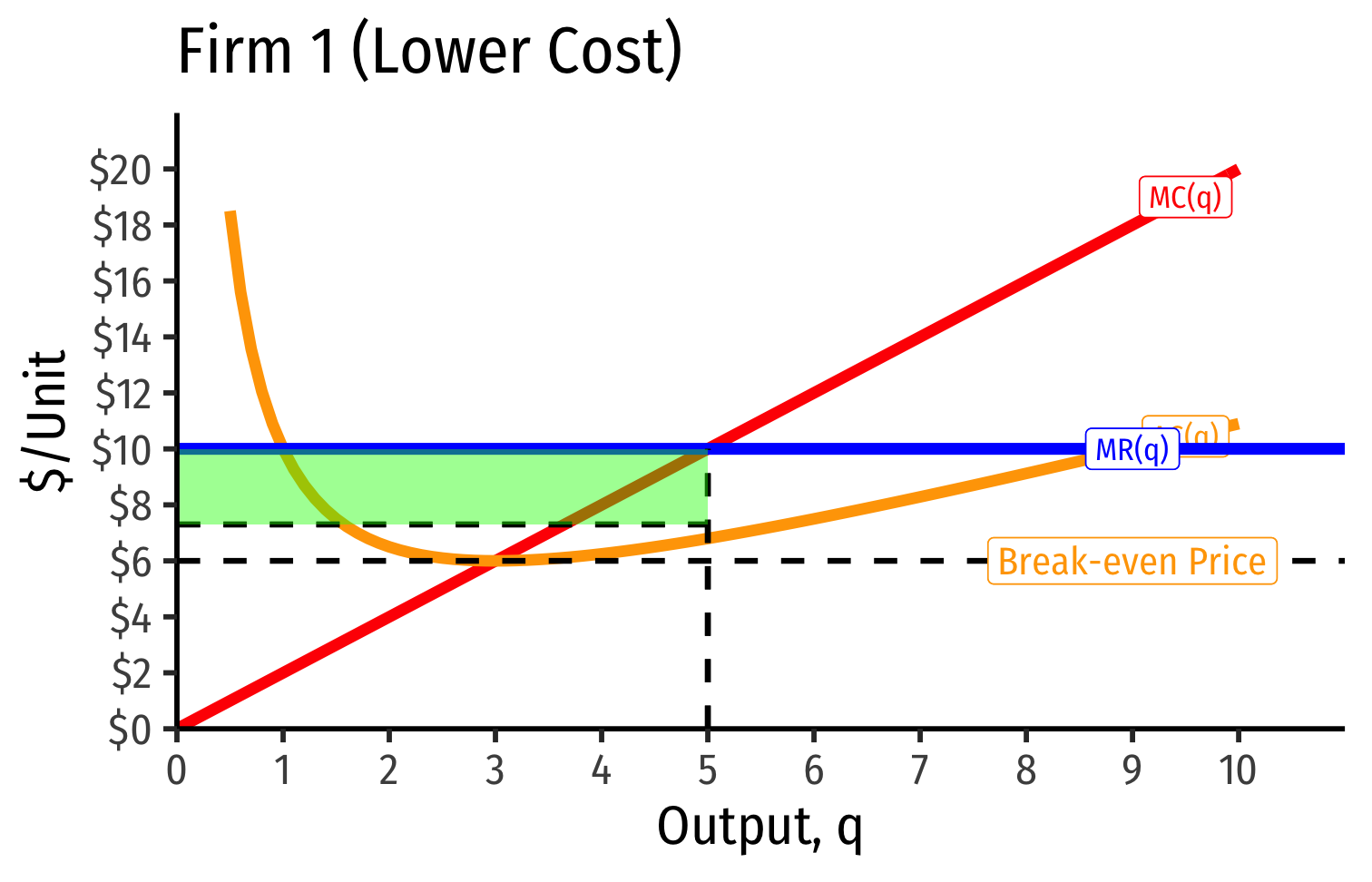

Industry demand curve (where equal to supply curve) sets market price, demand for each firm

Long run industry equilibrium: p=AC(q)min, π=0 for marginal (highest cost) firm (Firm 2)

Industry Supply Curves (Different Firms) II

Industry demand curve (where equal to supply curve) sets market price, demand for each firm

Long run industry equilibrium: p=AC(q)min, π=0 for marginal (highest cost) firm (Firm 2)

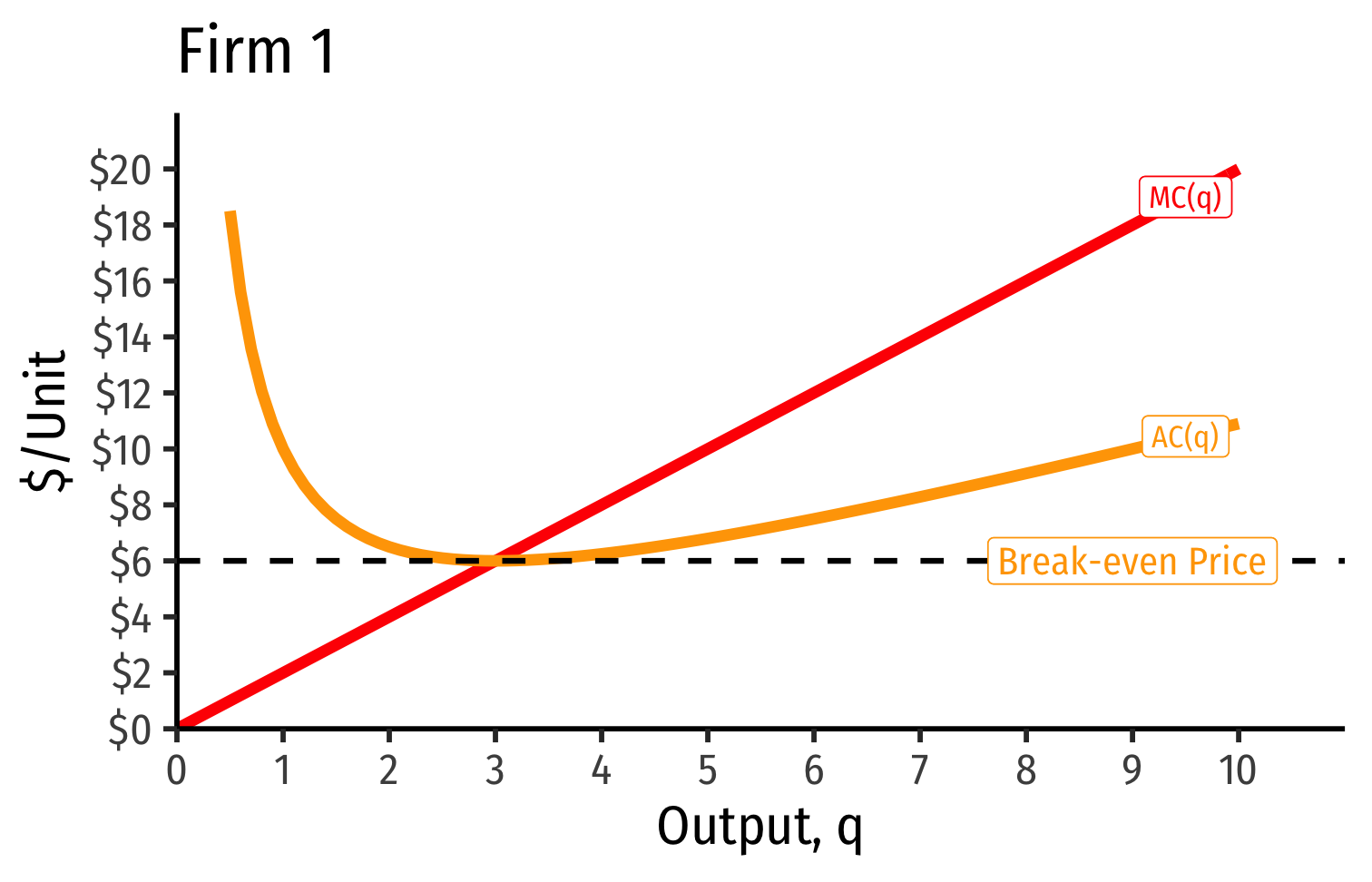

Firm 1 (lower cost) appears to be earning profits

Economic Rents and Zero Economic Profits I

With differences between firms, long-run equilibrium p=AC(q)min of the marginal (highest-cost) firm

- If p>AC(q) for that firm, would induce more entry into industry!

"Inframarginal" (lower-cost) firms earn economic rents: returns higher than their opportunity cost (what is needed to bring them online

- p>AC(q)

Economic rents arise from relative differences between firms

Economic Rents and Zero Economic Profits II

Relatively scarce factors in the economy (talent, location, secrets, IP, licenses, being first, political favoritism, lobbying)

Inframarginal firms using the scarce factors gain a cost-advantage

It would seem these firms earn profits as other firms have higher costs

But what will happen to the prices for the scarce factors?

Rent: Microeconomics IV

Rents ≠ profits!

Rival firms willing to pay for rent-generating factor to gain advantage

Rents are included in the opportunity cost (price) for inputs

Firm does not earn the rents, they raise firm's costs and squeeze out profits!

Factor owners (workers, landowners, inventors, etc) earn the rents as higher payments for their services (wages, rents, interest, royalties, etc).

Recall: Accounting vs. Economic Point of View

- Helpful to consider two points of view:

- "Accounting point of view": are you taking in more cash than you are spending?

- "Economic point of view: is your product you making the best social use of your resources (i.e. are there higher-valued uses of your resources you are keeping them away from)?

Entry Effects & External Economies

Entry/Exit Effects on Market Price

Firms entering or exiting an industry have an effect on the new market price

Think about basic supply & demand graphs:

- Entry: ↑ industry supply ⟹ ↑q,↓p

- Exit: ↓ industry supply ⟹ ↓q,↑p

External Economies

How large this change in price will be from entry/exit depends on industry-wide costs and external economies

Economies of scale are internal to the firm (a firm's own average cost curve)

External economies have to do with how the size of the entire industry affects all individual firm's costs

- These are externalities that spill over across all firms in an industry

Three possibilities

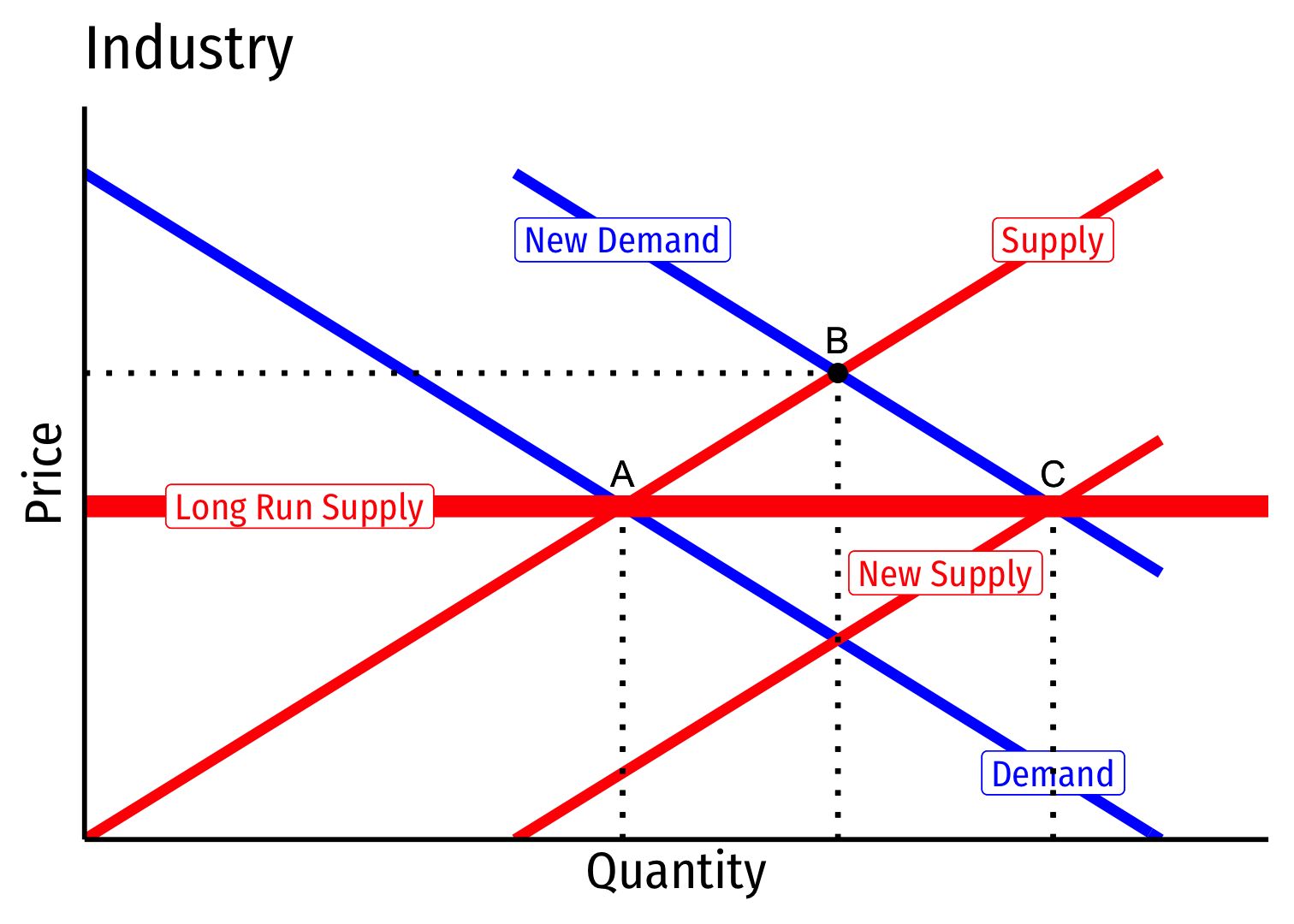

Constant Cost Industry (No External Economies) I

Constant cost industry has no external economies, no change in costs as industry output increases (firms enter & incumbents produce more)

A perfectly elastic long-run industry supply curve!

