2.1: Theory of the Firm

ECON 306 · Microeconomic Analysis · Fall 2019

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microf19

microF19.classes.ryansafner.com

Producer Behavior

How do producers decide:

- which products to produce

- in what quantity

- using which resources

- and for what price?

Answers to these questions are building blocks for supply curves

The Basics of Production

Nearly all goods must be produced before we can exchange and consume them

Consumption is the destruction of value to gain utility

- Consumption is the ultimate goal of all economic activity

Production is the creation of value, by transforming lower-valued goods (resources, inputs, etc) into higher-valued goods (outputs, consumer products, etc)

The Firm

In modern market economies, most production takes place in a legal organization known as the firm

It does not have to be this way, and for most of history it was not this way

- Craft guilds

- Independent artisans

- Independent contractors

Firms exist in the way they do because they are an efficient response to particular problems of economic organization

For now, we'll sidestep this interesting issue, you can take my Industrial Organization course next semester to learn more!

What Do Firms Do?

What Do Firms Do? I

We'll assume "the firm" is the agent to model:

So what do firms do?

How would we set up an optimization model:

Choose: < some alternative >

In order to maximize: < some objective >

Subject to: < some constraints >

What Do Firms Do? II

- Firms convert some goods to other goods:

What Do Firms Do? II

Firms convert some goods to other goods:

Inputs: x1,x2,⋯,xn

- Examples: worker efforts, warehouse space, electricity, loans, gasoline, cardboard, fertilizer, computers, software programs, etc

What Do Firms Do? II

Firms convert some goods to other goods:

Inputs: x1,x2,⋯,xn

- Examples: worker efforts, warehouse space, electricity, loans, gasoline, cardboard, fertilizer, computers, software programs, etc

Output:1 q

- Examples: oil, cars, legal services, mobile apps, vegetables, consulting advice, financial reports, etc

1 For simplicity, we assume a firm produces a single product.

What Do Firms Do? III

- Technology or a production function: rate at which firm can convert specified inputs (x1,x2,⋯,xn) into output (q)

q=f(x1,x2,⋯,xn)

Production Function as Recipe

The production function

The production algorithm

Factors of Production I

q=f(t,l,k,e,a)

- Economists typically classify inputs in categories, known as the factors of production (FOP) or "the factors"

| Factor | Owned By | Earns |

|---|---|---|

| Land (t) | Landowners | Rent |

| Labor (l) | Laborers | Wages |

| Capital (k) | Capitalists | Interest |

| Entrepreneurship (e) | Entrepreneurs | Profit |

- a: "total factor productivity" (ideas/knowledge/institutions)

Factors of Production II

q=f(l,k)

- We will assume just two inputs: labor l and capital k

| Factor | Owned By | Earns |

|---|---|---|

| Labor (l) | Laborers | Wages |

| Capital (k) | Capitalists | Interest |

What Does a Firm Maximize?

We will assume firms maximize profit (π)

Not true for all firms

- Examples: non-profits, charities, civic associations, government agencies, criminal organizations, etc

Even profit-seeking firms may also want to maximize additional things

- Examples: goodwill, sustainability, social responsibility, etc

Profits Have a Bad Rap These Days

What is Profit?

- In economics, profit is simply benefits minus (opportunity) costs

What is Profit?

In economics, profit is simply benefits minus (opportunity) costs

Suppose a firm sells output q at a price p

What is Profit?

In economics, profit is simply benefits minus (opportunity) costs

Suppose a firm sells output q at a price p

- It can buy each input xi at an associated price pi

- labor l at wage rate w

- capital k at rental rate r

What is Profit?

In economics, profit is simply benefits minus (opportunity) costs

Suppose a firm sells output q at a price p

It can buy each input xi at an associated price pi

- labor l at wage rate w

- capital k at rental rate r

The profit of selling q units and using inputs l,k is: π=pq⏟revenues−(wl+rk)⏟costs

Who Gets the Profits? I

π=pq⏟revenues−(wl+rk)⏟costs

The firm's costs are all of the factor-owner's incomes!

- Landowners, laborers, creditors are all paid rent, wages, and interest, respectively

Profits are the residual value leftover after paying all factors

Profits are income for the residual claimant(s) of the production process (i.e. owner(s) of a firm):

- Entrepreneurs

- Shareholders

Who Gets the Profits? II

π=pq⏟revenues−(wl+rk)⏟costs

Residual claimants have incentives to maximize firm's profits, as this maximizes their own income

Entrepreneurs and shareholders are the only participants in production that are not guaranteed an income!

- Starting and owning a firm is inherently risky!

A Peek Inside the Corporate Veil I

While the largest category of firms have a sole proprietor, corporations have many owners (shareholders)

Many owners cannot possibly coordinate production: choose managers to run day-to-day production in exchange for a salary

One of the key differences in modern large firms is the separation of ownership and control

A Peek Inside the Corporate Veil II

Principal-Agent problem: owners and agents may have different incentives

Maximizing different things!

- Shareholders: maximize profit

- Management: maximize own salary

Profits and Entrepreneurship: A Preview

In markets, production must face the profit test:

- Is consumer's willingness to pay > opportunity cost of inputs?