Determinants:

- Industry's purchases are not a large share of input markets

- Often constant marginal costs, insignificant fixed costs

Examples: toothpicks, domain name registration, waitstaff

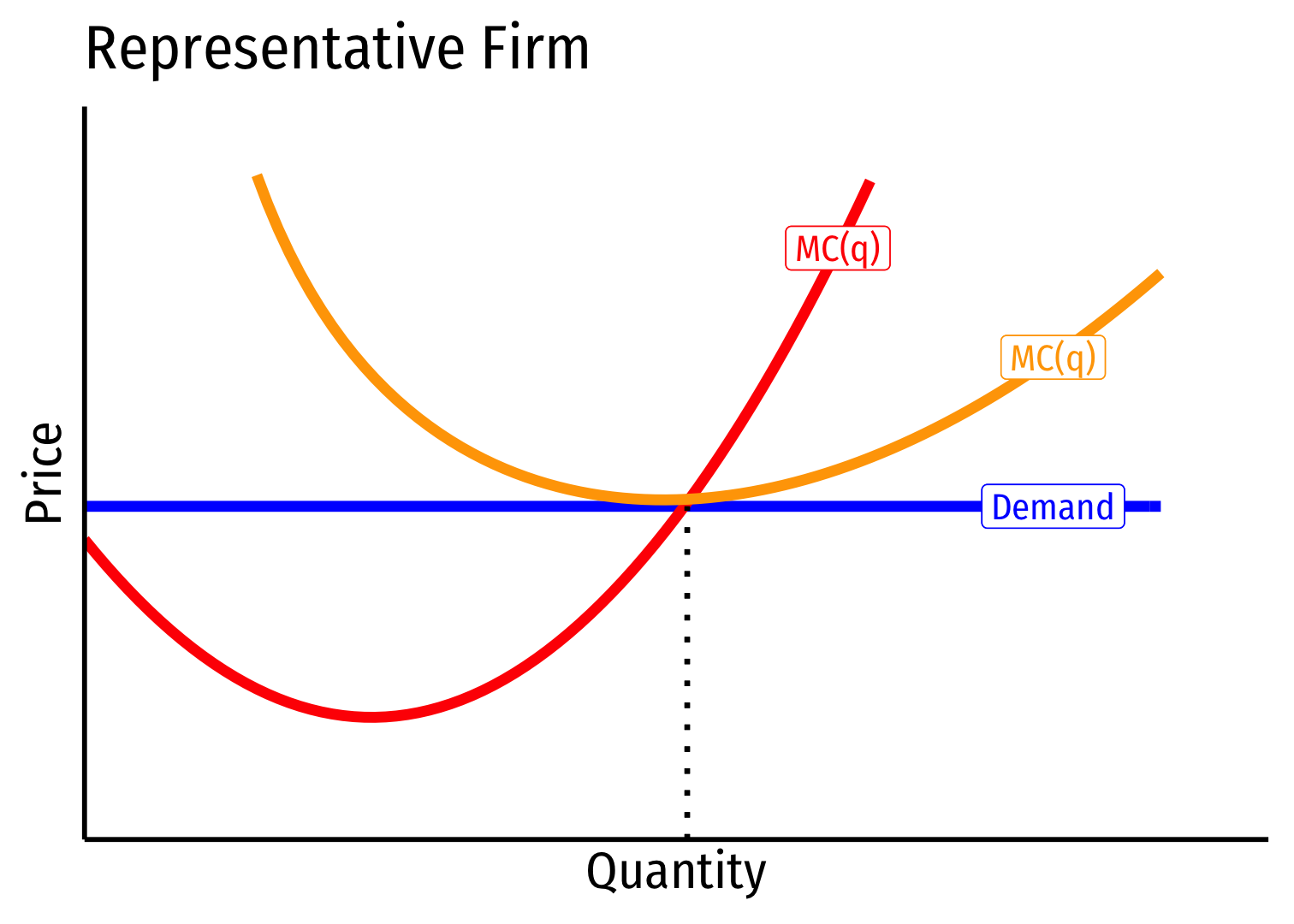

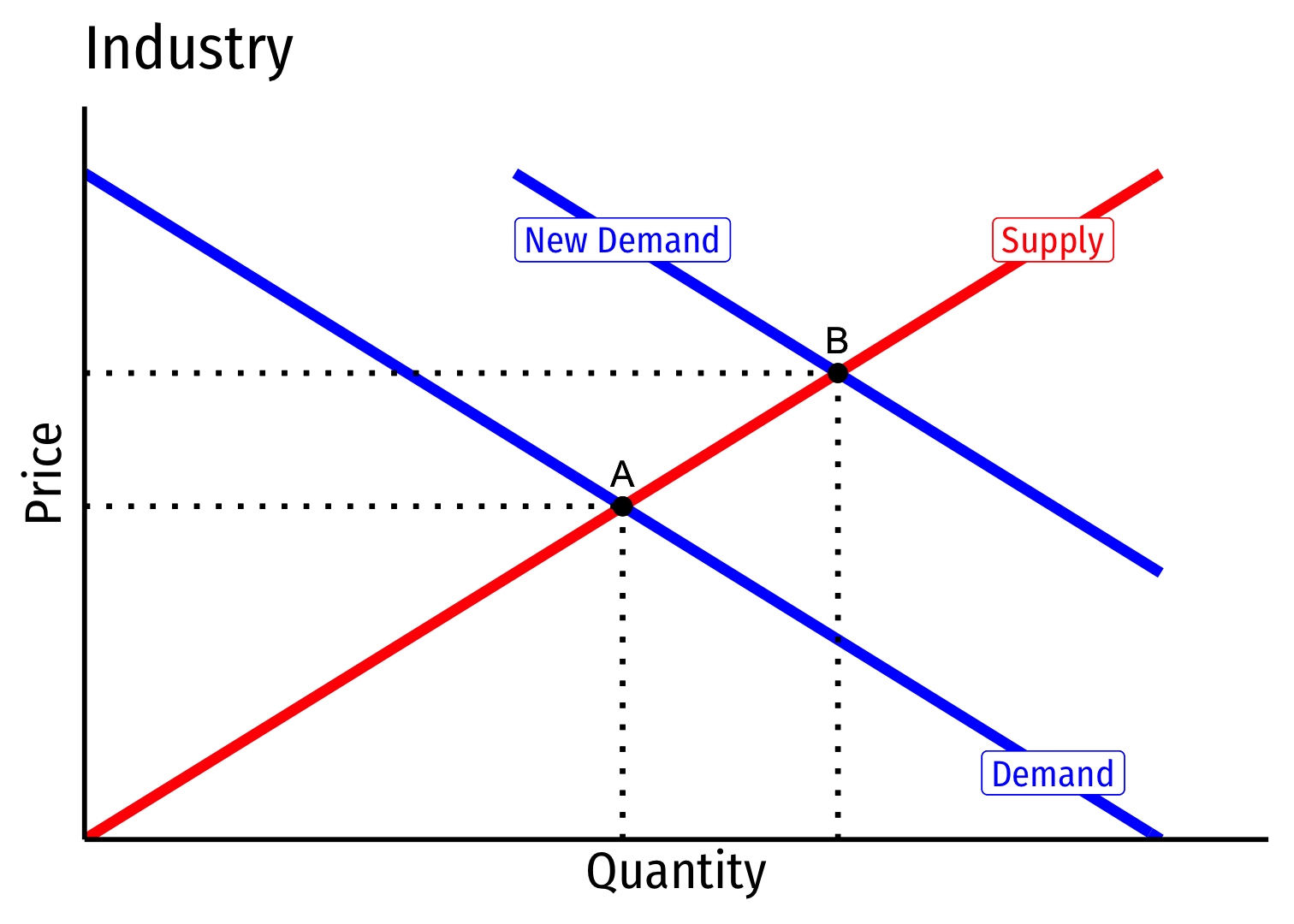

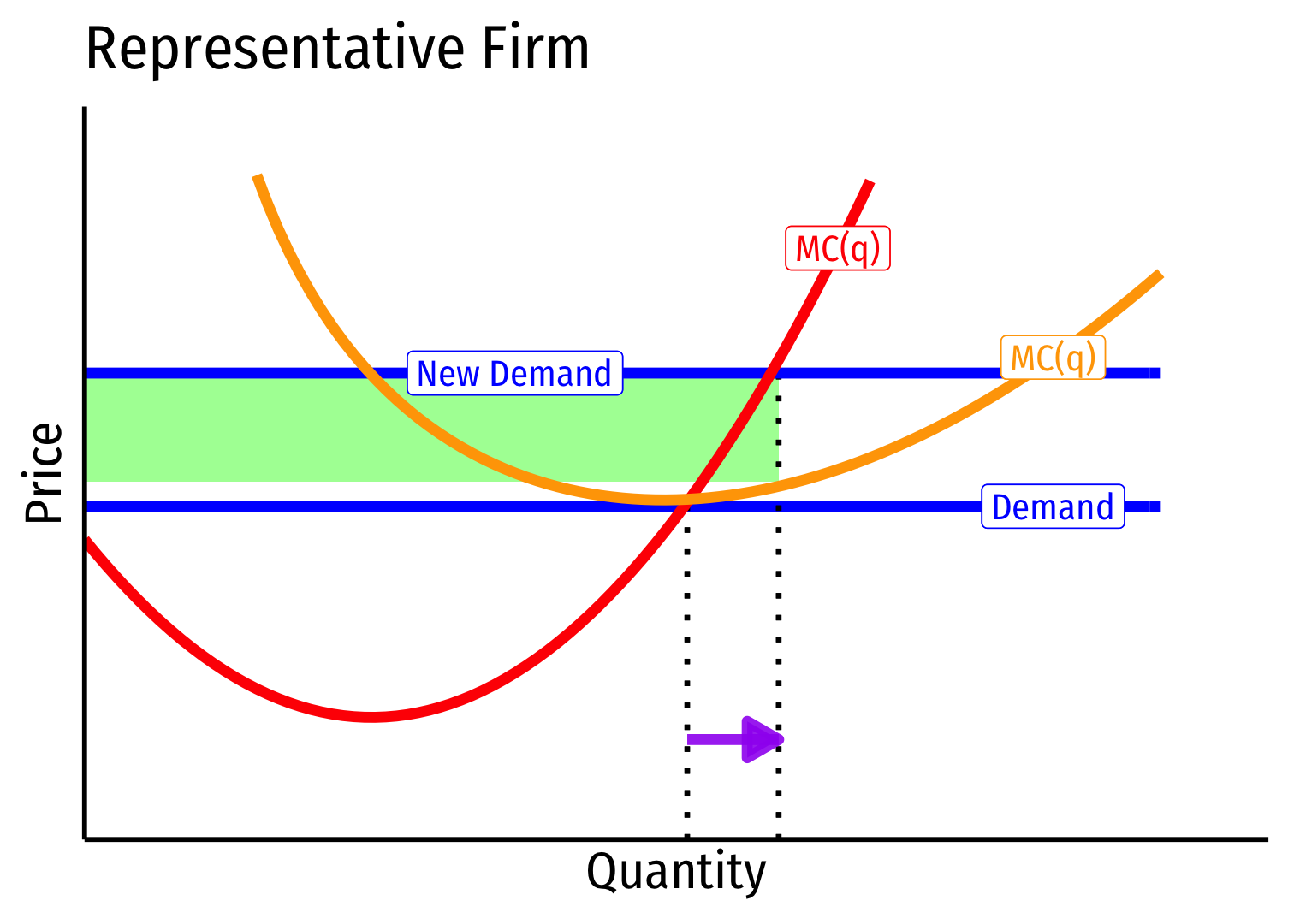

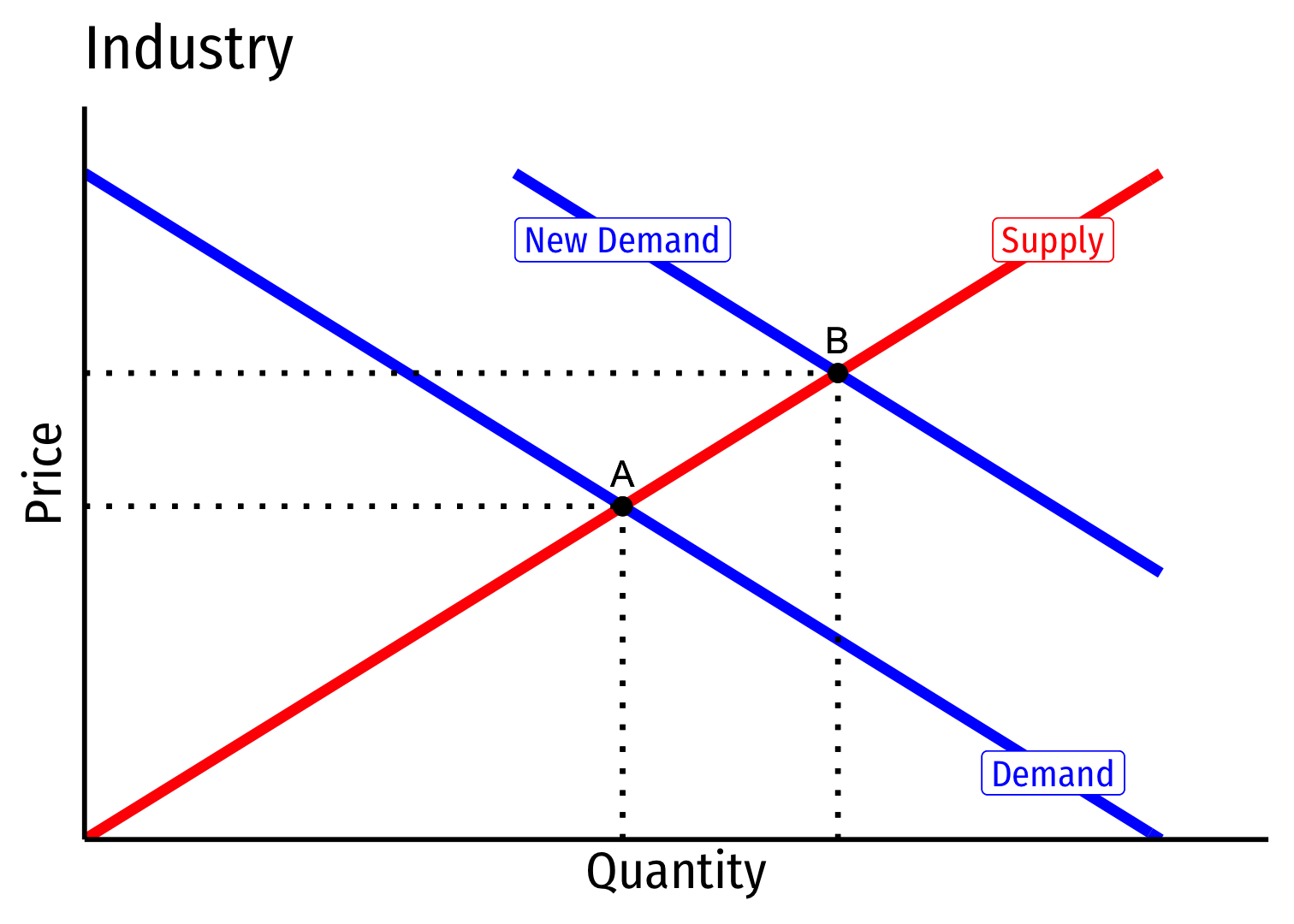

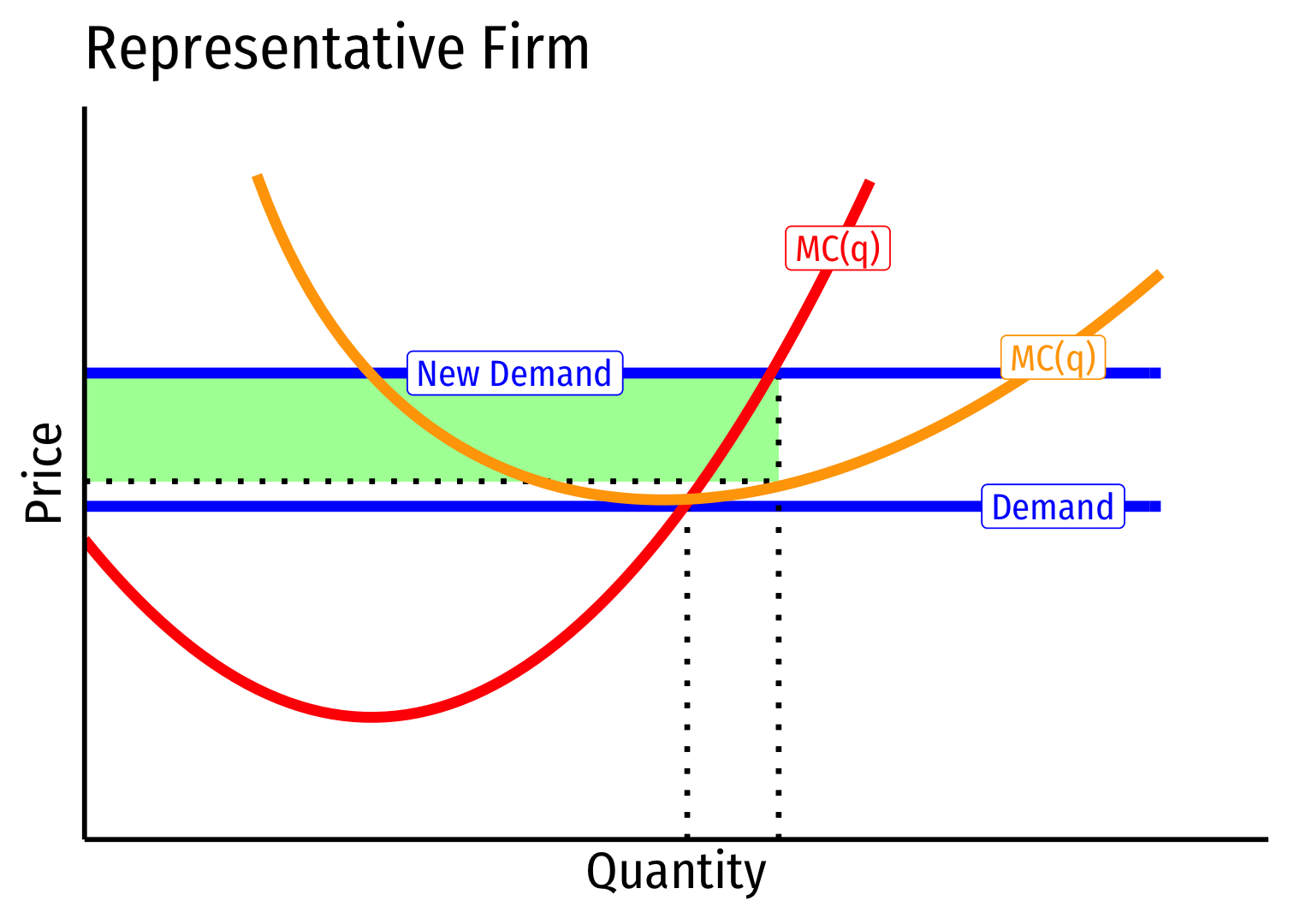

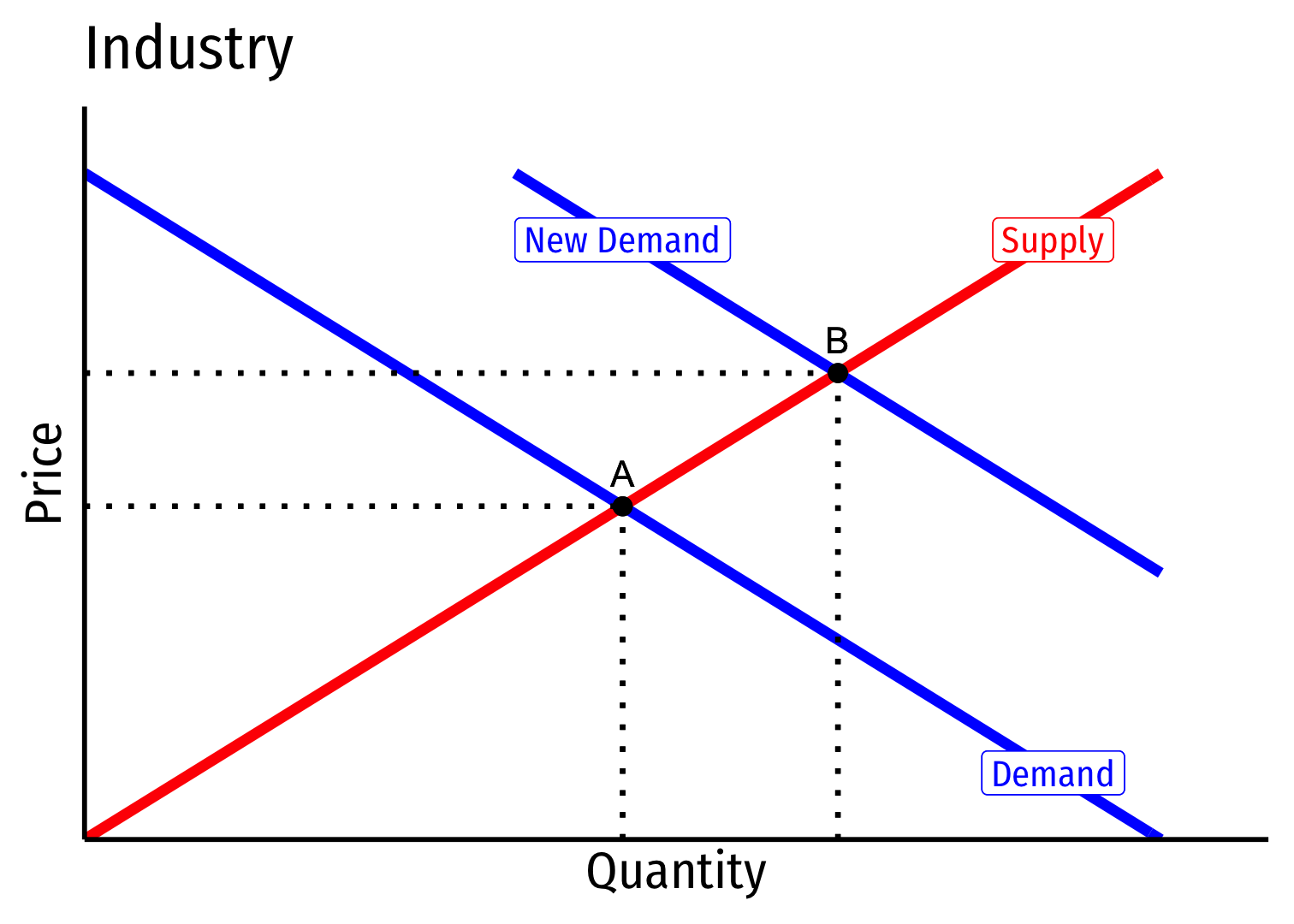

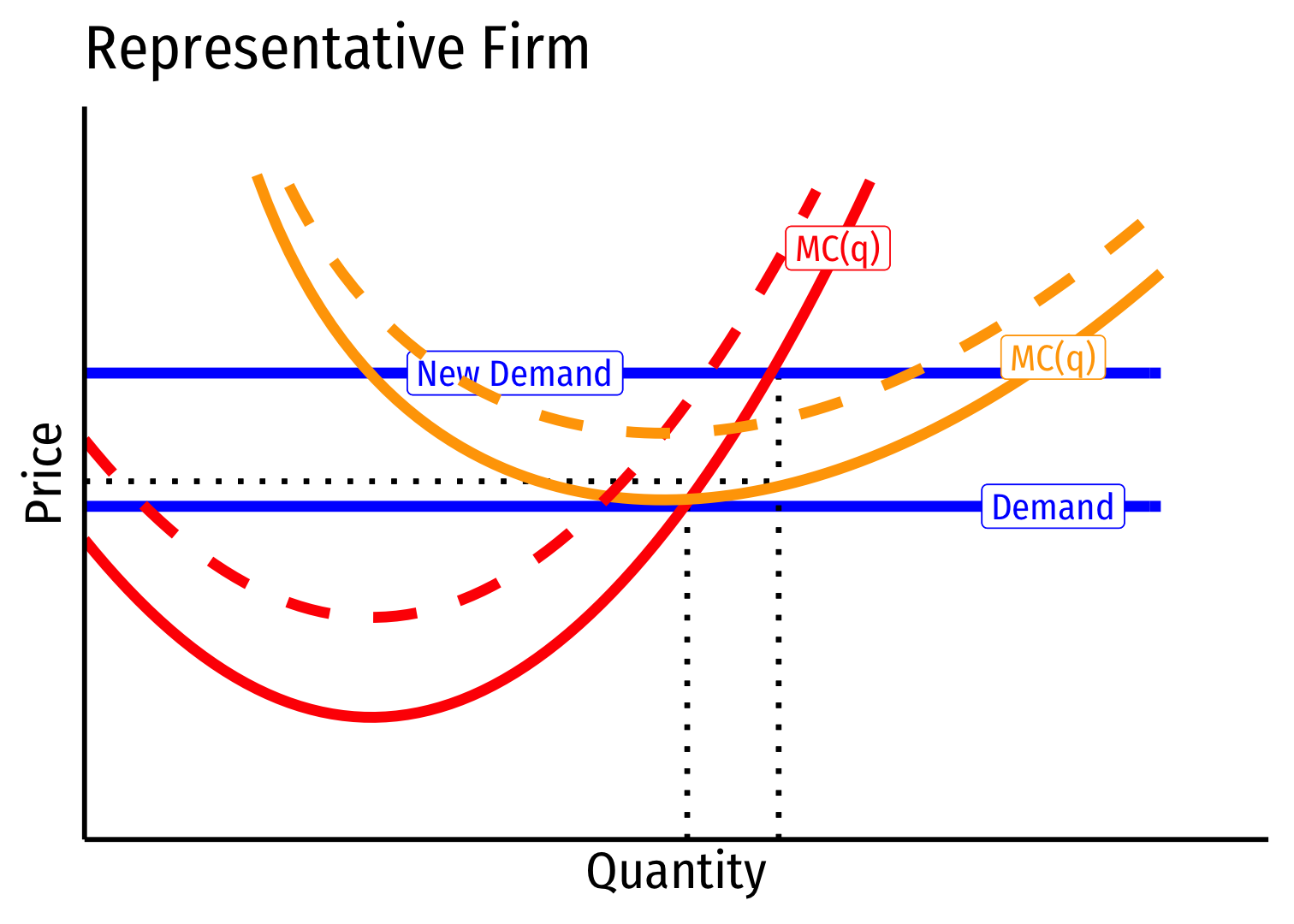

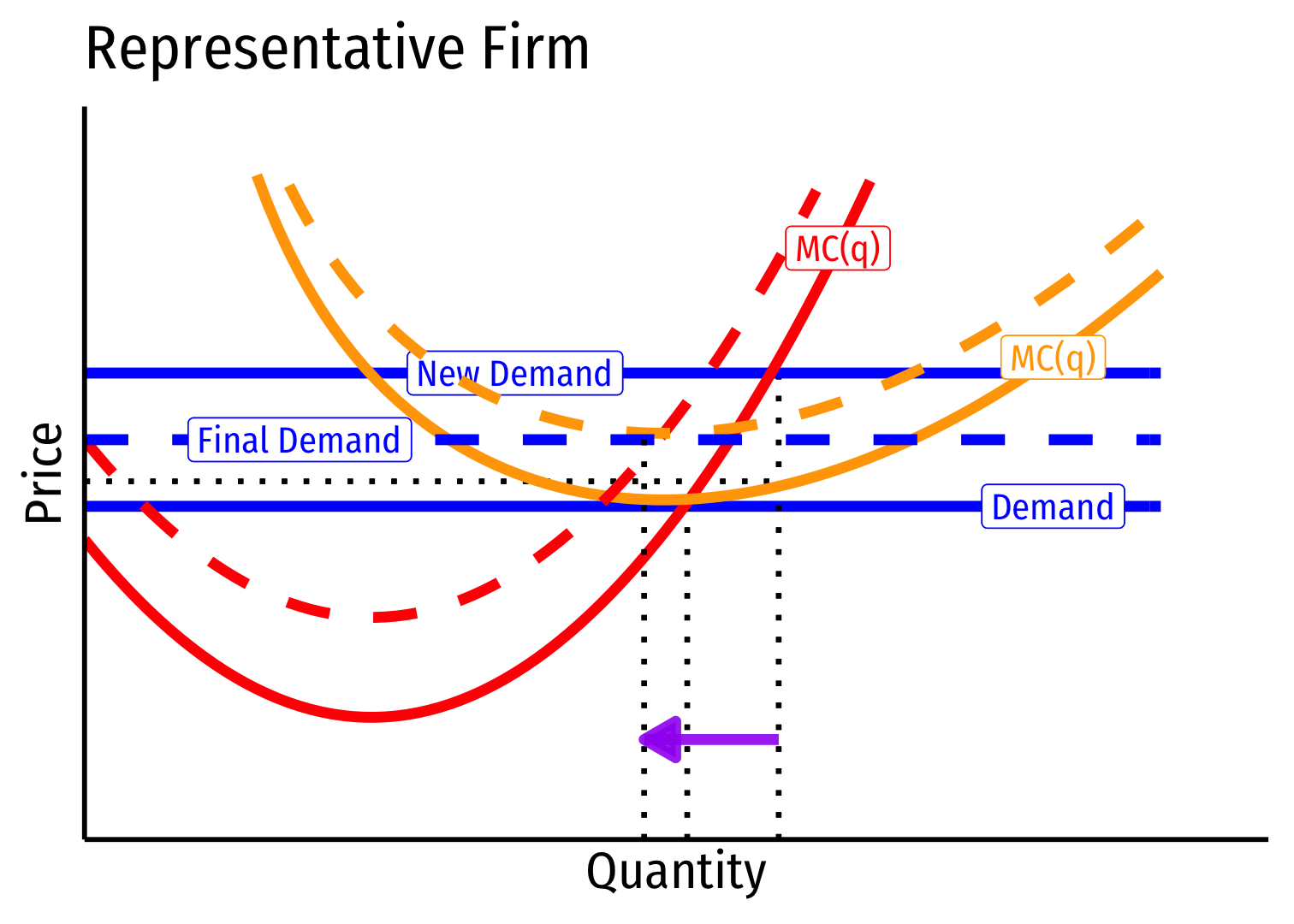