Profits are an indication that value is being created for society

Losses are an indication that value is being destroyed for society

Survival for sellers in markets requires firms continually create value and earn profits or die

The Firm's Optimization Problem I

- So what do firms do?

Choose: < some alternative >

In order to maximize: < profits >

Subject to: < technology >

- We've so far assumed they maximize profits and they are limited by their technology

The Firm's Optimization Problem II

What do firms choose? (Not an easy answer)

Prices?

- Depends on the market the firm is operating in!

- Study of industrial organization

Essential question: how competitive is a market? This will influence what firms (can) do

Industrial Organization: A Roadmap I

Begin with one extreme case: "perfect competition"

- Firms can choose to sell as much q∗ as they want

- Firms are constrained to sell at the (exogenous) market price ˉp

Appropriate for settings with many firms, each small relative to market

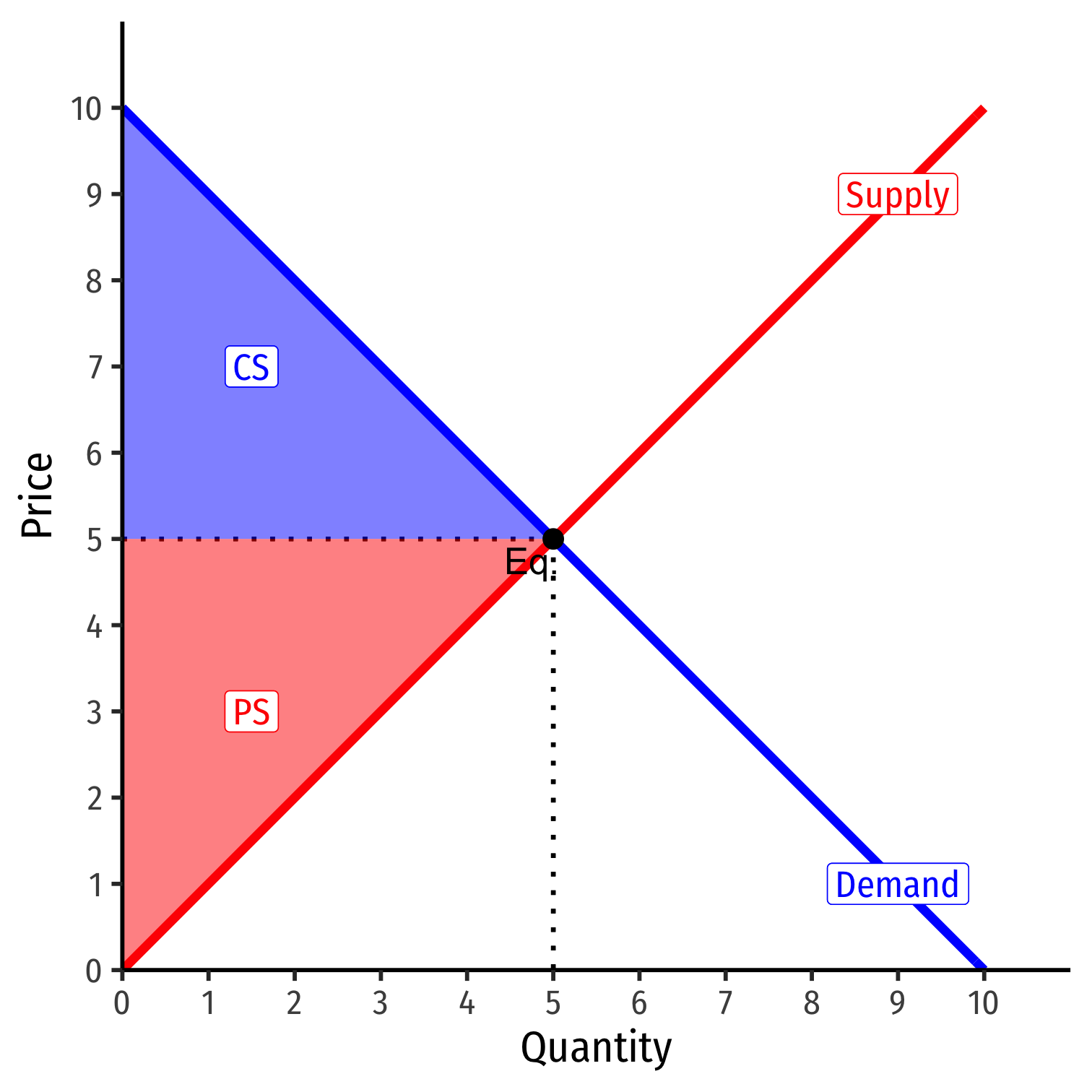

Interlude

After we find firm's optimal decisions in this market (and have Exam 2), we will then finally look at market equilibrium

Put Supply and Demand together

- We've started to see the origins of how consumers cause and respond to market changes (changes in px, py, m, etc.)

- We're about to explore how producers cause and respond to market changes

- Finally we can explain these market changes with Supply and Demand models

Discuss how markets work, why they are good and efficient, and when they are not a good idea

Industrial Organization: A Roadmap II

Examine another extreme case: monopoly of a single seller

- Appropriate for some markets

More realistic "imperfect competition": models of monopolistic competition and oligopoly

- In latter case, firms can act strategically, so we will introduce game theory

In all of these cases, firms can choose both output q∗ and price p∗ to maximize π