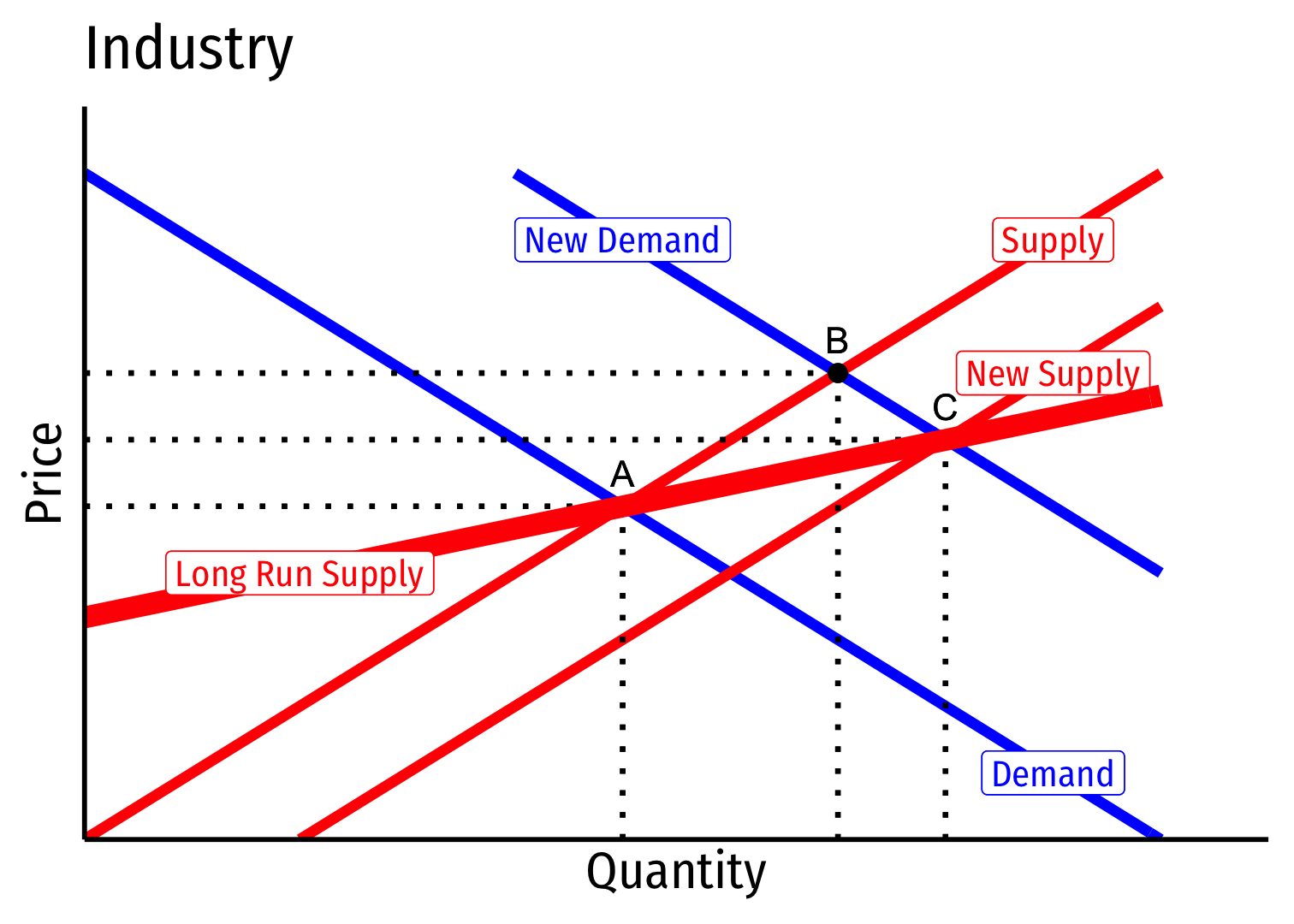

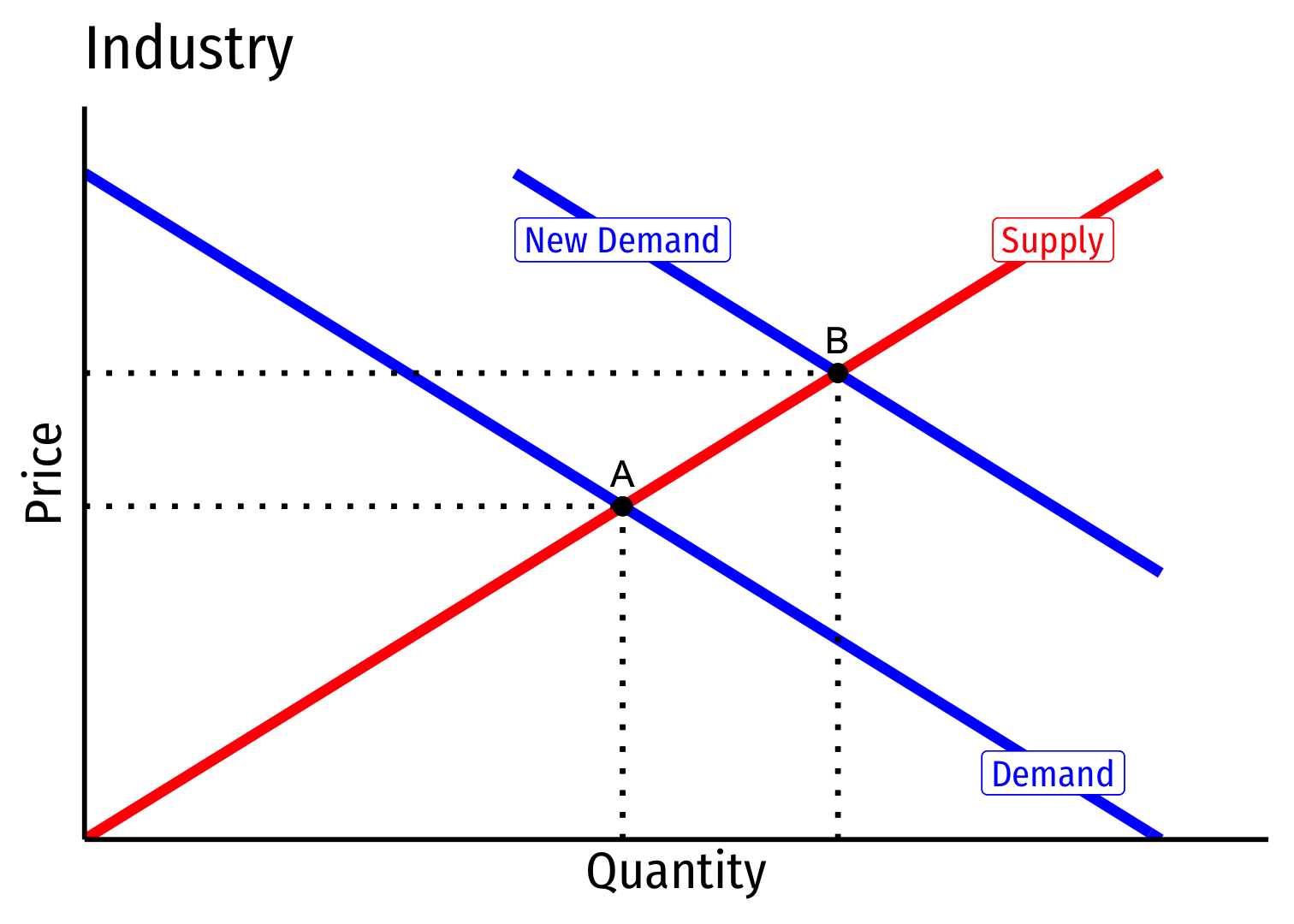

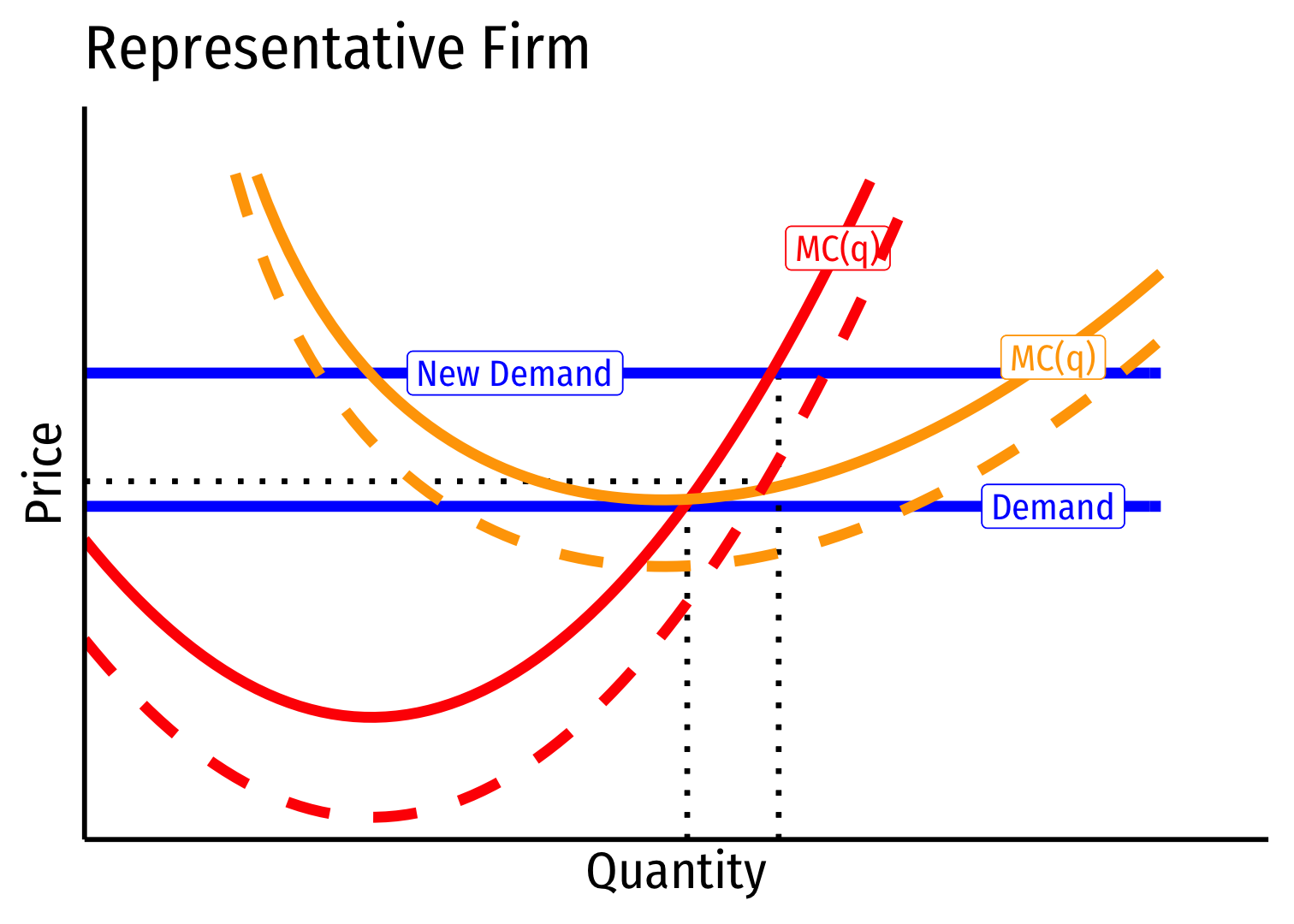

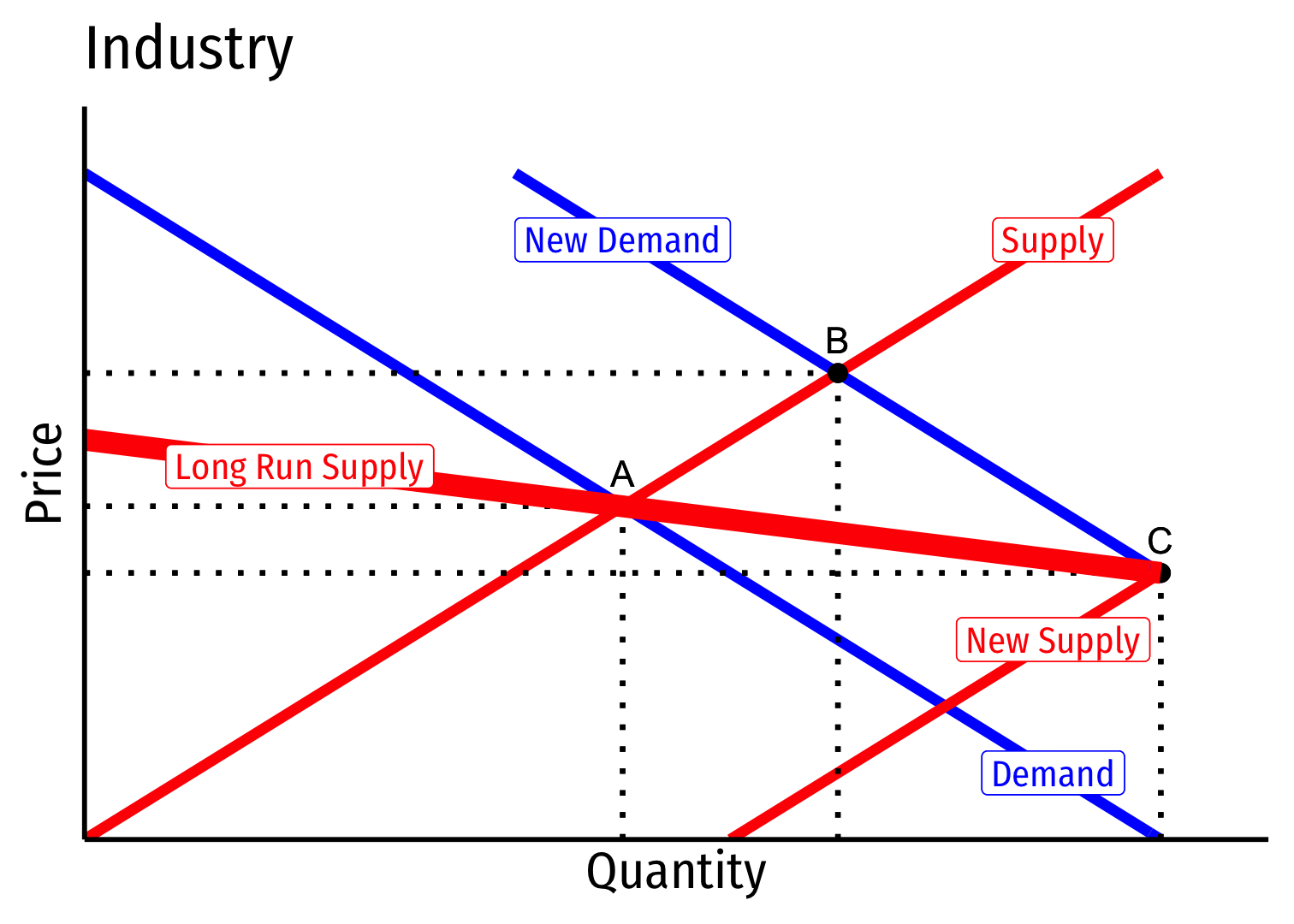

Constant Cost Industry (No External Economies) II

- Industry equilibrium: firms earning normal π=0,p=MC(q)=AC(q)

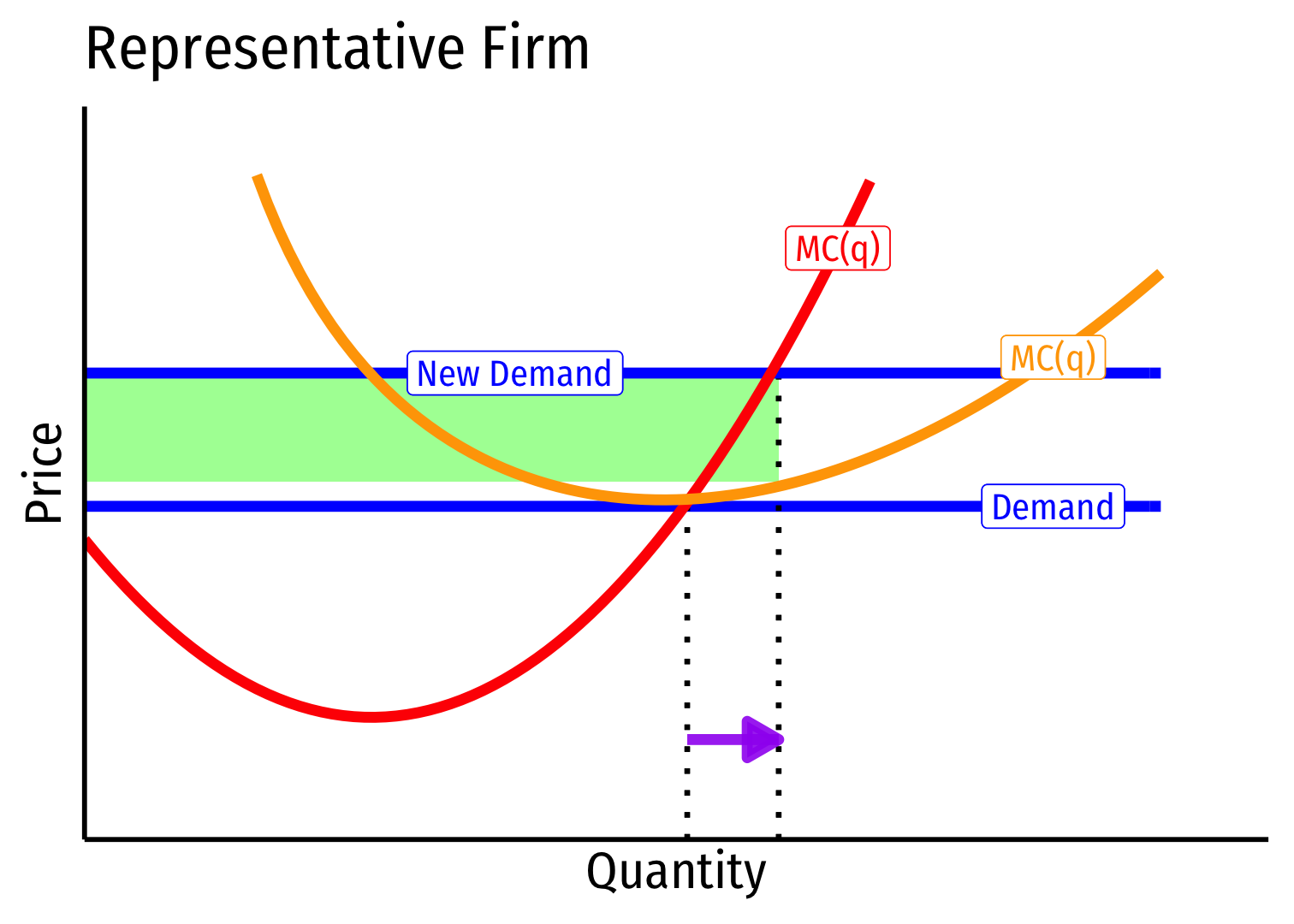

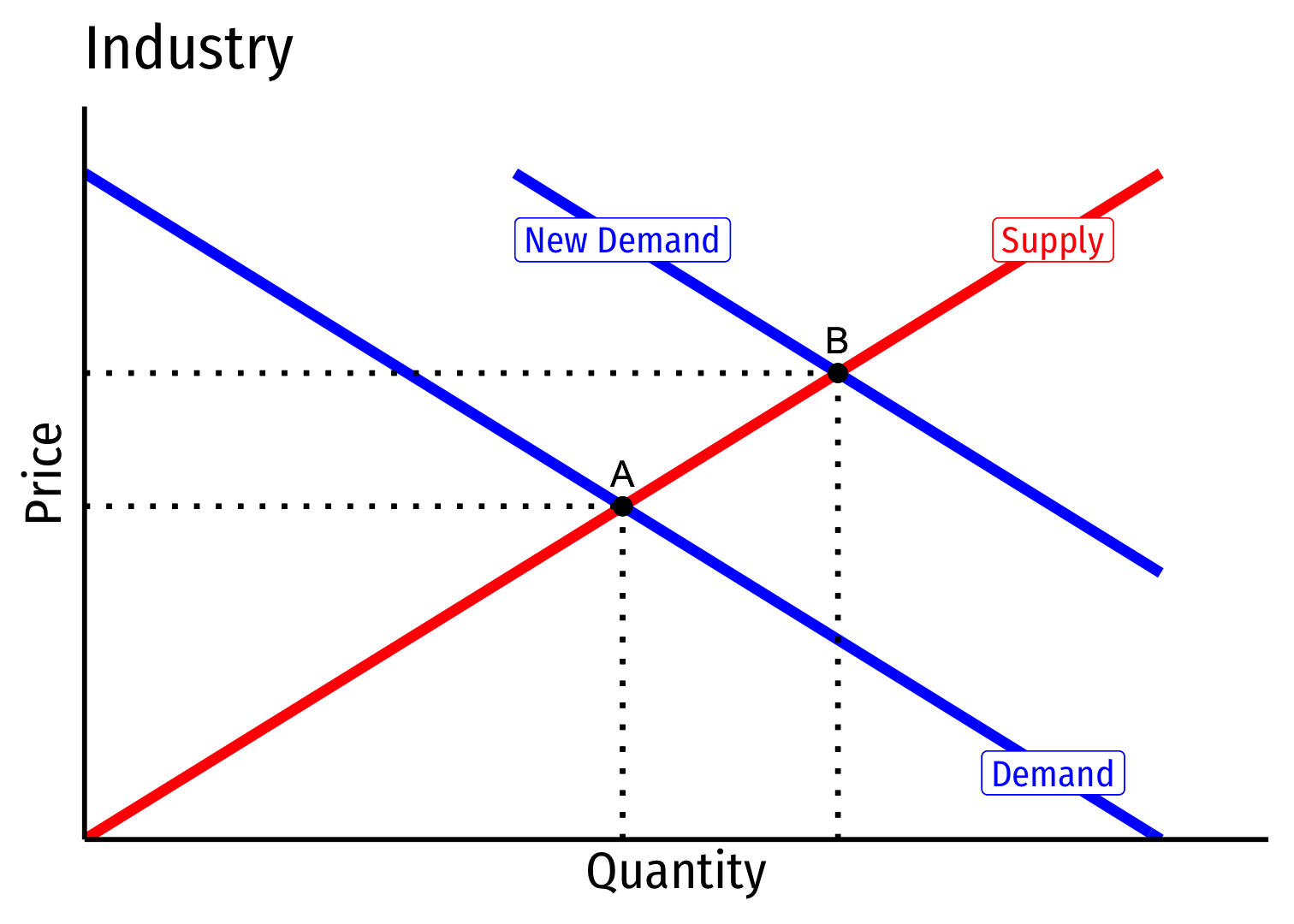

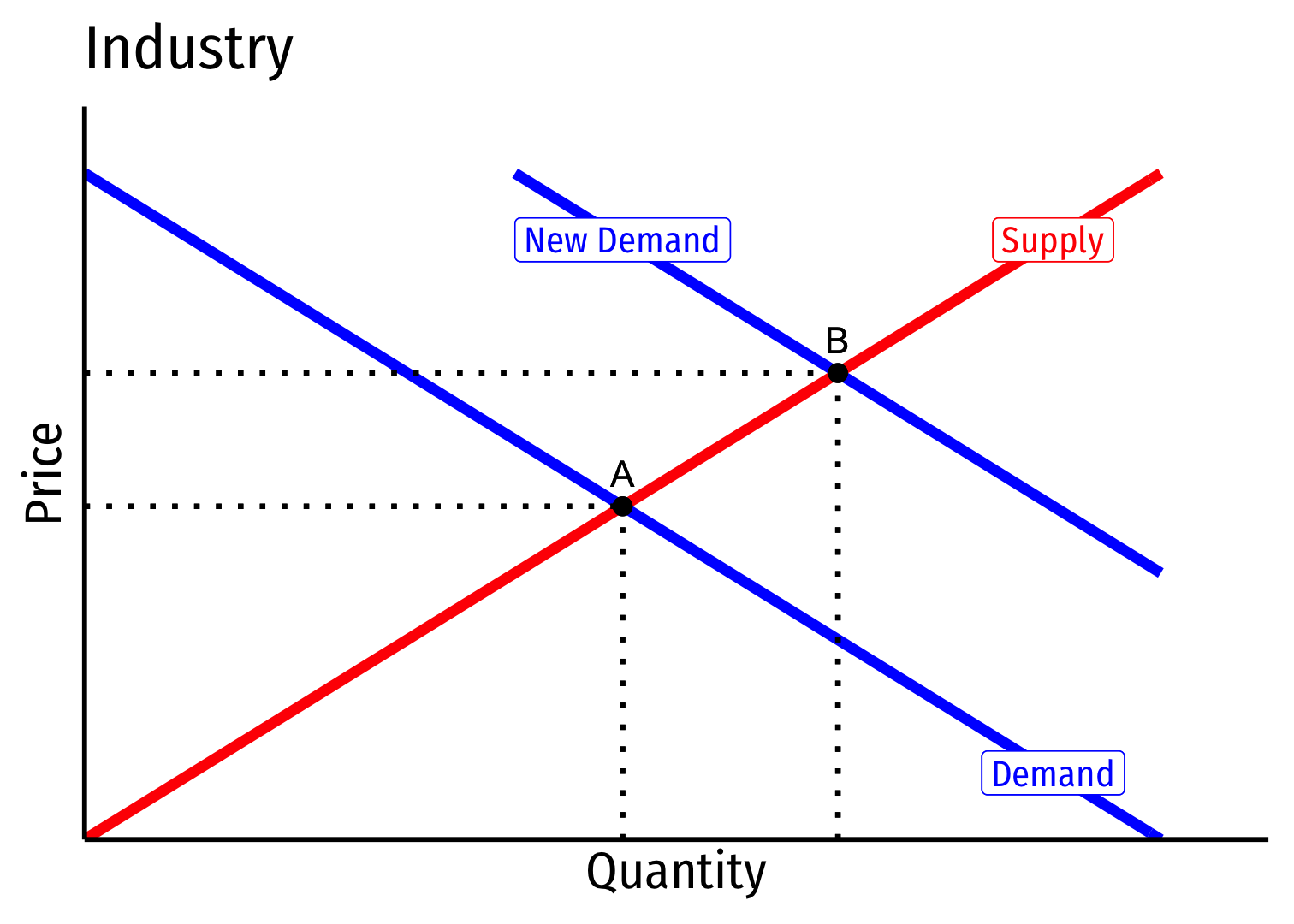

Constant Cost Industry (No External Economies) III

Industry equilibrium: firms earning normal π=0,p=MC(q)=AC(q)

Exogenous increase in market demand

Constant Cost Industry (No External Economies) IV

Short run (A→B): industry reaches new equilibrium

Firms charge higher p∗, produce more q∗, earn π

Constant Cost Industry (No External Economies) V

Long run (B→C): profit attracts entry ⟹ industry supply increases

No change in costs to firms in industry, firms enter until π=0 at p=AC(q)

Firms must charge original p∗, return to original q∗, earn π=0

Constant Cost Industry (No External Economies) VI

- Long Run Industry Supply is perfectly elastic

Increasing Cost Industry (External Diseconomies) I

Increasing cost industry has external _dis_economies, costs rise for all firms in the industry as industry output increases (firms enter & incumbents produce more)

An upward sloping long-run industry supply curve!

Determinants:

- Finding more resources in harder-to-reach places

- Diminishing marginal products

- Greater complexity and administrative costs at larger scales

Examples: oil, mining, particle physics

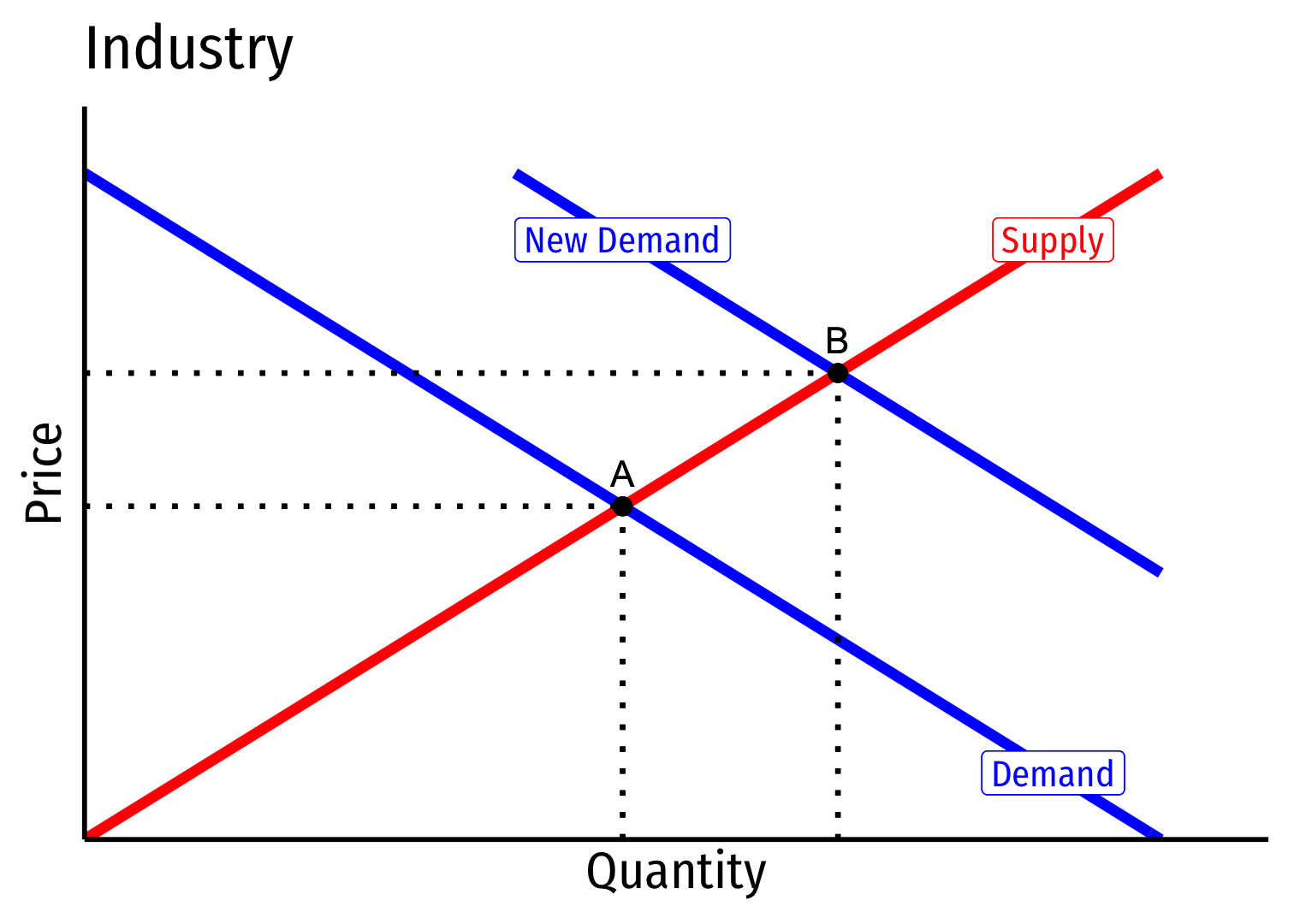

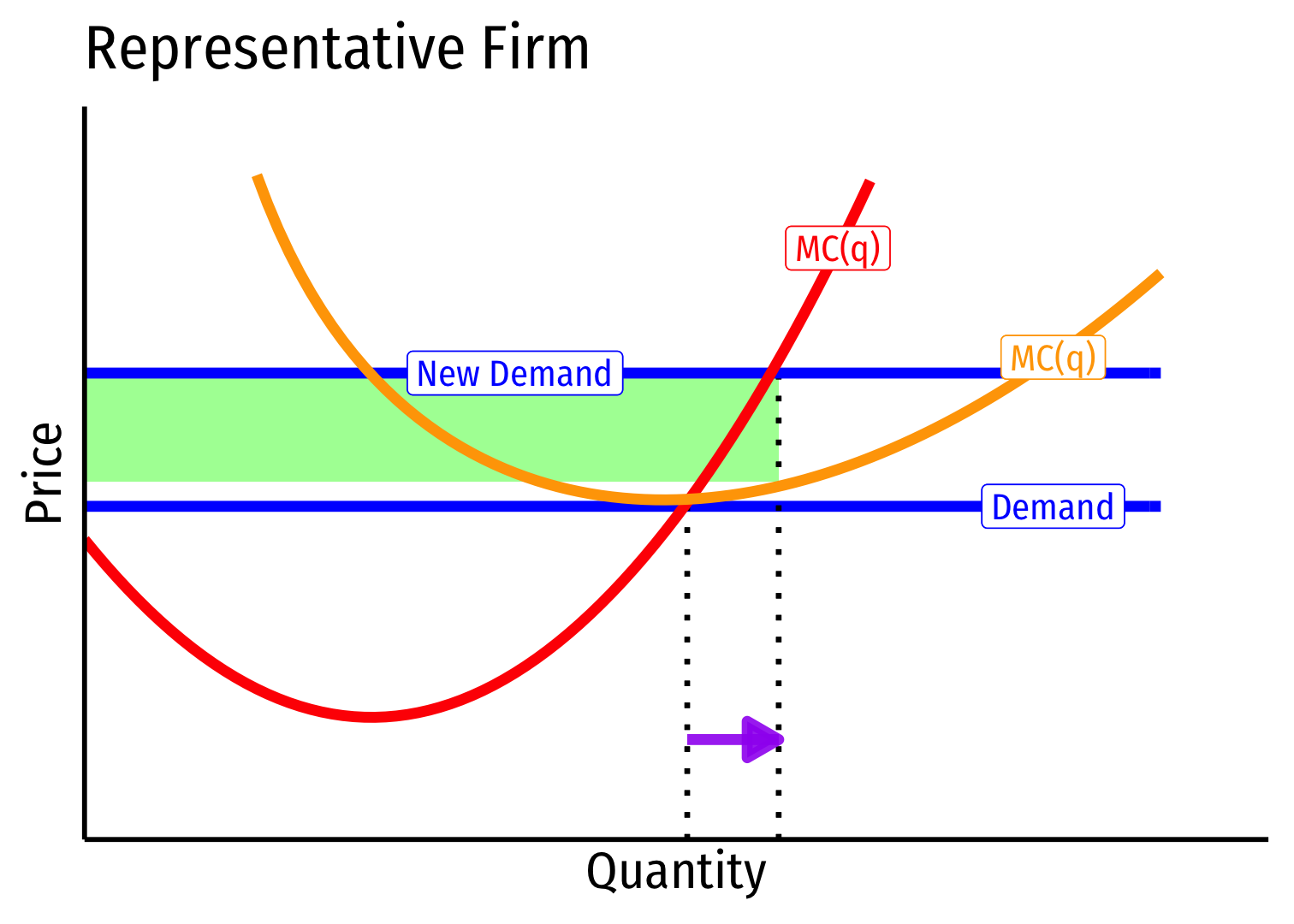

Increasing Cost Industry (External Diseconomies) II

- Industry equilibrium: firms earning normal π=0,p=MC(q)=AC(q)

Increasing Cost Industry (External Diseconomies) III

Industry equilibrium: firms earning normal π=0,p=MC(q)=AC(q)

Exogenous increase in market demand

Increasing Cost Industry (External Diseconomies) IV

Short run (A→B): industry reaches new equilibrium

Firms charge higher p∗, produce more q∗, earn π

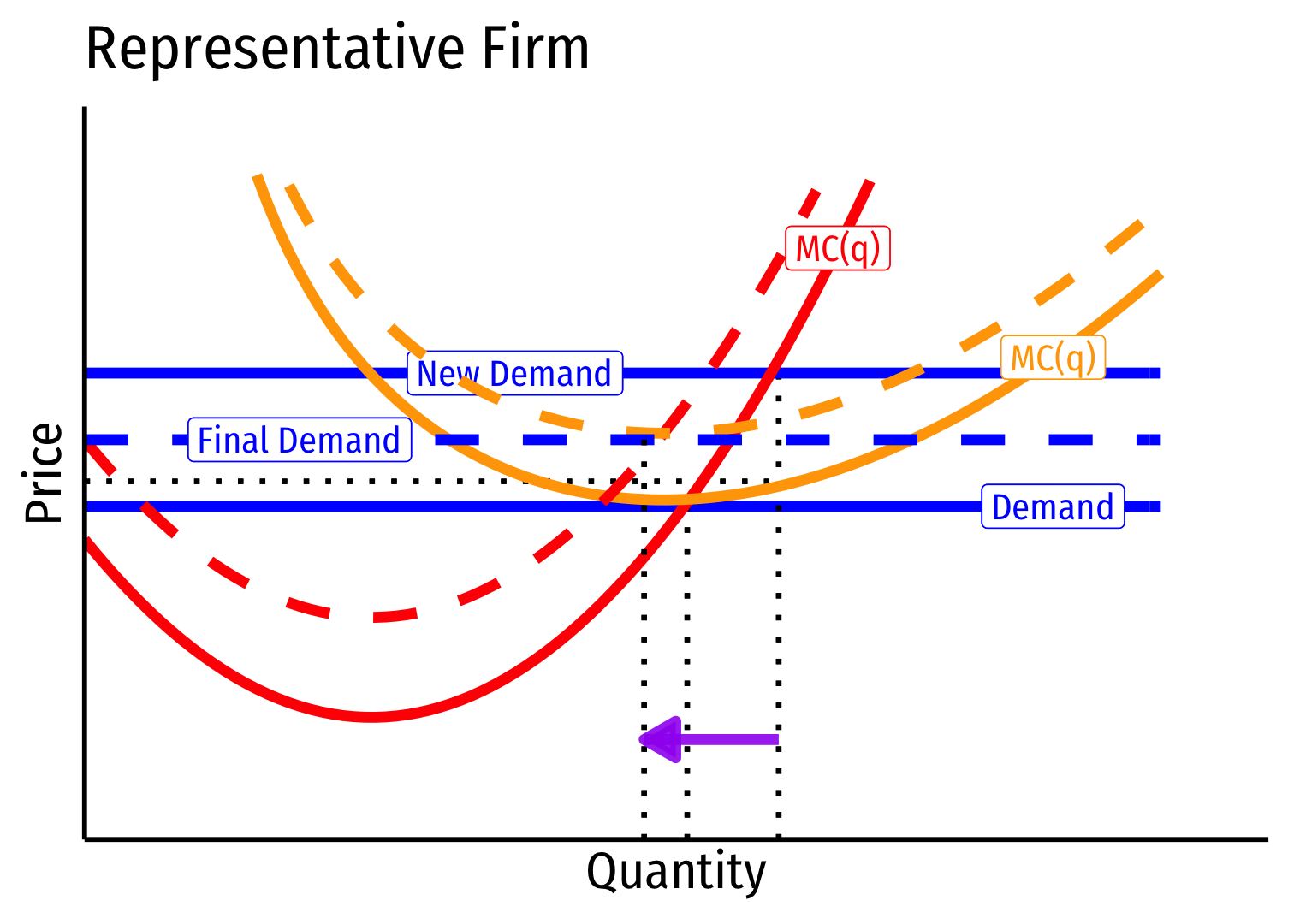

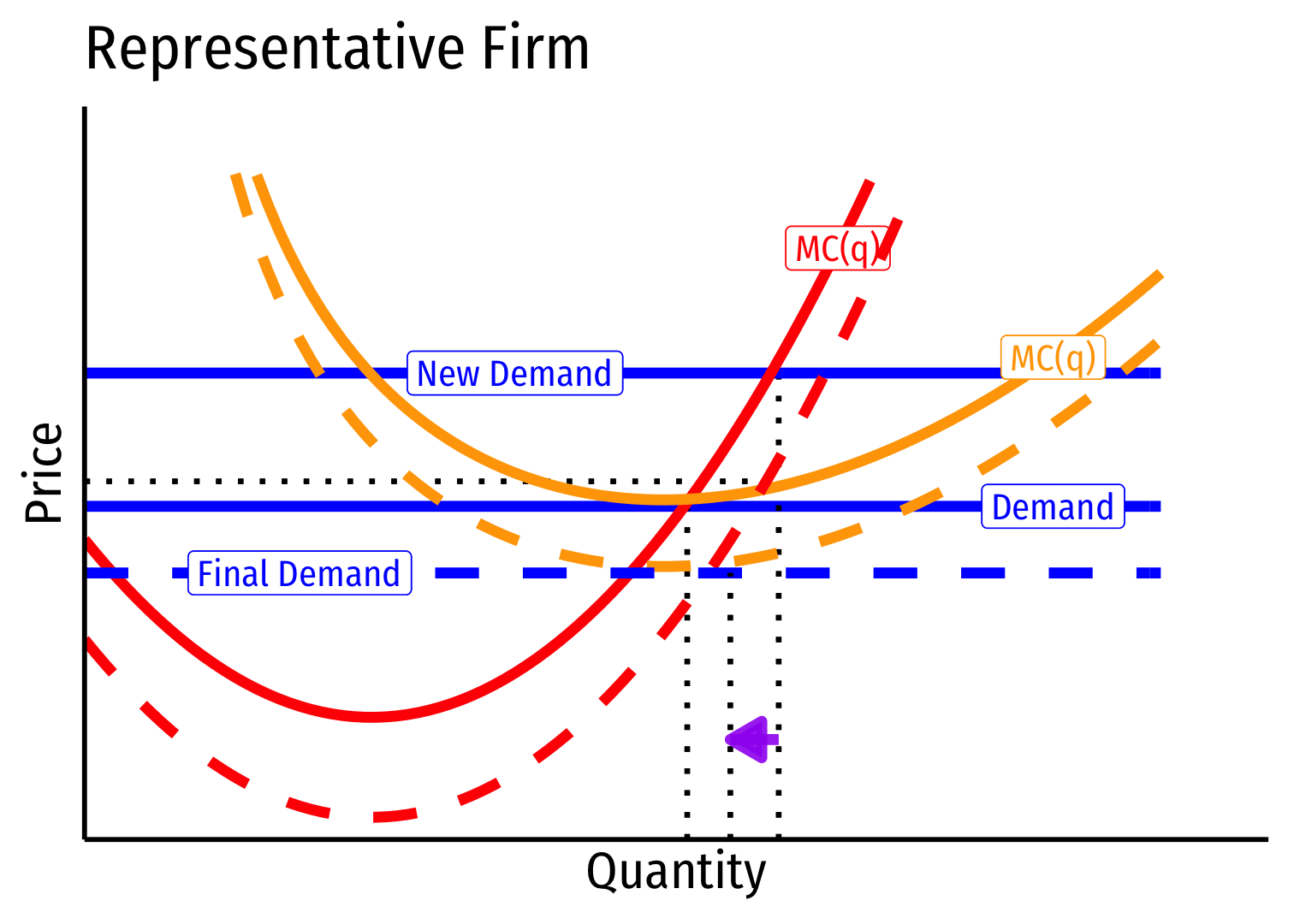

Increasing Cost Industry (External Diseconomies) V

Long run: profit attracts entry ⟹ industry supply will increase

But more production increases costs (MC,AC) for all firms in industry

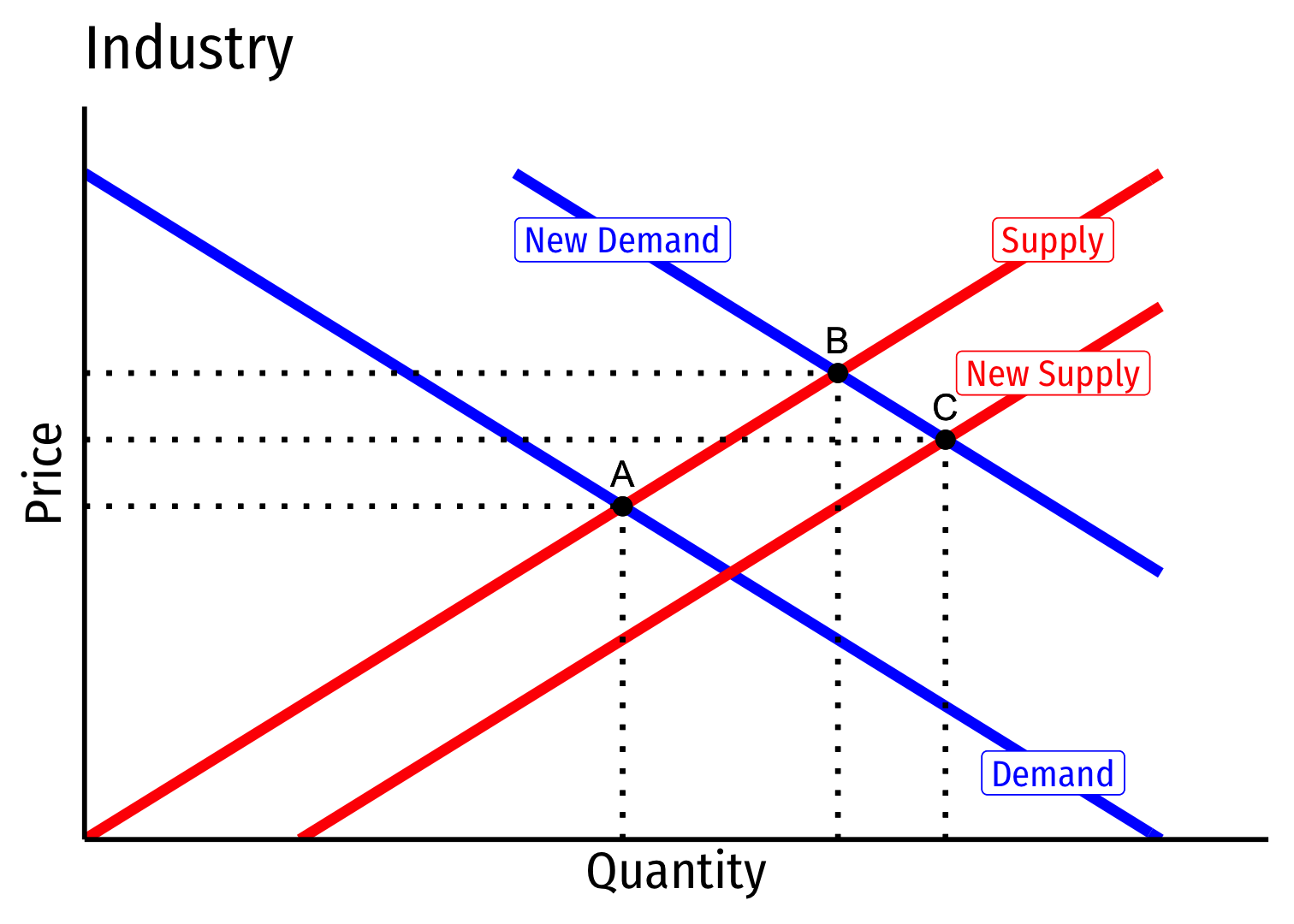

Increasing Cost Industry (External Diseconomies) VI

Long run (B→C): firms enter until π=0 at p=AC(q)

Firms charge higher p∗, producer lower q∗, earn π=0

Increasing Cost Industry (External Diseconomies) VII

- Long run industry supply curve is upward sloping

Decreasing Cost Industry (External Economies) I

Decreasing cost industry has external economies, costs fall for all firms in the industry as industry output increases (firms enter & incumbents produce more)

A downward sloping long-run industry supply curve!

Determinants:

- High fixed costs, low marginal costs

- Economies of scale

Examples: geographic clusters, public utilities, infrastructure, entertainment

Tends towards "natural" monopoly

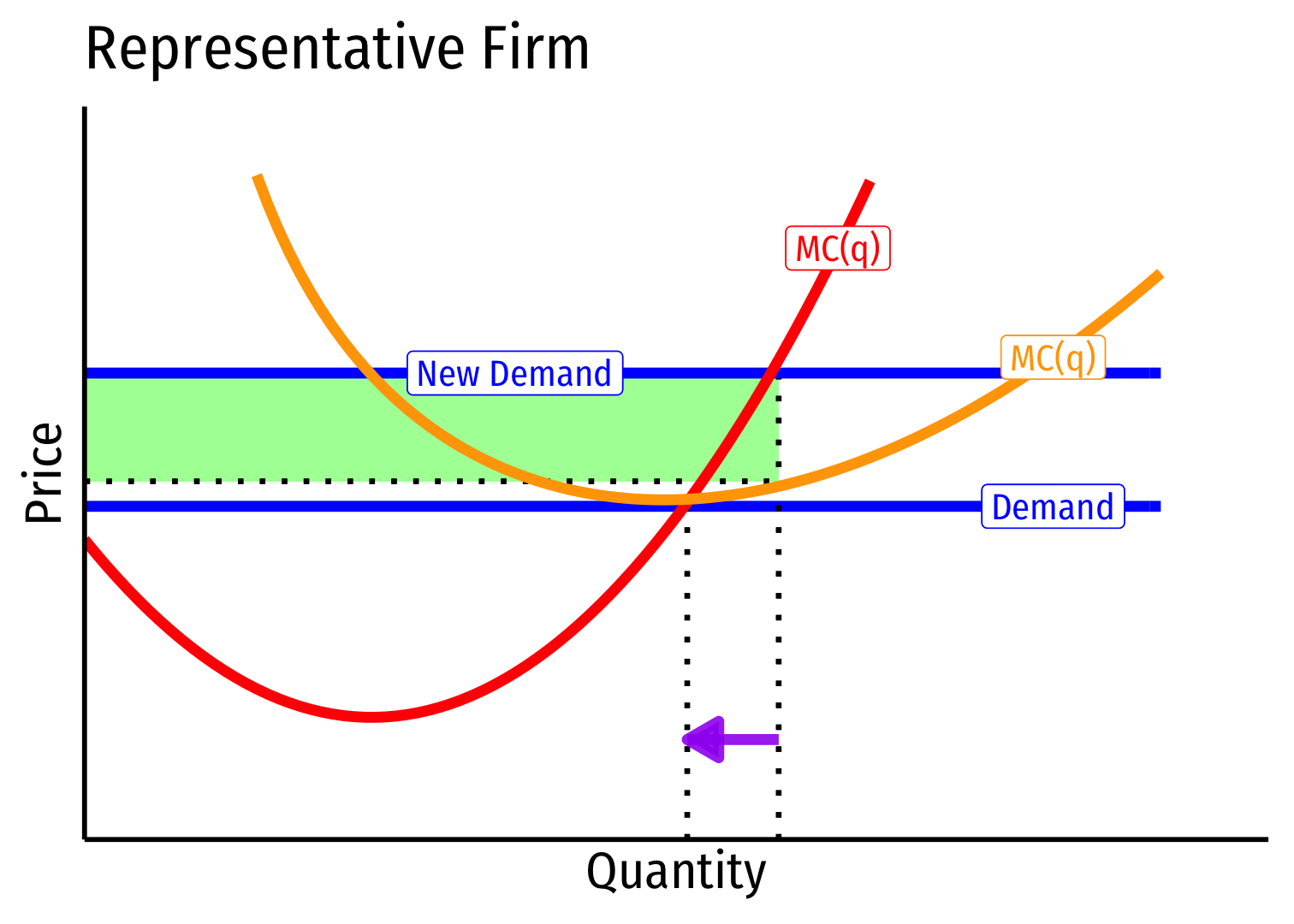

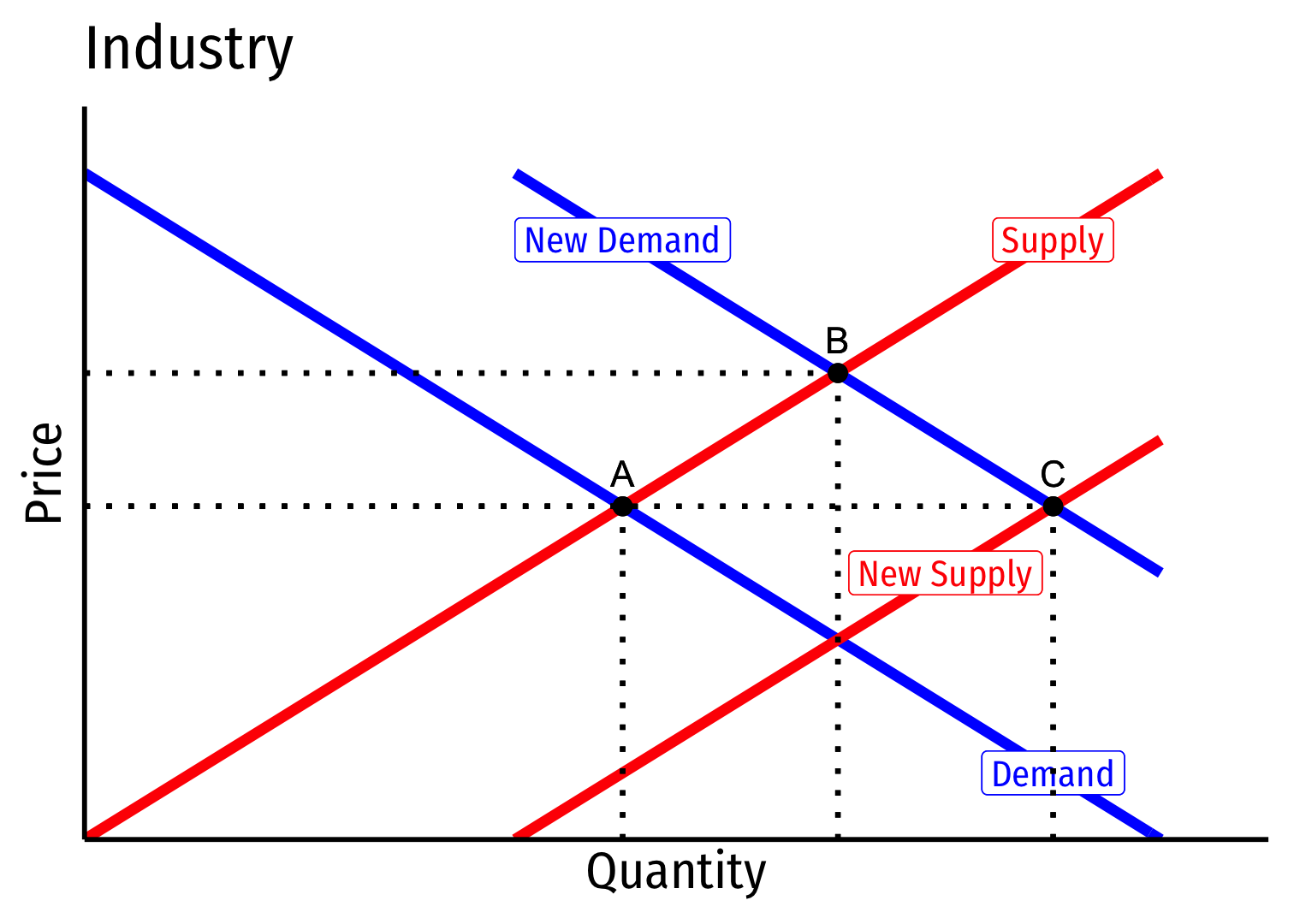

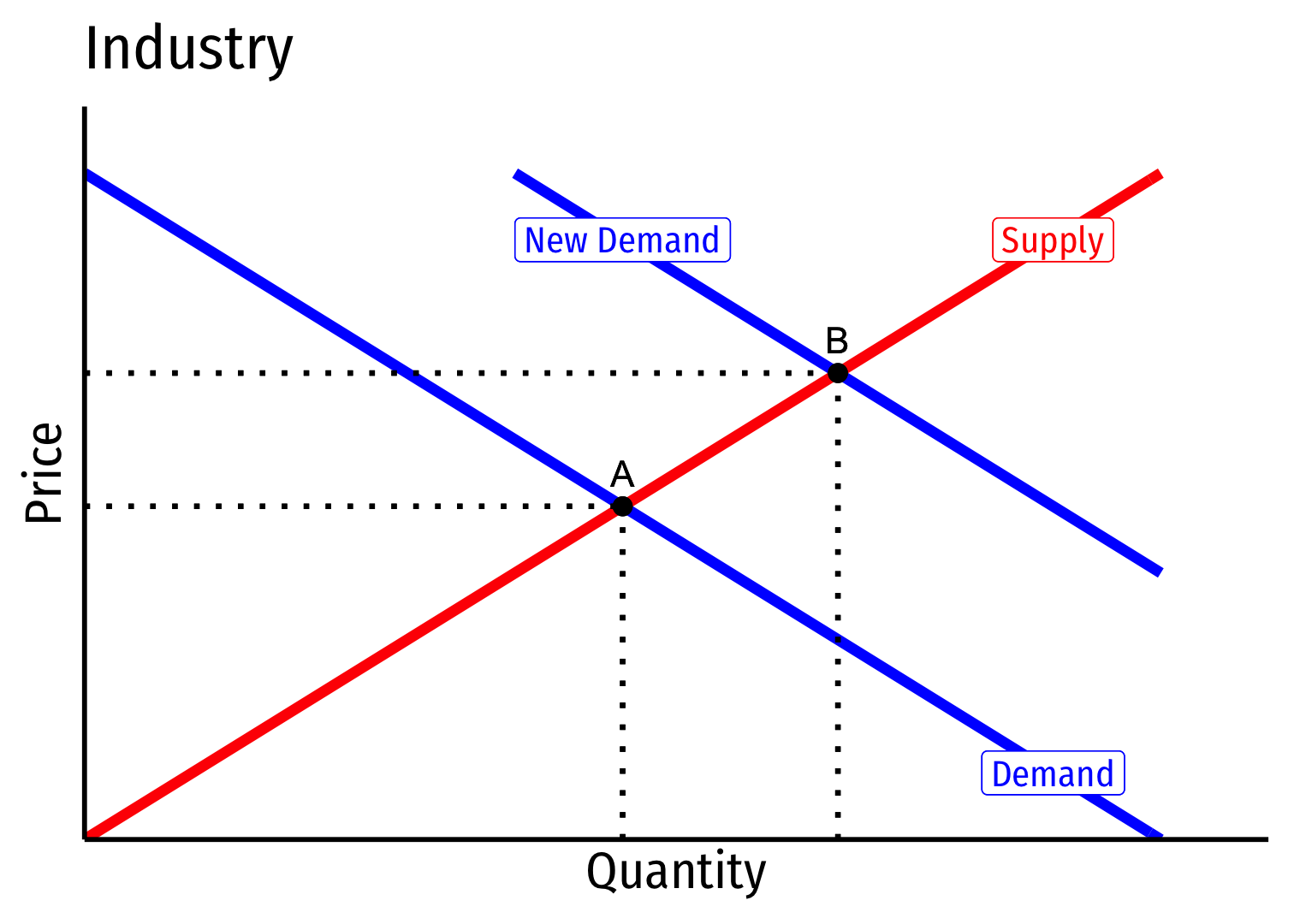

Decreasing Cost Industry (External Economies) II

- Industry equilibrium: firms earning normal π=0,p=MC(q)=AC(q)

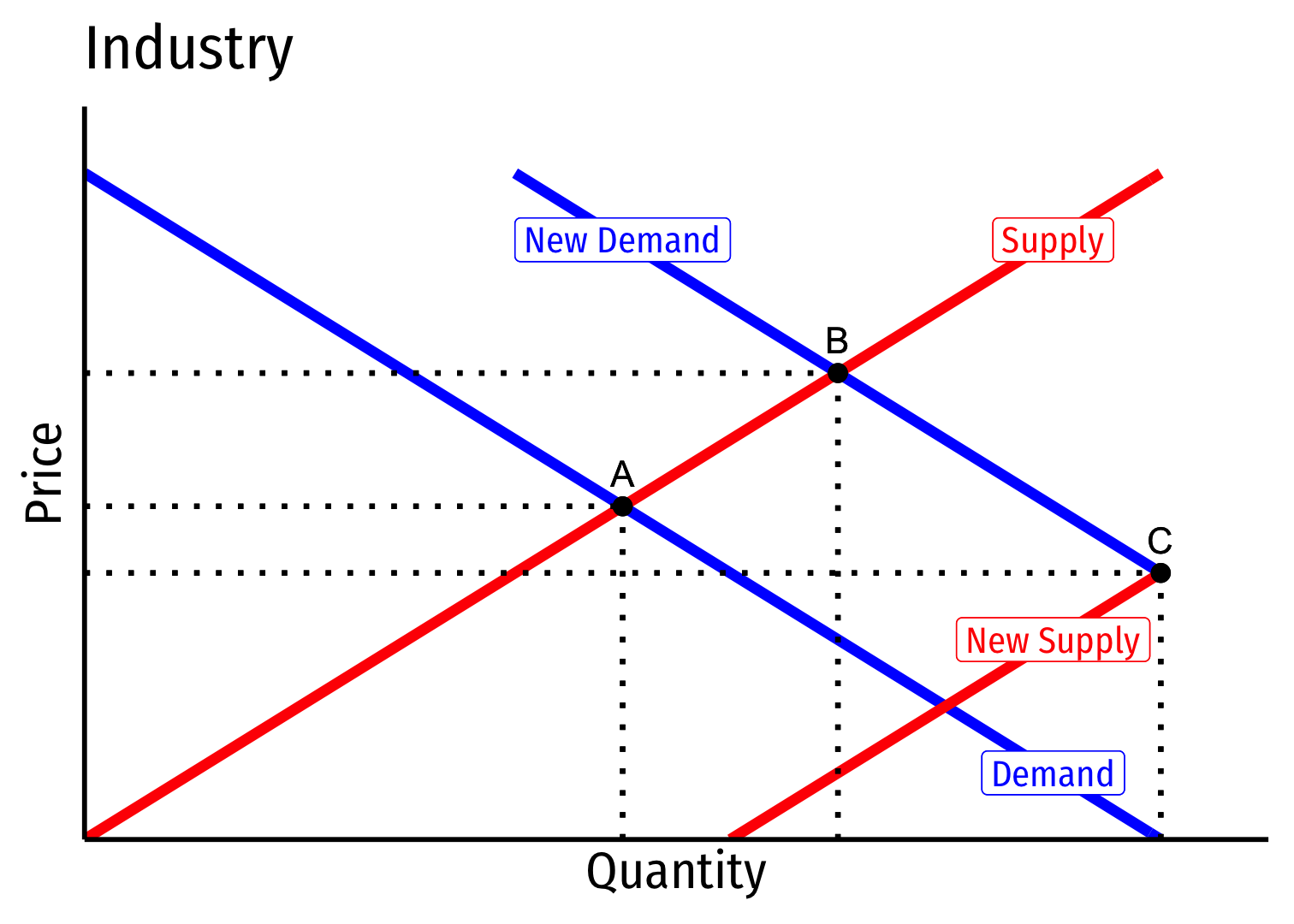

Decreasing Cost Industry (External Economies) III

Industry equilibrium: firms earning normal π=0,p=MC(q)=AC(q)

Exogenous increase in market demand

Decreasing Cost Industry (External Economies) IV

Short run (A→B): industry reaches new equilibrium

Firms charge higher p∗, produce more q∗, earn π

Decreasing Cost Industry (External Economies) V

Long run: profit attracts entry ⟹ industry supply will increase

But more production lowers costs (MC,AC) for all firms in industry

Decreasing Cost Industry (External Economies) VI

Long run (B→C): firms enter until π=0 at p=AC(q)

Firms charge higher p∗, producer lower q∗, earn π=0

Decreasing Cost Industry (External Economies) VII

- Long run industry supply curve is downward sloping!

Supply Functions

Supply Function

- Supply function relates quantity supplied to price

Example: q=2p−4

- Not graphable (wrong axes)!

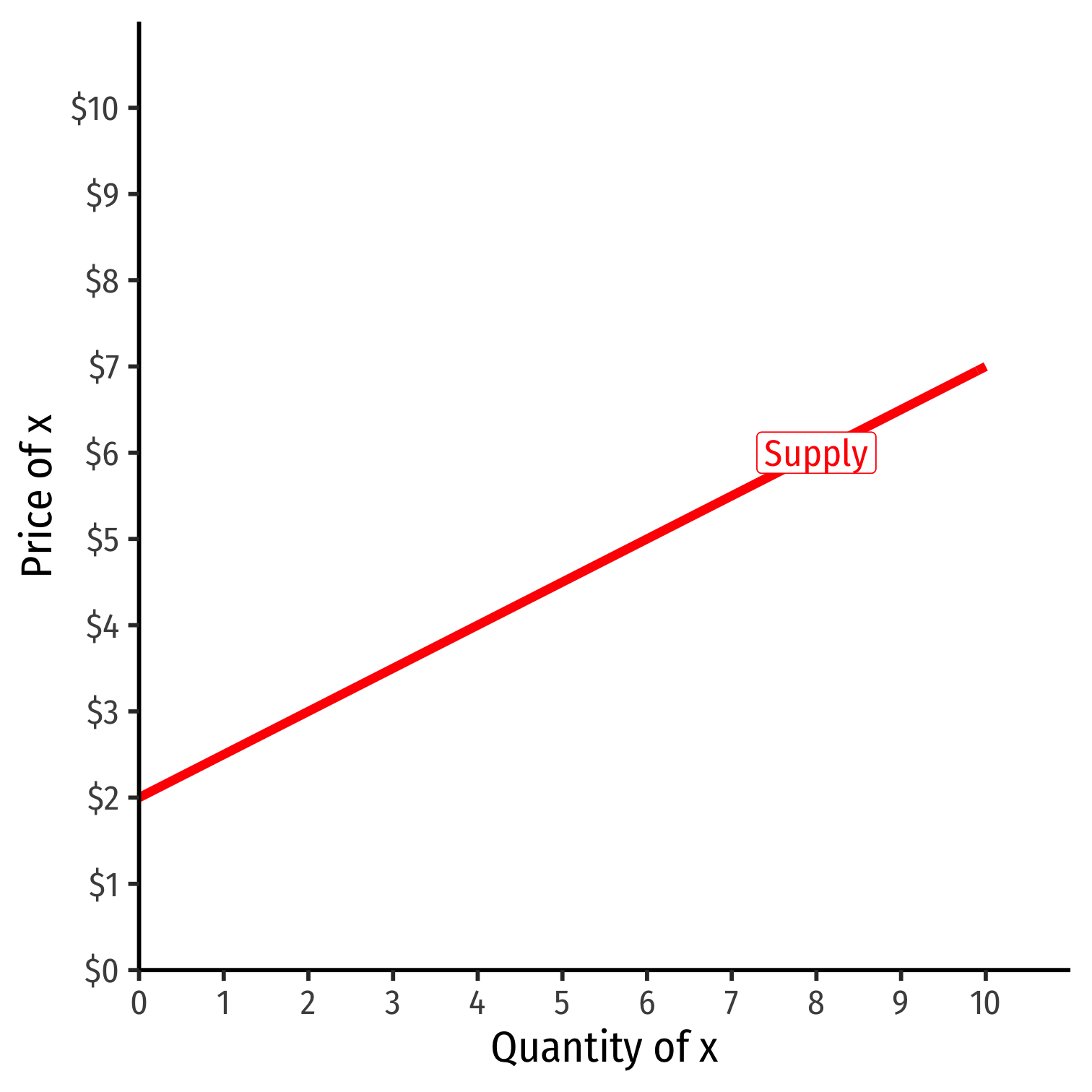

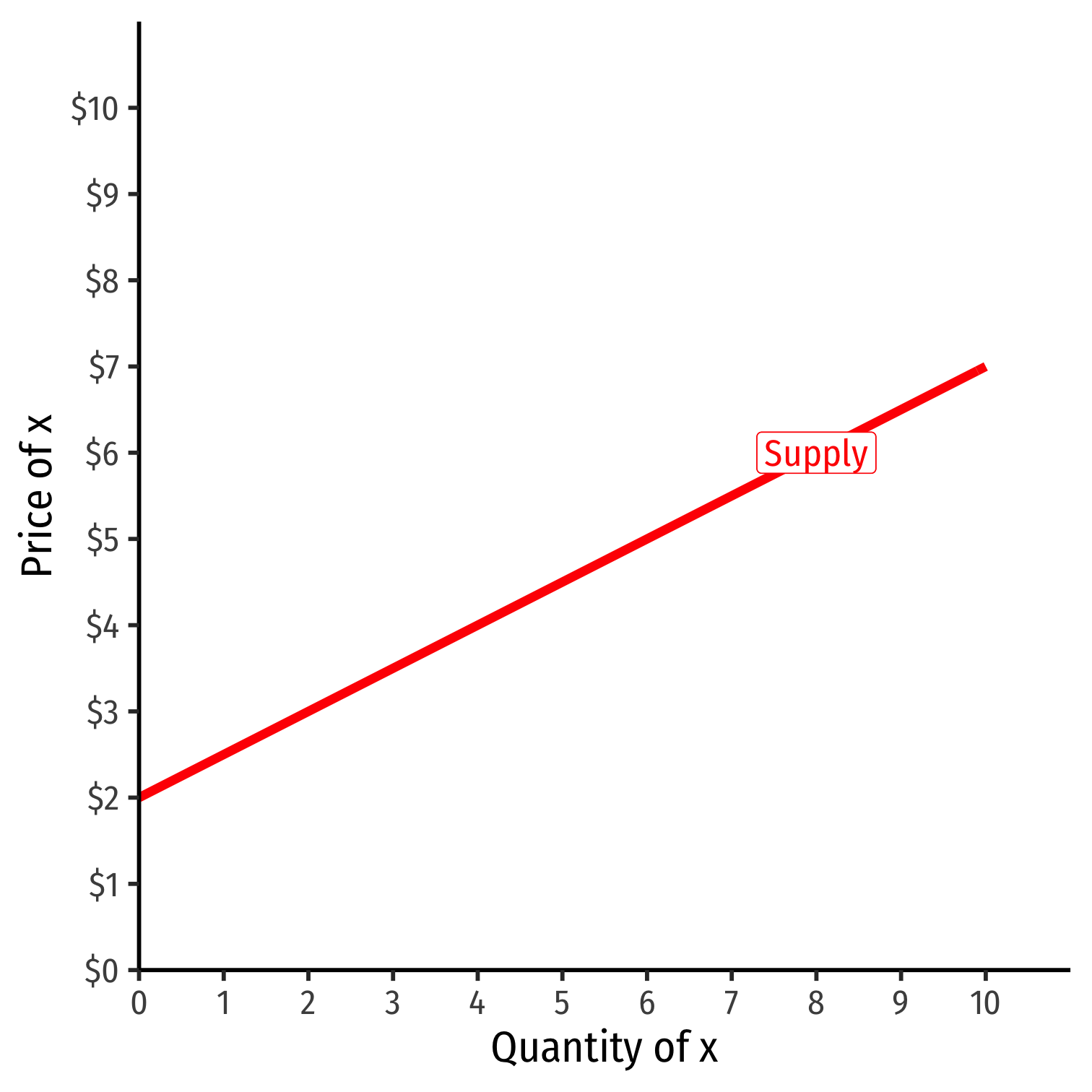

Inverse Supply Function

- Inverse supply function relates price to quantity

- Find by taking supply function and solving for p

Example: p=2+0.5q

- Graphable (price on vertical axis)!

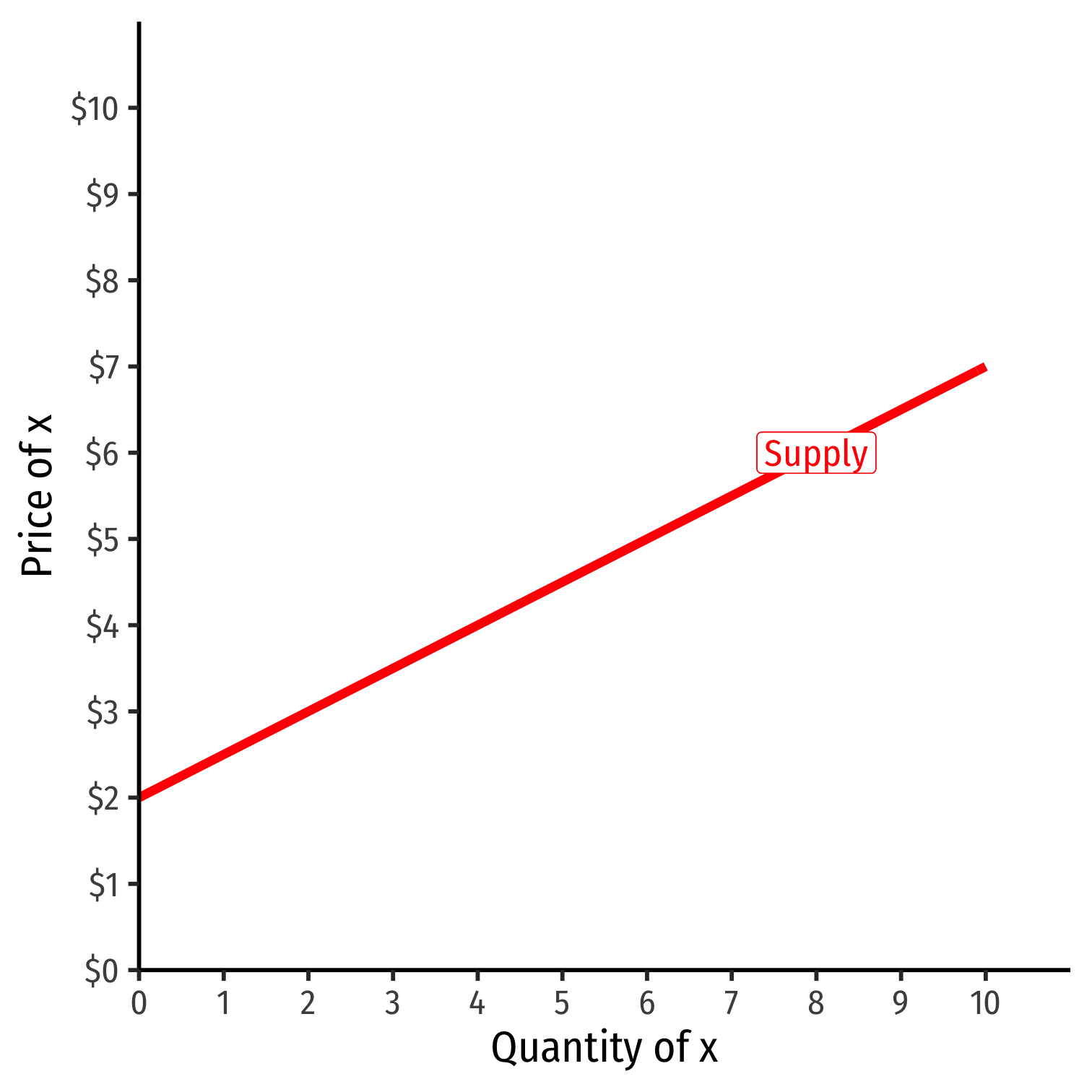

Inverse Supply Function

- Supply demand function relates price to quantity

- Find by taking demand function and solving for p

Example: p=2+0.5q

Graphable (price on vertical axis)!

Slope: 0.5

Vertical intercept called the "Choke price": price where qS=0 ($2), just low enough to discourage any sales

Inverse Supply Function

- Inverse supply function relates price to quantity

- Find by taking suuply function and solving for p

Example: p=2+0.5q

Read two ways:

Horizontally: at any given price, how many units firm wants to sell

Vertically: at any given quantity, the minimum willingness to accept (WTA) for that quantity

Price Elasiticity of Supply

Price Elasticity of Supply

- Price elasticity of supply measures how much (in %) quantity supplied changes in response to a (1%) change in price

ϵqS,p=%ΔqS%Δp

Price Elasticity of Supply: Elastic vs. Inelastic

ϵqS,p=%ΔqS%Δp

| "Elastic" | "Unit Elastic" | "Inelastic" | |

|---|---|---|---|

| Intuitively: | Large response | Proportionate response | Little response |

| Mathematically: | ϵqs,p>1 | ϵqs,p=1 | ϵqs,p<1 |

| Numerator > Denominator | Numerator = Denominator | Numerator < Denominator | |

| A 1% change in p | More than 1% change in qS | 1% change in qS | Less than 1% change in qS |

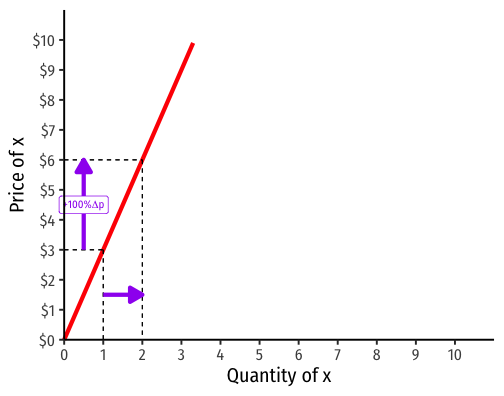

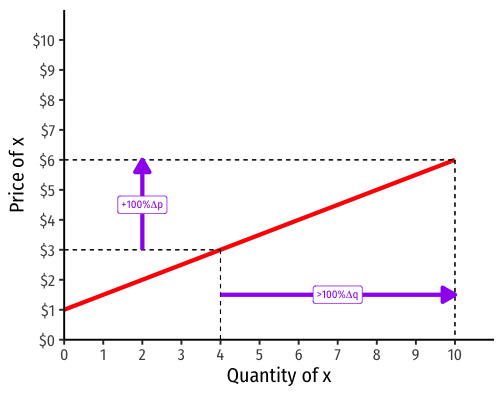

Visualizing Price Elasticity of Supply

An identical 100% price increase on an:

"Inelastic" Supply Curve

"Elastic" Supply Curve

Price Elasticity of Supply Formula

ϵq,p=1slope×pq

First term is the inverse of the slope of the inverse supply curve (that we graph)!

To find the elasticity at any point, we need 3 things:

- The price

- The associated quantity supplied

- The slope of the (inverse) supply curve

Example

Example: The supply of bicycle rentals in a small town is given by:

qS=10p−200

Find the inverse supply function.

What is the price elasticity of supply at a price of $25.00?

What is the price elasticity of supply at a price of $50.00?

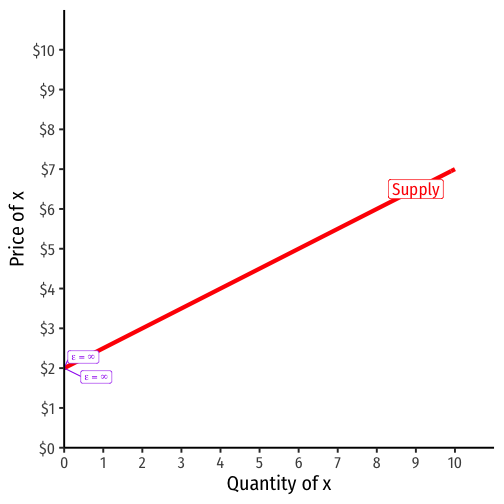

Price Elasticity of Supply Changes Along the Supply Curve

ϵq,p=1slope×pq

Elasticity ≠ slope (but they are related)!

Elasticity changes along the supply curve

Often gets less elastic as ↑ price (↑ quantity)

- Harder to supply more

Determinants of Price Elasticity of Supply I

What determines how responsive your selling behavior is to a price change?

Increasing/Decreasing/Constant Cost industry ⟹ less/more/perfectly elastic supply

- Mining for natural resources vs. automated manufacturing

Smaller (larger) share of market for inputs ⟹ more (less) elastic

- Will your suppliers raise the price much if you buy more?

- How much competition is there in your input markets?

Determinants of Price Elasticity of Supply II

What determines how responsive your selling behavior is to a price change?

- More (less) time to adjust to price changes ⟹ more (less) elastic